United Airlines 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

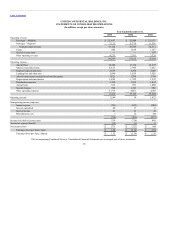

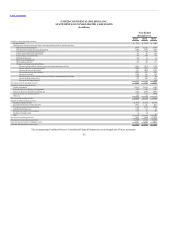

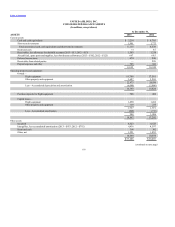

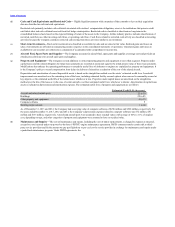

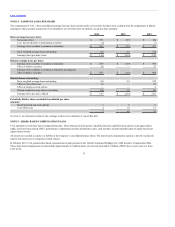

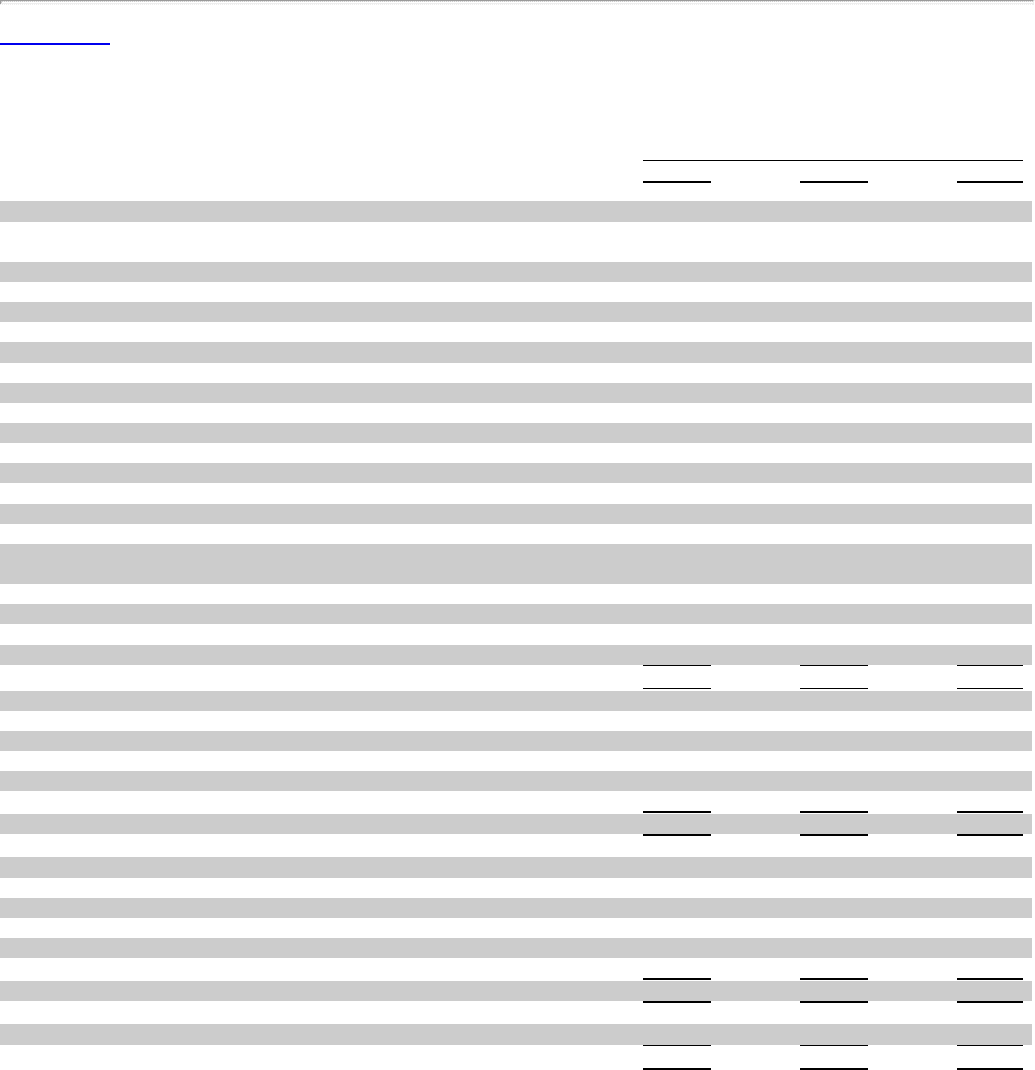

Cash Flows from Operating Activities:

Net income (loss) $ 654 $ (661) $ 850

Adjustments to reconcile net income (loss) to net cash provided (used) by

operating activities -

Depreciation and amortization 1,689 1,522 1,547

Debt discount and lease fair value amortization (178) (239) (186)

Amortization of capitalized financing costs 73 52 52

Pension and postretirement amortization 42 18 (23)

Special charges, non-cash portion 50 389 46

Deferred income taxes 1 13 (5)

Share-based compensation 11 14 18

Other operating activities 11 4 48

Changes in operating assets and liabilities -

Decrease in frequent flyer deferred revenue and advanced purchase of miles (415) (712) (110)

Increase (decrease) in accounts payable (265) 285 177

(Increase) decrease in other assets 163 (484) (200)

Increase (decrease) in other liabilities (203) 422 263

Increase in receivables (142) (21) (87)

Unrealized (gain) loss on fuel derivatives and change in related pending

settlements (56) 120 (2)

Increase in advance ticket sales 45 246 115

Increase in fuel hedge collateral — — (59)

Increase in intercompany receivables (5) (9) (83)

Increase (decrease) in intercompany payables (34) (28) 46

Net cash provided by operating activities 1,441 931 2,407

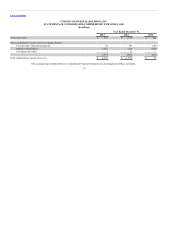

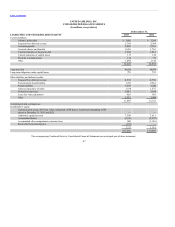

Cash Flows from Investing Activities:

Capital expenditures (2,164) (2,016) (840)

Proceeds from sale of property and equipment 152 183 123

Increase in short-term and other investments, net (120) (240) (898)

(Increase) decrease in restricted cash, net 52 121 (185)

Other, net 57 — 2

Net cash used in investing activities (2,023) (1,952) (1,798)

Cash Flows from Financing Activities:

Payments of long-term debt (2,185) (1,392) (2,367)

Proceeds from issuance of long-term debt 1,423 1,121 152

Principal payments under capital leases (134) (125) (250)

Capitalized financing costs (103) (71) (8)

Proceeds from exercise of stock options 29 17 26

Other, net 1 (4) 15

Net cash used in financing activities (969) (454) (2,432)

Net decrease in cash and cash equivalents (1,551) (1,475) (1,823)

Cash and cash equivalents at beginning of year 4,765 6,240 8,063

Cash and cash equivalents at end of year $ 3,214 $ 4,765 $ 6,240

The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statements.

68