United Airlines 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

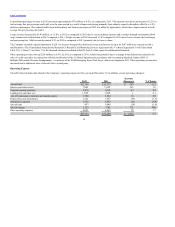

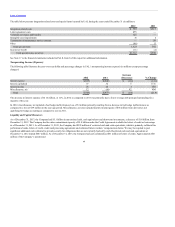

The Company’s capital expenditures were $2 billion and $840 million in 2012 and 2011, respectively. The Company’s capital expenditures for 2012 were

primarily attributable to the purchase of new Boeing aircraft and other fleet-related expenditures to improve the onboard experience of our existing aircraft.

The Company increased its short-term investments, net of proceeds, by $245 million in 2012 in order to improve interest income.

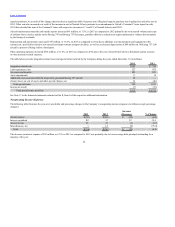

Cash Flows from Financing Activities

Significant financing events in 2013 were as follows:

• On February 1, 2013, United redeemed all of the $400 million aggregate principal amount of its 9.875% Senior Secured Notes due 2013 and $200

million aggregate principal amount of 12.0% Senior Second Lien Notes due 2013. On February 8, 2013, United redeemed all $123 million aggregate

principal amount of the B tranche of the 2006-1 enhanced equipment trust certificate (“EETC”) equipment notes due 2013. On April 1, 2013,

United redeemed all of the $180 million aggregate principal amount of the senior tranche of the 2006-1 EETC equipment notes due 2013.

• On March 27, 2013, the Company used $900 million from the Credit Agreement, together with approximately $300 million of cash to retire the

entire principal balance of a $1.2 billion term loan due 2014 that was outstanding under United’s Amended and Restated Revolving Credit, Term

Loan and Guaranty Agreement, dated as of February 2, 2007 (the “Amended Credit Facility”). The Amended Credit Facility was terminated

concurrently with the repayment of the term loan. The Company also terminated the $500 million revolving credit facility that it had previously

entered into in December 2011. There were no outstanding borrowings under the revolving credit facility.

• On March 27, 2013, United and UAL entered into the Credit Agreement as the borrower and guarantor, respectively. The Credit Agreement consists

of a $900 million term loan due April 1, 2019 and a $1.0 billion revolving credit facility available for drawing until April 1, 2018. As of

December 31, 2013, United had its entire commitment capacity of $1.0 billion available under the revolving credit facility. The obligations of

United under the Credit Agreement are secured by liens on certain international route authorities between certain specified cities, certain take-off and

landing rights and related assets of United.

Borrowings under the Credit Agreement bear interest at a variable rate equal to the London Interbank Offered Rate (“LIBOR”), subject to a 1% floor,

plus a margin of 3.0% per annum, or another rate based on certain market interest rates, plus a margin of 2.0% per annum. The principal amount

of the term loan must be repaid in consecutive quarterly installments of 0.25% of the original principal amount thereof, commencing on June 30,

2013, with any unpaid balance due on April 1, 2019. United may prepay all or a portion of the loan from time to time, at par plus accrued and

unpaid interest. United pays a commitment fee equal to 0.75% per annum on the undrawn amount available under the revolving credit facility.

Certain covenants in the Credit Agreement and in the Company’s indentures are summarized in Note 11 to the financial statements included in Part

II, Item 8 of this report.

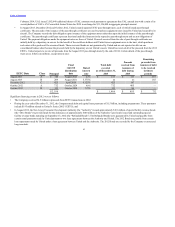

• In May 2013, UAL issued $300 million aggregate principal amount of 6.375% Senior Notes due June 1, 2018. The notes are fully and

unconditionally guaranteed and recorded by United on its balance sheet as debt.

• In November 2013, UAL issued $300 million aggregate principal amount of 6% Senior Notes due December 1, 2020. The notes are fully and

unconditionally guaranteed and recorded by United on its balance sheet as debt.

• UAL issued approximately 28 million shares of UAL common stock pursuant to agreements that UAL entered into with certain of its

securityholders in exchange for approximately $240 million in aggregate principal amount of UAL’s outstanding 6% Convertible Senior Notes due

2029 held by such securityholders. The Company retired the 6% Convertible Senior Notes acquired in the exchange. In

42