United Airlines 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Set forth below is a discussion of the principal matters that we believe could impact our financial and operating performance and cause our results of

operations in future periods to differ materially from our historical operating results and/or from our anticipated results of operations described in the forward-

looking statements in this report. See Item 1A., Risk Factors, of this report and the factors described under “Forward-Looking Information” for further

discussion of these and other factors that could affect us.

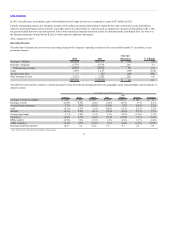

The Company is committed to improving the efficiency and quality of all aspects of its business in 2014. Key initiatives for the year include improving

customer experience by adding satellite-based Wi-Fi on more than 300 additional mainline aircraft, introducing a new united.com website, refurbishing aircraft

interiors, investing in our airports and taking delivery of more than 50 new, highly-efficient and customer-pleasing aircraft.

Economic Conditions. The economic outlook for the aviation industry in 2014 is characterized by expected slow or modest U.S. and global economic

growth. In such conditions, we expect a modest increase in the demand for air travel. Continuing economic uncertainty, including uncertainty in the strength of

key Asian markets, such as China, and continued political and socioeconomic tensions in regions such as the Middle East, may result in diminished demand

for air travel and may impair our ability to achieve sufficient profitability in 2014.

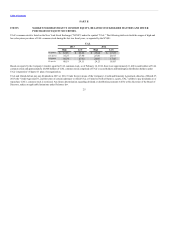

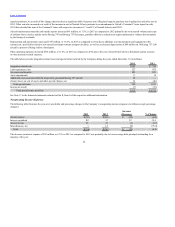

Capacity. Over the past three years, the Company leveraged the flexibility of its combined fleet to better match capacity with market demand. In 2014, the

Company expects consolidated ASMs to grow between 1% and 2% year-over-year. The Company announced that it is expanding its worldwide route network

in 2014 by launching nonstop service from San Francisco to Chengdu, China (the fourth-largest city in China) and Taipei, Taiwan, and from Chicago to

Edinburgh, Scotland, and new routes from its hubs to international destinations such as Houston to Munich and Washington Dulles to Madrid. Should fuel

prices increase significantly or should the U.S. or global economic growth outlook decline substantially, we would likely adjust our capacity plans to reflect

the different operating environment.

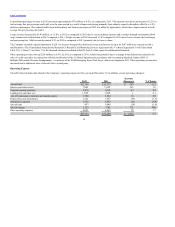

In February of 2014 the Company announced that it would be reducing its flying from Cleveland in stages beginning in April. The Company will reduce its

average daily departures from Cleveland by around 60 percent. The decision to reduce flying was driven by continued losses in Cleveland, and the timing of

the flight reductions was accelerated by industry-wide effects of new federal regulations that impact the Company and its regional partner flying. These new

regulations impact the Company and its regional partner flying, as they have caused mainline airlines to hire regional pilots, while simultaneously

significantly reducing the pool of new pilots from which regional carriers themselves can hire. Although this is an industry issue, it directly affects the

Company and requires it to reduce regional partner flying, as several regional partners are beginning to have difficulty flying their schedules due to reduced

new pilot availability. As a result, we will be reducing our average daily departures from Cleveland by approximately 60%. We expect to be able to keep almost

all mainline departures (reducing only one of our 26 peak day mainline departures), but will need to reduce regional departures from Cleveland by over 70%.

We will make these reductions in roughly one-third increments in each of early April, May and June 2014. When the schedule reductions are fully

implemented in June, we plan to offer 72 peak-day flights from Cleveland, and serve 20 destinations from Cleveland on a non-stop basis. We currently expect

to reduce up to 470 airport operations and catering positions in Cleveland. Those reductions will likely begin in June. The Company expects to record a special

charge in 2014 related to the reduction in force and other contractual commitments at Cleveland. The Company is not currently able to estimate the amount of

these charges or the time period in which they will be recorded, but such amounts could be significant.

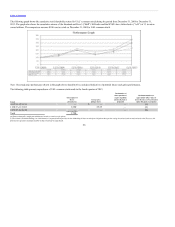

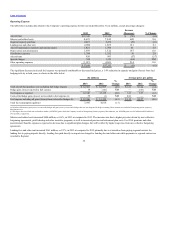

Fuel. The Company’s average aircraft fuel price per gallon including related taxes was $3.13 in 2013 as compared to $3.27 in 2012. If fuel prices rise

significantly from their current levels, we may be unable to raise fares or other fees sufficiently to fully offset our increased costs. In addition, high fuel prices

may impair our ability to achieve profitability. Based on projected fuel consumption in 2014, a one dollar change in the price of a barrel of crude oil would

change the Company’s annual fuel expense by approximately $94 million. To protect against increases in the prices of aircraft fuel, the Company routinely

hedges a portion of its future fuel requirements.

32