United Airlines 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

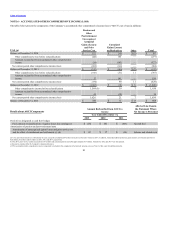

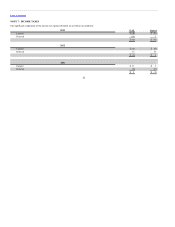

Table of Contents

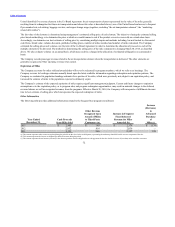

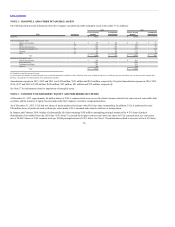

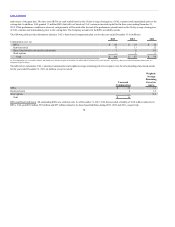

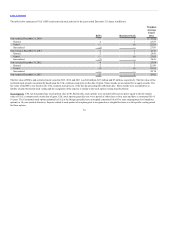

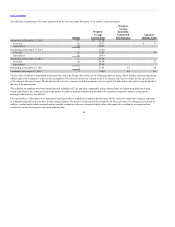

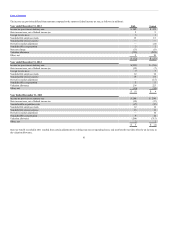

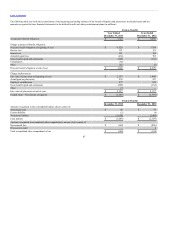

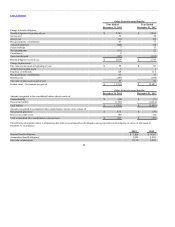

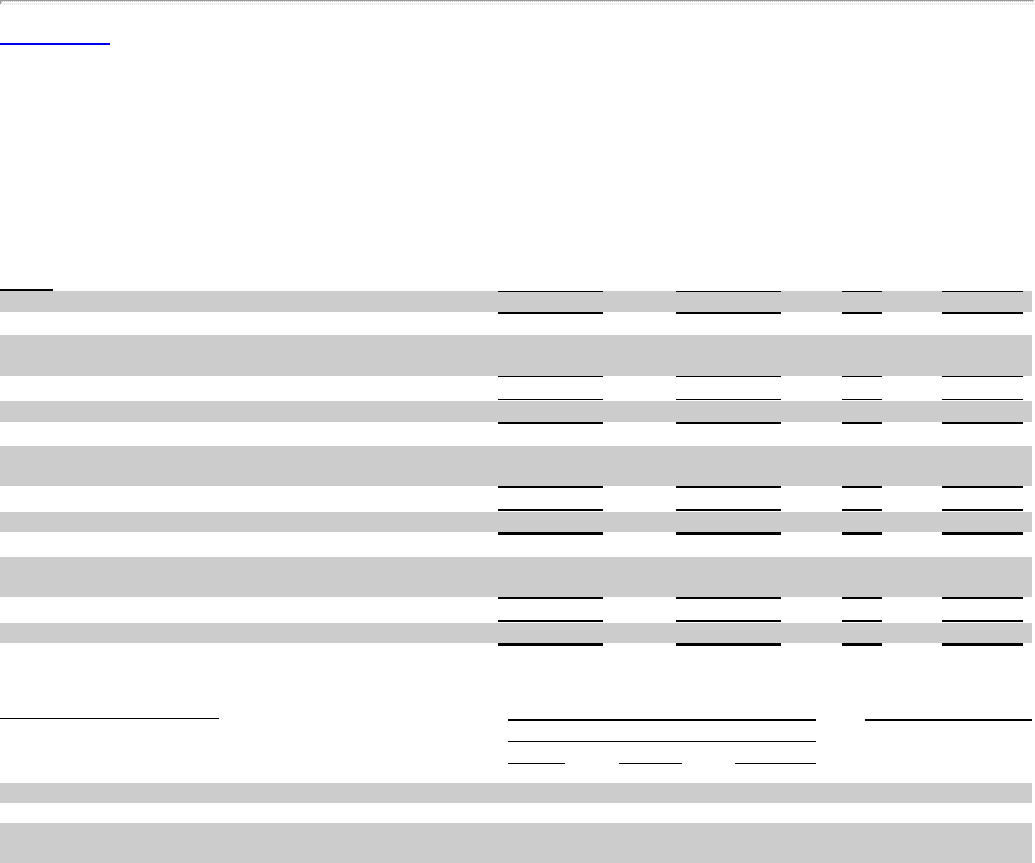

The tables below present the components of the Company’s accumulated other comprehensive income (loss) (“AOCI”), net of tax (in millions):

Balance at December 31, 2010 $ 152 $ 240 $ (5) $ 387

Other comprehensive loss before reclassifications (440) 163 — (277)

Amounts reclassified from accumulated other comprehensive

income (24) (503) — (527)

Net current-period other comprehensive income (loss) (464) (340) — (804)

Balance at December 31, 2011 $ (312) $ (100) $ (5) $ (417)

Other comprehensive loss before reclassifications (747) (51) 11 (787)

Amounts reclassified from accumulated other comprehensive

income 17 141 — 158

Net current-period other comprehensive income (loss) (730) 90 11 (629)

Balance at December 31, 2012 $ (1,042) $ (10) $ 6 $ (1,046)

Other comprehensive income before reclassifications 1,584 (b) 39 7 1,630

Amounts reclassified from accumulated other comprehensive

income 42 (18) — 24

Net current-period other comprehensive income (loss) 1,626 21 7 1,654

Balance at December 31, 2013 $ 584 $ 11 $ 13 $ 608

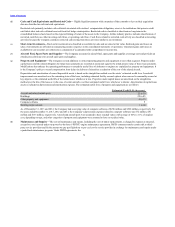

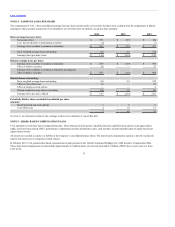

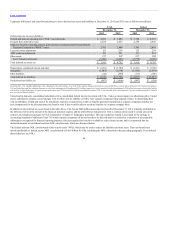

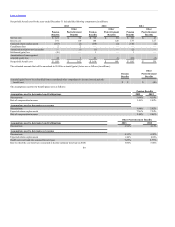

Derivatives designated as cash flow hedges

Fuel contracts-reclassifications of (gains) losses into earnings (c) $ (18) $ 141 $ (503) Aircraft fuel

Amortization of pension and post-retirement items

Amortization of unrecognized (gains) losses and prior service cost

and the effect of curtailments and settlements (c) (d) $ 42 $ 17 $ (24) Salaries and related costs

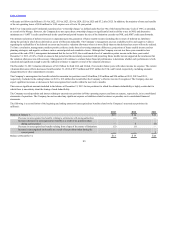

(a) UAL and United amounts are substantially the same except for an additional $6 million of income tax benefit at United in 2013. In addition, United had additional (losses) gains related to investments and other of

$(2) million, $1 million and $1 million in 2011, 2012 and 2013, respectively.

(b) For 2013, prior service credits increased by $331 million and actuarial gains increased by approximately $1.3 billion. Amounts for 2012 and 2011 were not material.

(c)Income tax expense offset by Company’s valuation allowance.

(d) This accumulated other comprehensive income component is included in the computation of net periodic pension costs (see Note 8 of this report for additional details).

81