United Airlines 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

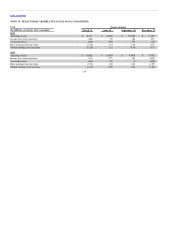

aircraft. Additionally, the Company recorded a $5 million gain related to a contract termination and $3 million in gains on the sale of assets.

During 2012, the Company recorded net gains of $46 million related to gains and losses on the disposal of aircraft and related parts and other assets.

During 2011, other special charges included costs to terminate a maintenance service contract, adjustments to reserves for certain legal matters and gains and

losses on the disposal of aircraft.

Special Revenue Item. As discussed in Note 1 of this report, during the second quarter of 2011, United modified the previously existing co-branded credit

card agreements with Chase as a result of the Merger. In accordance with Accounting Standards Update 2009-13, Multiple-Deliverable Revenue Arrangements -

a consensus of the FASB Emerging Issues Task Force (“ASU 2009-13”), the Company retroactively adjusted its existing deferred revenue balance to reflect the

value of any undelivered element remaining at the date of contract modification as if we had been applying ASU 2009-13 since the initiation of the Co-Brand

Agreement. We applied this transition provision by revaluing the undelivered air transportation element using its new estimated selling price as determined in

connection with the contract modification. This estimated selling price was lower than the rate at which the undelivered element had been deferred under the

previous co-branded credit card contracts, and as a result, we recorded a one-time non-cash adjustment to decrease frequent flyer deferred revenue and increase

special revenues by $107 million in June 2011.

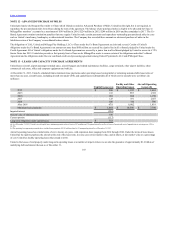

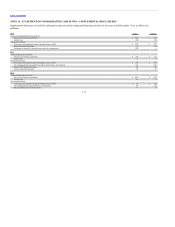

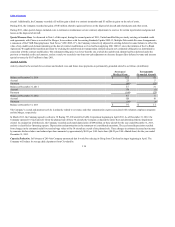

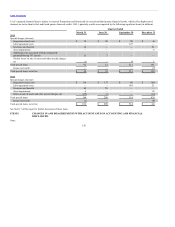

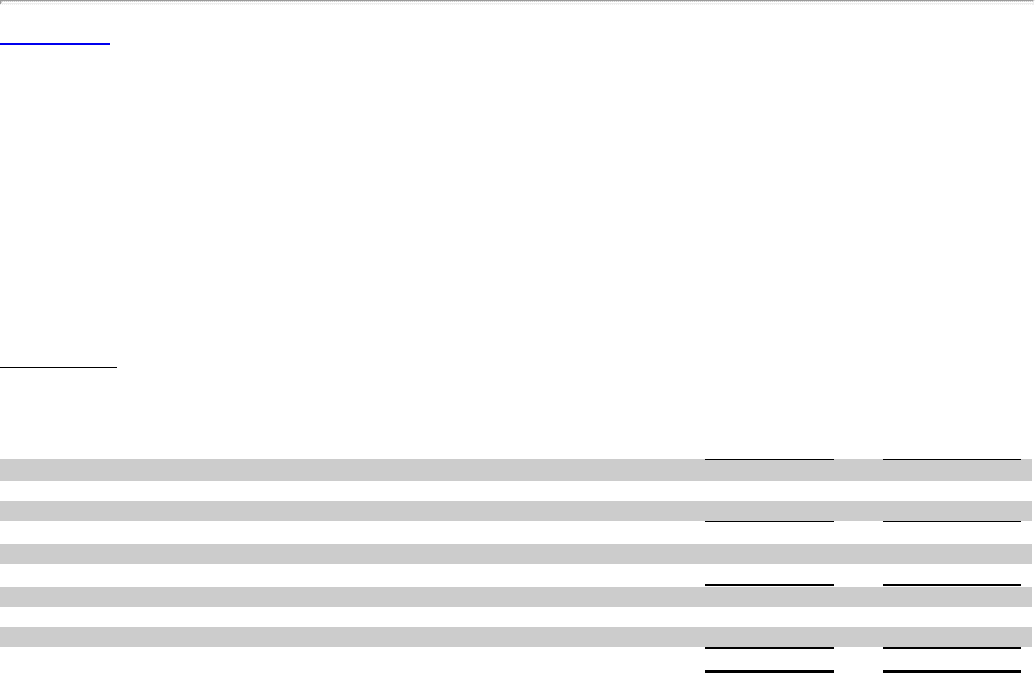

Activity related to the accruals for severance and medical costs and future lease payments on permanently grounded aircraft is as follows (in millions):

Balance at December 31, 2010 $ 102 $ 41

Accrual 21 5

Payments (68) (15)

Balance at December 31, 2011 55 31

Accrual 170 (1)

Payments (160) (25)

Balance at December 31, 2012 65 5

Accrual 120 10

Payments (94) (4)

Balance at December 31, 2013 $ 91 $ 11

The Company’s accrual and payment activity is primarily related to severance and other compensation expense associated with voluntary employee programs

and the Merger, respectively.

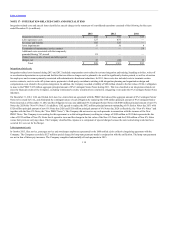

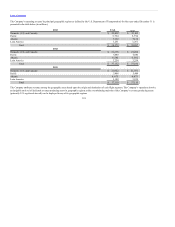

In March 2013, the Company agreed to sell up to 30 Boeing 757-200 aircraft to FedEx Corporation beginning in April 2013. As of December 31, 2012, the

Company operated 133 such aircraft. Given the planned sale of these 30 aircraft, the Company evaluated the entire fleet and determined that no impairment

existed. In conjunction with that sale, the Company recorded accelerated depreciation of $89 million on these aircraft for the year ended December 31, 2013,

and this is classified as Operating expense: Depreciation and amortization in the statements of consolidated operations. The accelerated depreciation resulted

from changes in the estimated useful lives and salvage values of the 30 aircraft as a result of the planned sale. These changes in estimate decreased net income

by amounts disclosed above and reduced per share amounts by approximately $0.26 per UAL basic share ($0.23 per UAL diluted share) for the year ended

December 31, 2013.

Capacity Reduction. In February of 2014 the Company announced that it would be reducing its flying from Cleveland in stages beginning in April. The

Company will reduce its average daily departures from Cleveland by

116