United Airlines 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

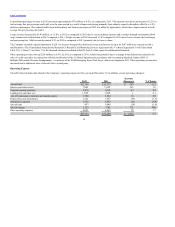

Table of Contents

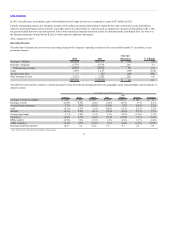

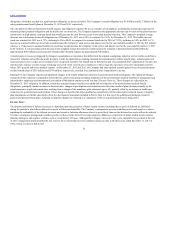

Significant financing events in 2011 were as follows:

• The Company entered into a $500 million revolving credit facility with a syndicate of banks, led by Citibank, N.A., as administrative agent. The

facility was undrawn when it was replaced on March 27, 2013 with the Credit Agreement. The Company terminated its prior $255 million revolver

under the Amended Credit Facility on December 21, 2011;

• During 2011, the Company made debt and capital lease payments of $2.6 billion. These payments include $150 million related to the repurchase of

UAL’s 5% Senior Convertible Notes and $570 million related to the repurchase of UAL’s 4.5% Senior Limited-Subordination Convertible Notes; and

• The Company received $239 million in 2011 from its December 2010 pass-through trust financing. The proceeds were used to fund the acquisition of

new aircraft and in the case of the currently owned aircraft, for general corporate purposes.

For additional information regarding these matters, see Notes 3, 11, 13 and 16 to the financial statements included in Part II, Item 8 of this report.

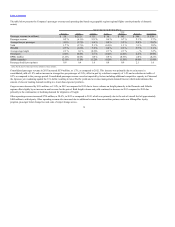

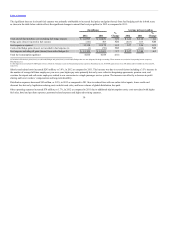

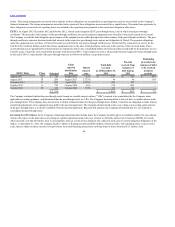

Credit Ratings. As of the filing date of this report, UAL and United had the following corporate credit ratings:

S&P

Moody’

s Fitch

UAL B B2 B

United B * B

* The credit agency does not issue corporate credit ratings for subsidiary entities.

These credit ratings are below investment grade levels. Downgrades from these rating levels, among other things, could restrict the availability or increase the

cost of future financing for the Company.

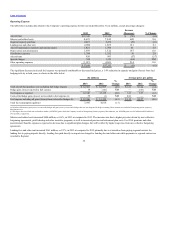

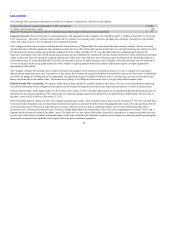

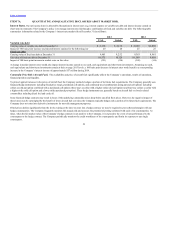

Below is a summary of additional liquidity matters. See the indicated notes to our consolidated financial statements included in Part II, Item 8 of this report for

additional details related to these and other matters affecting our liquidity and commitments.

Pension and other postretirement plans Note 8

Hedging activities Note 10

Long-term debt and debt covenants (a) Note 11

Leases and capacity purchase agreements Note 13

Commitments and contingencies Note 15

(a) Certain of the Company’s financing agreements have covenants that impose certain operating and financial restrictions, as applicable, on the Company and its material subsidiaries.

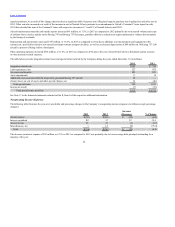

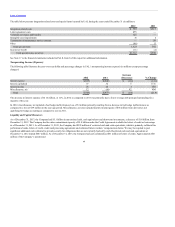

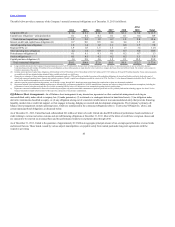

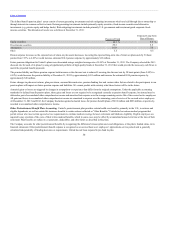

Contractual Obligations. The Company’s business is capital intensive, requiring significant amounts of capital to fund the acquisition of assets,

particularly aircraft. In the past, the Company has funded the acquisition of aircraft through outright purchase, by issuing debt, by entering into capital or

operating leases, or through vendor financings. The Company also often enters into long-term lease commitments with airports to ensure access to terminal,

cargo, maintenance and other required facilities.

44