United Airlines 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

x

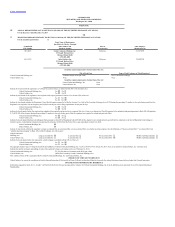

¨

001-06033

Delaware

36-2675207

001-10323

Delaware

74-2099724

United Continental Holdings, Inc. Common Stock, $0.01 par value New York Stock Exchange

United Airlines, Inc. None None

United Continental Holdings, Inc. None

United Airlines, Inc. None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

United Continental Holdings, Inc. Yes ¨ No x

United Airlines, Inc. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

United Continental Holdings, Inc. Yes x No ¨

United Airlines, Inc. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

United Continental Holdings, Inc. x

United Airlines, Inc. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and

“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

United Continental

Holdings, Inc. Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

United Airlines, Inc. Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

United Continental Holdings, Inc. Yes ¨ No x

United Airlines, Inc. Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of United Continental Holdings, Inc. was $11,107,386,154 as of June 30, 2013. There is no market for United Airlines, Inc. common stock.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of February 14, 2014.

United Continental Holdings, Inc. 371,556,314 shares of common stock ($0.01 par value)

United Airlines, Inc. 1,000 (100% owned by United Continental Holdings, Inc.)

This combined Form 10-K is separately filed by United Continental Holdings, Inc. and United Airlines, Inc.

United Airlines, Inc. meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this form with the reduced disclosure format allowed under that General Instruction.

Information required by Items 10, 11, 12 and 13 of Part III of this Form 10-K are incorporated by reference for United Continental Holdings, Inc. from its definitive proxy statement for its 2014 Annual Meeting of

Stockholders.

Table of contents

-

Page 1

... 30, 2013. There is no market for United Airlines, Inc. common stock. Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of February 14, 2014. United Continental Holdings, Inc. 371,556,314 shares of common stock ($0.01 par value) United Airlines, Inc... -

Page 2

... Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management... -

Page 3

... name was changed to United Airlines, Inc. The financial statements of United Air Lines, Inc. and Continental are now combined at their historical cost for all periods presented beginning on October 1, 2010, the date on which Continental became a wholly-owned subsidiary of UAL. Operations Network... -

Page 4

... of Financial Condition and Results of Operations, 2014 Outlook of this report for additional information on Cleveland. All of the Company's domestic hubs are located in large business and population centers, contributing to a large amount of "origin and destination" traffic. The hub and spoke... -

Page 5

... of reservations, ticketing, passenger check-in, baggage handling, airport lounge access and flight schedules, and other resource-sharing activities that include joint sales and marketing. United is a member of Star Alliance, a global integrated airline network co-founded by United in 1997 and... -

Page 6

... Business. United generates third-party business revenue that includes fuel sales, catering, ground handling, maintenance services and frequent flyer award non-air redemptions, and third-party business revenue is recorded in Other operating revenue. The Company has a contract to sell aircraft fuel... -

Page 7

..., and aircraft maintenance and airworthiness. The FAA issues air carrier operating certificates and aircraft airworthiness certificates, prescribes maintenance procedures, oversees airport operations, and regulates pilot and other employee training. The 2011 FAA final rule amending existing flight... -

Page 8

... and delayed flights, in addition to denied boarding compensation. Similar regulations in other countries require passenger compensation and subject the Company to enforcement penalties in addition to changes in operating procedures. Airport Access. Historically, access to foreign markets has been... -

Page 9

...EU ETS would apply only to intra-EU flights. In October 2013, ICAO adopted a resolution establishing the path for development of a global market-based measure to regulate international aviation carbon emissions for final approval by ICAO in 2016. The cost to the Company of any such global measure is... -

Page 10

... with its unionized employee groups, although significant increases in the pay and benefits resulting from new collective bargaining agreements would have an adverse financial impact on the Company. See Notes 15 and 17 to the financial statements included in Part II, Item 8 of this report for more... -

Page 11

... travel. To protect against increases in the prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. However, the Company's hedging program may not be successful in controlling fuel costs, and price protection provided may be limited due to market conditions... -

Page 12

...in the price of fuel, adverse economic conditions, disruptions in the global capital markets and catastrophic external events. If the Company's liquidity is constrained due to the various risk factors noted in this Item 1A or otherwise, the Company might not be able to timely pay its debts or comply... -

Page 13

...7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this report for further information regarding the Company's liquidity. Extensive government regulation could increase the Company's operating costs and restrict its ability to conduct its business. Airlines... -

Page 14

...the number of flights and/or increase costs of operations at certain times or throughout the day. The FAA may limit the Company's airport access by limiting the number of departure and arrival slots at high density traffic airports, which could affect the Company's ownership and transfer rights, and... -

Page 15

...the Company's services versus those of its competitors, materially impair its ability to market its services and operate its flights, result in the unauthorized release of confidential or otherwise protected information, result in increased costs, lost revenue and the loss or compromise of important... -

Page 16

...The Company has engaged an increasing number of third-party service providers to perform a large number of functions that are integral to its business, including regional operations, operation of customer service call centers, distribution and sale of airline seat inventory, provision of information... -

Page 17

...mergers and acquisitions. On December 9, 2013, the same date American Airlines emerged from bankruptcy protection, US Airways and American Airlines closed their merger transaction and, as a result of the merger transaction, the Company anticipates US Airways will exit Star Alliance on March 30, 2014... -

Page 18

...or financial position. The Company's results of operations fluctuate due to seasonality and other factors associated with the airline industry. Due to greater demand for air travel during the spring and summer months, revenues in the airline industry in the second and third quarters of the year are... -

Page 19

... flight disruption costs caused by the FAA-imposed temporary grounding of the U.S. airline industry's fleet, significantly increased security costs and associated passenger inconvenience, increased insurance costs, substantially higher ticket refunds and significantly decreased traffic and passenger... -

Page 20

... the market price of the UAL common stock. For additional information regarding the 5% ownership limitation, please refer to UAL's amended and restated certificate of incorporation available on the Company's website. Certain provisions of UAL's Governance Documents could discourage or delay changes... -

Page 21

...exercises such option, UAL may elect to pay the repurchase price in cash, shares of its common stock or a combination thereof. See Note 11 to the financial statements included in Part II, Item 8 of this report for additional information related to these convertible notes. The number of shares issued... -

Page 22

... carriers, United operated 1,265 aircraft as of December 31, 2013. UAL's combined fleet as of December 31, 2013 is presented in the table below: Seats in Standard Tircraft Type Mainline: 747-400 Total 23 Owned Leased 8 17 1 - 2 16 12 61 - 4 73 24 Configuration 374 Tverage Tge (In Years) 18... -

Page 23

... it serves with its most significant leases at airport hub locations. United has major terminal facility leases at SFO, Washington Dulles, Chicago O'Hare, LAX, Denver, Newark Liberty, Houston Bush, Cleveland and Guam with expiration dates ranging from 2014 to 2041. United expects to enter into a new... -

Page 24

...Company to cover environmental remediation costs for this site. On January 13, 2014, United received an offer of settlement from the Bay Area Air Quality Management District for three Notices of Violation ("NOVs") issued in 2012 and 2013 to United's San Francisco maintenance center (the "Maintenance... -

Page 25

...stock is listed on the New York Stock Exchange ("NYSE") under the symbol "UAL." The following table sets forth the ranges of high and low sales prices per share of UAL common stock during the last two fiscal years, as reported by the NYSE: UTL 2013 High 1st quarter 2012 $ 2nd quarter 3rd quarter... -

Page 26

... in the fourth quarter of 2013: Total number of shares purchased as part of publicly announced plans or Period Total number of shares purchased (a) Tverage price paid per share programs Maximum number (or approximate dollar value) of shares that may yet be purchased under the plans or programs... -

Page 27

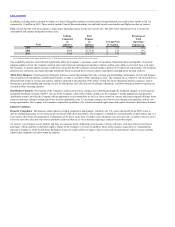

... The Company's consolidated financial statements and statistical data are provided in the tables below. UTL Statement of Consolidated Operations Data (a) (In millions, except per share amounts) 2013 2012 Year Ended December 31, 2011 2010 2009 Income Statement Data: Operating revenue Operating... -

Page 28

...revenue passenger mile ("Yield") (cents) (e) Cost per available seat mile ("CASM") (cents) Average price per gallon of fuel, including fuel taxes Fuel gallons consumed (millions) Average stage length (miles) (f) Average daily utilization of each aircraft (hours) (g) Regional 2013 91,329 2012 Year... -

Page 29

... is useful to investors because the special items are non-recurring items not indicative of the Company's ongoing performance. The Company also believes that excluding third-party business expenses, such as maintenance, ground handling and catering services for third parties, fuel sales and non-air... -

Page 30

Table of Contents 2013 Year ended December 31, 2012 2011 2010 Mainline CTSM Operating expense Special charges Third-party business expenses Aircraft fuel and related taxes Profit sharing Operating expense excluding above items ASMs - mainline $ 30,483 (520) (694) (9,990) (190) $ 19,089 213,007... -

Page 31

... Continental Holdings, Inc. On March 31, 2013, the Company merged United Air Lines, Inc. into Continental to form one legal entity, and Continental's name was changed to United Airlines, Inc. The financial statements of United Air Lines, Inc. and Continental are now combined at their historical cost... -

Page 32

... in 2014 by launching nonstop service from San Francisco to Chengdu, China (the fourth-largest city in China) and Taipei, Taiwan, and from Chicago to Edinburgh, Scotland, and new routes from its hubs to international destinations such as Houston to Munich and Washington Dulles to Madrid. Should fuel... -

Page 33

... employee groups, although significant increases in the pay and benefits resulting from new collective bargaining agreements would have a material financial impact on the Company. CASM. In 2014, the Company expects CASM, excluding fuel, third-party business expense, profit sharing and special... -

Page 34

... to 2012, which was primarily due to the sale of aircraft fuel of approximately $400 million to a third party. Other operating revenue also increased due to additional revenue from non-airline partners under our MileagePlus loyalty program, passenger ticket change fees and sales of airport lounge... -

Page 35

...or 8.6%, in 2013 as compared to 2012. The increase was due to higher pay rates driven by new collective bargaining agreements, profit sharing and other incentive programs, as well as increased pension and retirement plan costs. For 2014, pensions and other postretirement benefits expense is expected... -

Page 36

... agreement costs Severance and benefits 2013 $205 127 105 33 2012 $ 739 475 125 30 Asset impairments Additional costs associated with the temporarily grounded Boeing 787 aircraft (Gains) losses on sale of assets and other special charges, net Total special items Income tax benefit Total special... -

Page 37

.... See Note 9 to the financial statements included in Part II, Item 8 of this report for additional information. 2012 cospared to 2011 Operating Revenue The table below illustrates the year-over-year percentage change in the Company's operating revenues for the years ended December 31 (in millions... -

Page 38

...-Branded Card Marketing Services Agreement (the "Co-Brand Agreement") with Chase Bank USA, N.A. ("Chase"). See Note 17 to the financial statements included in Part II, Item 8 of this report for additional information. Other operating revenue was up $226 million, or 6.8%, in 2012 as compared to 2011... -

Page 39

... pay rates primarily driven by new collective bargaining agreements, pension costs, and overtime for airport and call center employees related to our conversion to a single passenger service system. The increase was offset by a decrease in profit sharing and lower workers' compensation and long-term... -

Page 40

... service contract Other Total special items Income tax benefit Total special items, net of tax 2012 $ 739 475 125 30 2011 $517 - - 4 - (46) 1,323 (11) $1,312 58 13 592 (2) $590 See Note 17 to the financial statements included in Part II, Item 8 of this report for additional information... -

Page 41

...in earnings in 2013. 2012 cospared to 2011 The Company's cash from operating activities decreased by $1.5 billion in 2012, as compared to 2011. Cash from operations declined due to the Company's net loss position and the reduction of frequent flyer deferred revenue and advanced purchase of miles by... -

Page 42

.... United pays a commitment fee equal to 0.75% per annum on the undrawn amount available under the revolving credit facility. Certain covenants in the Credit Agreement and in the Company's indentures are summarized in Note 11 to the financial statements included in Part II, Item 8 of this report... -

Page 43

... issued and outstanding special facility revenue bonds maturing on September 15, 2012 (the "Refunded Bonds"). The Refunded Bonds were guaranteed by United and payable from certain rental payments made by United pursuant to two lease agreements between the Authority and United. The 2012 Bonds are... -

Page 44

... financial statements included in Part II, Item 8 of this report for additional details related to these and other matters affecting our liquidity and commitments. Pension and other postretirement plans Hedging activities Long-term debt and debt covenants (a) Leases and capacity purchase agreements... -

Page 45

... United's pension plans. Represents contractual commitments for firm order aircraft and spare engines only and noncancelable commitments to purchase goods and services, primarily information technology support. See Note 15 to the financial statements included in Part II, Item 8 of this report... -

Page 46

... depositary in escrow for the benefit of the certificate holders until United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These escrowed funds are not guaranteed by United and are not reported as debt on our consolidated balance sheet because... -

Page 47

...additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer order are separately determined and represent distinct earnings processes. Refundable tickets expire after one year. The Company records an estimate of breakage revenue on the flight date... -

Page 48

... airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and non-travel awards. The Company records its obligation for future award redemptions using a deferred revenue model. In the case of the sale of air services... -

Page 49

...: Frequent flyer deferred revenue at December 31, 2013 (in millions) % of miles earned expected to expire Impact of 1% change in outstanding miles or weighted average ticket value on deferred revenue (in millions) $ 4,904 20% $ 57 Long-Lived Assets. The net book value of operating property... -

Page 50

... other comprehensive income are amortized to expense over the remaining years of service of the covered active employees. At December 31, 2013 and 2012, the Company had unrecognized actuarial losses for pension benefit plans of $162 million and $826 million, respectively, recorded in accumulated... -

Page 51

... Company's total service and interest cost for the year ended December 31, 2013 by $17 million. A one percentage point decrease in the weighted average discount rate would increase the Company's postretirement benefit liability by approximately $203 million and increase the estimated 2013 benefits... -

Page 52

... forward-looking statements in this report are based upon information available to the Company on the date of this report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or... -

Page 53

... of operations, financial position and liquidity. To protect against increases in the prices of aircraft fuel, the Company routinely hedges a portion of its future fuel requirements. The Company generally uses financial hedge instruments including fixed price swaps, purchased call options, and... -

Page 54

... in market conditions. The following table summarizes information related to the Company's cost of fuel and hedging (in millions, except percentages): Fuel Costs In 2013, fuel cost as a percent of total operating expenses (a) Impact of $1 increase in price per barrel of aircraft fuel on annual fuel... -

Page 55

...not enter into derivative instruments for non-risk management purposes. At December 31, 2013, the Company had forward contracts and collars outstanding to hedge 29% of its projected Japanese yendenominated cash inflows, primarily from passenger ticket sales, through 2014. The result of a uniform 10... -

Page 56

... PUBLIC TCCOUNTING FIRM The Board of Directors and Stockholders United Continental Holdings, Inc. We have audited the accompanying consolidated balance sheets of United Continental Holdings, Inc. (the "Company") as of December 31, 2013 and 2012, and the related statements of consolidated operations... -

Page 57

... of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM The Board of Directors and Stockholder of United Airlines, Inc. We have audited the accompanying consolidated balance sheets of United Airlines, Inc. (the "Company") as of December 31, 2013 and 2012, and the related statements of... -

Page 58

... share amounts) 2013 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Special revenue item Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other rent Aircraft maintenance materials... -

Page 59

... of Contents UNITED CONTINENTTL HOLDINGS, INC. STTTEMENTS OF CONSOLIDTTED COMPREHENSIVE INCOME (LOSS) (In millions) Net income (loss) Other comprehensive income (loss), net change related to: Fuel derivative financial instruments Employee benefit plans Investments and other 2013 $ 571 Year Ended... -

Page 60

...(2013-$13; 2012-$13) Aircraft fuel, spare parts and supplies, less obsolescence allowance (2013-$162; 2012-$125) Deferred income taxes Prepaid expenses and other Tt December 31, 2013 2012 $ 3,220 1,901 5,121 31 $ 1,503 667 676 704 8,702 Operating property and equipment: Owned- Flight equipment... -

Page 61

... UNITED CONTINENTTL HOLDINGS, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) LITBILITIES TND STOCKHOLDERS' EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt Current... -

Page 62

... financing costs Pension and postretirement amortization Special charges, non-cash portion Deferred income taxes Share-based compensation Other operating activities Changes in operating assets and liabilities Decrease in frequent flyer deferred revenue and advanced purchase of miles Increase... -

Page 63

... 31, 2011 Net loss Other comprehensive loss Share-based compensation Proceeds from exercise of stock options Treasury stock acquisitions Balance at December 31, 2012 Net income Other comprehensive income Shares issued in exchange for redemption of convertible debt Share-based compensation Proceeds... -

Page 64

...In millions) 2013 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Special revenue item Other operating revenue Operating expense: Aircraft fuel Salaries and related costs Regional capacity purchase Landing fees and other rent Aircraft maintenance materials and... -

Page 65

... UNITED TIRLINES, INC. STTTEMENTS OF CONSOLIDTTED COMPREHENSIVE INCOME (LOSS) (In millions) 2013 $ 654 Net income (loss) Other comprehensive income (loss), net change related to: Fuel derivative financial instruments Employee benefit plans Investments and other Other Year Ended December 31, 2012... -

Page 66

...In millions, except shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments Total unrestricted cash, cash equivalents and short-term investments Restricted cash Receivables, less allowance for doubtful accounts (2013-$13; 2012-$13) Aircraft fuel, spare parts... -

Page 67

...Contents UNITED TIRLINES, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) Tt December 31, LITBILITIES TND STOCKHOLDER'S EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt... -

Page 68

... financing costs Pension and postretirement amortization Special charges, non-cash portion Deferred income taxes Share-based compensation Other operating activities Changes in operating assets and liabilities Decrease in frequent flyer deferred revenue and advanced purchase of miles Increase... -

Page 69

... compensation UAL contribution related to 17 7,611 - - (68) 7 11 29 - $ 7,590 17 1,161 654 1,661 (68) 7 11 29 (232) stock plans Reclassification of related party receivables to equity Balance at December 31, 2013 $ $ $ 3,223 The accompanying Combined Notes to Consolidated Financial Statements... -

Page 70

...wholly-owned subsidiary of UAL Corporation (the "Merger"). Upon closing of the Merger, UAL Corporation became the parent company of both United Air Lines, Inc. and Continental and UAL Corporation's name was changed to United Continental Holdings, Inc. On March 31, 2013, the Company merged United Air... -

Page 71

... fees), discounted or upgraded air travel and non-travel awards. The Company records its obligation for future award redemptions using a deferred revenue model. Miles Earned in Conjunction with Flights In the case of the sale of air services, the Company recognizes a portion of the ticket sales... -

Page 72

... Increase (Decrease) Other Revenue Recognized Upon in Year Ended December 31, 2013 2012 2011 Cash Proceeds from Miles Sold $ 2,903 2,852 3,121 Tward of Miles to Third-Party Customers (a) $ 903 816 566 Increase in Frequent Flyer Deferred Revenue for Miles Twarded (b) Tdvanced Purchase of Miles... -

Page 73

... workers' compensation obligations, reserves for institutions that process credit card ticket sales and cash collateral received from fuel hedge counterparties. Restricted cash is classified as short-term or long-term in the consolidated balance sheets based on the expected timing of return of the... -

Page 74

...'s ticket sales through a fee included in ticket prices. The Company collects these fees and remits them to the appropriate government agency. These fees are recorded on a net basis (excluded from operating revenue). (p) Retirement of Leased Tircraft- The Company accrues for estimated lease costs... -

Page 75

... handling, maintenance services and frequent flyer award non-air redemptions, and third-party business revenue is recorded in other revenue. The Company has a contract to sell aircraft fuel to a third party which is earnings-neutral but results in revenue and expense, specifically cost of sale which... -

Page 76

... attrition rate of customers in the frequent flyer database is considered in the determination of the amortization schedules. Amortization expense in 2013, 2012 and 2011 was $142 million, $121 million and $169 million, respectively. Projected amortization expense in 2014, 2015, 2016, 2017 and 2018... -

Page 77

... as equity or a liability in the Company's consolidated balance sheets. The share-based compensation expense is directly recorded in salaries and related costs or integration-related expense. In February 2013, UAL granted share-based compensation awards pursuant to the United Continental Holdings... -

Page 78

...-day average closing price of UAL common stock immediately prior to the vesting date. The Company accounts for the RSUs as liability awards. The following table provides information related to UAL's share-based compensation plan cost for the years ended December 31 (in millions): 2013 Compensation... -

Page 79

... life of 10 years. The Continental stock options assumed by UAL at the Merger generally have an original contractual life of five years (management level employee options) or 10 years (outside directors). Expense related to each portion of an option grant is recognized on a straight-line basis over... -

Page 80

...UAL did not have any plans to pay dividends at the time of the option grants. The volatility assumptions were based upon historical volatilities of UAL and other comparable airlines whose shares are traded using daily stock price returns equivalent to the contractual term of the option. In addition... -

Page 81

...Components Income Tffected Line Item in the Statement Where Net Income is Presented Year Ended December 31, 2013 2012 2011 Derivatives designated as cash flow hedges Fuel contracts-reclassifications of (gains) losses into earnings (c) Amortization of pension and post-retirement items Amortization... -

Page 82

... NOTE 7 - INCOME TTXES The significant components of the income tax expense (benefit) are as follows (in millions): 2013 Current Deferred UTL $(18) (14) United $ (18) $ (32) 2012 Current Deferred 1 $ (17) $ (14) 13 $ (1) $ (9) $ 13 4 2011 Current Deferred $ 11 (6) $ 5 82 $ 3 (5) $ (2) -

Page 83

...) 5 223 $ (10) 4 Year Ended December 31, 2011 Income tax provision at statutory rate State income taxes, net of federal income tax Nondeductible acquisition costs Nondeductible employee meals Nondeductible interest expense Derivative market adjustment Nondeductible compensation Valuation allowance... -

Page 84

...): UTL December 31, 2013 2012 Deferred income tax asset (liability): Federal and state net operating loss ("NOL") carryforwards Frequent flyer deferred revenue Employee benefits, including pension, postretirement, medical and the Pension Benefit Guaranty Corporation ("PBGC") notes Lease fair... -

Page 85

... benefits of the net operating losses of $168 million for UAL expires over a five to 20-year period. Both UAL Corporation and Continental experienced an "ownership change" as defined under Section 382 of the Internal Revenue Code of 1986, as amended, as a result of the Merger. However, the Company... -

Page 86

... of years of benefit accruals service and an employee's final average compensation. Additional benefit accruals were frozen under the plan covering certain pilot employees during 2005 and management and administrative employees as of December 31, 2013 at which time any existing accrued benefits for... -

Page 87

... and plan assets, the funded status and the amounts recognized in these financial statements for the defined benefit and other postretirement plans (in millions): Accumulated benefit obligation: Change in projected benefit obligation: Projected benefit obligation at beginning of year Service cost... -

Page 88

... of year Service cost Interest cost Plan participants' contributions Actuarial (gain) loss Federal subsidy Plan amendments Curtailments Gross benefits paid Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer... -

Page 89

... income into net periodic benefit cost $ 9 $ (46) The assumptions used for the benefit plans were as follows: Tssumptions used to determine benefit obligations Discount rate Rate of compensation increase Pension Benefits 2013 2012 5.09% 4.19% 3.49% 2.49% Tssumptions used to determine net... -

Page 90

... reported for the other postretirement plans. A 1% change in the assumed health care trend rate for the Company would have the following additional effects (in millions): Effect on total service and interest cost for the year ended December 31, 2013 Effect on postretirement benefit obligation... -

Page 91

...beginning of year Actual return on plan assets: Sold during the year Held at year end Purchases, sales, issuances and settlements (net) Balance at end of year 2013 $ 256 2012 $ 249 15 7 15 $ 293 - (47) 54 $ 256 Funding requirements for tax-qualified defined benefit pension plans are determined... -

Page 92

... National Pension Fund 51-6031295 - 002 Green Zone No $38 million, $36 million and $34 million in the years ended December 31, 2013, 2012 and 2011, respectively No N/A At the date the financial statements were issued, Forms 5500 were not available for the plan year ending in 2013. Profit Sharing... -

Page 93

... non-U.S. co-workers the same percentage of eligible pay that is calculated under the U.S. profit sharing plan for management and administrative employees. Profit sharing expense is recorded as a component of salaries and related costs in the consolidated statements of operations. The Company... -

Page 94

... fair value on a recurring basis in the Company's financial statements as of December 31 (in millions): Total Cash and cash equivalents Short-term investments: Asset-backed securities Corporate debt Certificates of deposit placed through an account registry service ("CDARS") Auction rate securities... -

Page 95

... above relate to (a) supplemental indenture agreements that provide that United's convertible debt is convertible into shares of UAL common stock upon the terms and conditions specified in the indentures, and (b) the embedded conversion options in United's convertible debt that are required to be... -

Page 96

... valuation services. Derivative contracts are privately negotiated contracts and are not exchange traded. Fair value measurements are estimated with option pricing models that employ observable inputs. Inputs to the valuation models include contractual terms, market prices, yield curves, fuel price... -

Page 97

... expense for the last several years. The availability and price of aircraft fuel significantly affects the Company's operations, results of operations, financial position and liquidity. Aircraft fuel prices can fluctuate based on a multitude of factors including market expectations of supply and... -

Page 98

... is to mitigate the adverse financial impact of potential increases in the price of fuel. Currently, the only such economic hedges in the Company's hedging portfolio are three-way collars (a collar with a higher strike sold call option). The Company records changes in the fair value of three-way... -

Page 99

...31, the Company's derivatives were reported in its consolidated balance sheets as follows (in millions): Classification Derivatives designated as cash flow hedges Assets: Fuel contracts due within one year Fuel contracts with maturities greater than one year Total assets Liabilities: Fuel contracts... -

Page 100

... during the periods presented and their classification in the financial statements (in millions): Derivatives designated as cash flow hedges Gain (Loss) Reclassified from TOCI into Income (Fuel Expense) (Effective Portion) 2013 2012 Tmount of Gain (Loss) Recognized in Nonoperating income (expense... -

Page 101

... 6% convertible senior notes due 2029 Long-term debt, net-UAL $ $ 104 10,171 $ $ 345 10,440 (a) As further described below under "Convertible Debt Securities and Derivatives," there is a basis difference between UAL and United debt values, because we were required to apply different accounting... -

Page 102

...'s contractual principal payments at December 31, 2013 under then-outstanding long-term debt agreements in each of the next five calendar years (in millions): 2014 2015 2016 2017 2018 After 2018 UTL 1,368 2,072 1,051 614 1,135 5,468 $ 11,708 United $ $ $ 1,368 2,072 1,051 614 1,135 5,364... -

Page 103

... depositary in escrow for the benefit of the certificate holders until United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These escrowed funds are not guaranteed by United and are not reported as debt on our consolidated balance sheet because... -

Page 104

...unconditionally guaranteed by certain of its subsidiaries. 4.5% Convertible Notes. The 4.5% Convertible Notes may be converted by holders into shares of UAL common stock at a conversion price of approximately $18.93 per share. The Company does not have the option to pay the conversion price in cash... -

Page 105

... into shares of Continental common stock, convertible into shares of UAL common stock. For purposes of the United separate-entity reporting, as a result of this debt, which is now United debt, becoming convertible into the stock of a non-consolidated entity, the embedded conversion options in United... -

Page 106

...of United's international route authorities, specified take-off and landing slots at certain airports and certain other assets. The Credit Agreement requires the Company to maintain at least $3.0 billion of unrestricted liquidity at all times, which includes unrestricted cash, short-term investments... -

Page 107

...of December 31, 2013. Aircraft operating leases have initial terms of six to twenty-six years, with expiration dates ranging from 2014 through 2024. Under the terms of most leases, United has the right to purchase the aircraft at the end of the lease term, in some cases at fair market value, and in... -

Page 108

... statement of operations, of $428 million, $463 million and $498 million for the years ended December 31, 2013, 2012 and 2011, respectively. In connection with UAL Corporation's and United Air Lines, Inc.'s fresh-start reporting requirements upon their exit from Chapter 11 bankruptcy protection... -

Page 109

... from these estimates. For example, a 10% increase or decrease in scheduled block hours for all of United's regional operators (whether as a result of changes in average daily utilization or otherwise) in 2014 would result in a corresponding change in annual cash obligations under the CPAs of... -

Page 110

... allow United to purchase the aircraft at predetermined prices on specified dates during the lease term. Additionally, leases covering approximately 256 leased regional jet aircraft contain an option to purchase the aircraft at the end of the lease term at prices that, depending on market conditions... -

Page 111

... purchase options and purchase rights, will increase the total future capital commitments of the Company. As of December 31, 2013, United has arranged for EETC financing of 15 Boeing 737-900ER aircraft and two Boeing 787-8 aircraft, which are scheduled to be delivered from January through June 2014... -

Page 112

...United's employees were represented by various U.S. labor organizations as of December 31, 2013. In the fourth quarter 2013, the Company announced that the fleet service, passenger service and storekeeper work groups at its United, CMI and MileagePlus subsidiaries ratified new joint labor agreements... -

Page 113

...): 2013 Cash paid (refunded) during the period for: Interest (net of amounts capitalized) Income taxes Non-cash transactions: Net property and equipment acquired through issuance of debt Airport construction financing Exchanges of certain 6% convertible senior notes for common stock $ UTL United... -

Page 114

... if it were not for the Merger. Labor agreement costs In October 2013, fleet service, passenger service and storekeeper employees represented by the IAM ratified a joint collective bargaining agreement with the Company. The Company recorded a $127 million special charge for lump sum payments made... -

Page 115

... plans negotiated in connection with the agreement. The lump sum payments are not in lieu of future pay increases. The Company completed substantially all cash payments in 2013. Severance and benefits During 2013, the Company offered a voluntary retirement program for its fleet service, passenger... -

Page 116

... compensation expense associated with voluntary employee programs and the Merger, respectively. In March 2013, the Company agreed to sell up to 30 Boeing 757-200 aircraft to FedEx Corporation beginning in April 2013. As of December 31, 2012, the Company operated 133 such aircraft. Given the planned... -

Page 117

... in each of early April, May and June 2014. When the schedule reductions are fully implemented in June, we plan to offer 72 peak-day flights from Cleveland, and serve 20 destinations from Cleveland on a non-stop basis. We currently expect to reduce up to 470 airport operations and catering positions... -

Page 118

... of Contents The Company's operating revenue by principal geographic region (as defined by the U.S. Department of Transportation) for the years ended December 31 is presented in the table below (in millions): 2013 Domestic (U.S. and Canada) Pacific Atlantic Latin America Total 2012 $ UTL 22,092... -

Page 119

... QUTRTERLY FINTNCITL DTTT (UNTUDITED) UTL (In millions, except per share amounts) 2013 Operating revenue Income (loss) from operations Net income (loss) Basic earnings (loss) per share Diluted earnings (loss) per share March 31 Quarter Ended June 30 September 30 December 31 $ 8,721 (264... -

Page 120

... Quarter Ended March 31 2013 Special charges (income): Integration-related costs Labor agreement costs Severance and benefits June 30 September 30 December 31 $ 70 $ - 14 Asset impairments Additional costs associated with the temporarily grounded Boeing 787 aircraft (Gains) losses on sale... -

Page 121

... on a timely basis. Based on that evaluation, the Chief Executive Officer and the Chief Financial Officer of UAL and United have concluded that as of December 31, 2013, disclosure controls and procedures were effective. Changes in Internal Control over Financial Reporting during the Quarter Ended... -

Page 122

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2013 of the Company and our report dated February 20, 2014 expressed an unqualified opinion thereon. /s/ Ernst & Young... -

Page 123

... policies or procedures may deteriorate. Under the supervision and with the participation of management, including United's Chief Executive Officer and Chief Financial Officer, United conducted an evaluation of the design and operating effectiveness of our internal control over financial reporting... -

Page 124

.... From October 2010 to December 2012, Mr. Compton served as Executive Vice President and Chief Revenue Officer of UAL, United and Continental. From January 2010 to September 2010, Mr. Compton served as Executive Vice President and Chief Marketing Officer of Continental. From August 2004 to December... -

Page 125

... 43. Mr. Rainey has been Executive Vice President and Chief Financial Officer of UAL and United since April 2012. From October 2010 to April 2012, Mr. Rainey served as Senior Vice President Financial Planning and Analysis of United and Continental. From September 2007 to September 2010, Mr. Rainey... -

Page 126

... of services and fees incurred year-to-date and a list of newly pre-approved services since its last regularly scheduled meeting. The Audit Committee has considered whether the 2013 and 2012 non-audit services provided by Ernst & Young LLP, the Company's independent registered public accounting... -

Page 127

...control over financial reporting of United Continental Holdings, Inc. and its wholly owned subsidiaries. Audit fees also include the audit of the consolidated financial statements of United, attestation services required by statute or regulation, comfort letters, consents, assistance with and review... -

Page 128

... behalf by the undersigned, thereunto duly authorized. UNITED CONTINENTAL HOLDINGS, INC. UNITED AIRLINES, INC. (Registrants) By: /s/ John D. Rainey John D. Rainey Executive Vice President and Chief Financial Officer Date: February 20, 2014 Pursuant to the requirements of the Securities Exchange... -

Page 129

... Officer) Executive Vice President and Chief Financial Officer and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Director /s/ Chris Kenny Chris Kenny /s/ James E. Compton James E. Compton /s/ Peter D. McDonald Peter D. McDonald Director Date... -

Page 130

... - United: 487 333 $ 888 21 367 $ $ 2013 $ 2012 2011 4,503 4,048 4,008 8 661 371 $ 898 206 331 $ $ - - (a) Deduction from reserve for purpose for which reserve was created. (b) See Note 7 to the financial statements included in Part II, Item 8 of this report for additional information... -

Page 131

...(b)(2) of Regulation S-K) (filed as Exhibit 2.1 to UAL's Form 8-K filed May 4, 2010, Commission file number 1 - 0 6 0 3 3 , and incorporated herein by reference) Agreement and Plan of Merger, dated as of March 28, 2013, by and between Continental Airlines, Inc. and United Air Lines, Inc. (filed as... -

Page 132

...Indenture, dated as of April 1, 2013, by and among United Continental Holdings, Inc., United Airlines, Inc. and The Bank of New York Mellon Trust Company, N.A., as trustee, to the Indenture, dated as of July 25, 2006 (filed as Exhibit 4.2 to UAL's Form 8-K filed April 3, 2013, Commission file number... -

Page 133

...*†10.4 UAL United Continental Holdings, Inc. Profit Sharing Plan (amended and restated effective January 1, 2014, except as otherwise provided therein Employment Agreement, dated as of September 5, 2002, by and among United Air Lines, Inc., UAL Corporation and Glenn F. Tilton (filed as Exhibit 10... -

Page 134

...Holdings, Inc., United Air Lines, Inc., and Continental Airlines, Inc. (filed as Exhibit 10.24 to UAL's Form 10-K for the year ended December 31, 2011, Commission file number 1-06033, and incorporated herein by reference) *†10.15 UAL United Continental Holdings, Inc. Officer Travel Policy (filed... -

Page 135

...10.26 UAL Form of Restricted Share Award Notice pursuant to the United Continental Holdings, Inc. 2008 Incentive Compensation Plan (awards after 2011) (filed as Exhibit 10.37 to UAL's Form 10-K for the year ended December 31, 2011, Commission file number 1-06033, and incorporated by reference) 135 -

Page 136

... herein by reference) Form of Merger Performance Incentive Award Notice pursuant to the United Continental Holdings, Inc. 2008 Incentive Compensation Plan (filed as Exhibit 10.42 to UAL's Form 10-K for the year ended December 31, 2011, Commission file number 1-06033, and incorporated herein by... -

Page 137

... beginning on or after January 1, 2014) *†10.46 UAL Description of Compensation and Benefits for United Continental Holdings, Inc. Non-Employee Directors (filed as Exhibit 10.50 to UAL's Form 10-K for the year ended December 31, 2012, Commission file number 1-06033, and incorporated herein by... -

Page 138

...UAL UAL UAL UAL UAL UAL UAL Form of Share Unit Award Notice pursuant to the United Continental Holdings, Inc. 2006 Director Equity Incentive Plan (filed as Exhibit 10.4 to UAL's Form 10-Q for the quarter ended June 30, 2011, Commission file number 1-06033, and incorporated herein by reference) (for... -

Page 139

... reference) Continental Airlines, Inc. 2005 Pilot Supplemental Option Plan (filed as Exhibit 10.9 to Continental's Form 10-Q for the quarter ended March 31, 2005, Commission file number 1-10323, and incorporated herein by reference) United Air Lines, Inc. Management Cash Direct & Cash Match Program... -

Page 140

... S.A.S and United Air Lines, Inc. (filed as Exhibit 10.6 to UAL's Form 10-Q for the quarter ended June 30, 2010, Commission file number 1-06033, and incorporated herein by reference) *^10.80 UAL United Amendment No. 2 to the Airbus A350-900XWB Purchase Agreement, dated June 19, 2013 (filed as... -

Page 141

...the quarter ended June 30, 1996, Commission file number 1-10323, and incorporated herein by reference) *^10.89 UAL United *^10.90 UAL United Supplemental Agreement No. 1 to Purchase Agreement No. 1951, dated October 10, 1996 (filed as Exhibit 10.14(a) to Continental's Form 10-K for the year ended... -

Page 142

... year ended December 31, 2008, Commission file number 1-10323, and incorporated herein by reference) *^10.97 UAL United *^10.98 UAL United Letter Agreement No. 6-1162-GOC-131R1 to Purchase Agreement No. 1951, dated March 26, 1998 (filed as Exhibit 10.1 to Continental's Form 10-Q for the quarter... -

Page 143

... the year ended December 31, 2000, Commission file number 1-10323, and incorporated herein by reference) *^10.111 UAL United Supplemental Agreement No. 21, including side letters, to Purchase Agreement No. 1951, dated March 30, 2001 (filed as Exhibit 10.1 to Continental's Form 10-Q for the quarter... -

Page 144

... the quarter ended September 30, 2003, Commission file number 1-10323, and incorporated herein by reference) *^10.120 UAL United Supplemental Agreement No. 30 to Purchase Agreement No. 1951, dated November 4, 2003 (filed as Exhibit 10.23(ae) to Continental's Form 10-K for the year ended December... -

Page 145

... quarter ended September 30, 2007, Commission file number 1-10323, and incorporated herein by reference) *^10.133 UAL United *^10.134 UAL United Supplemental Agreement No. 44 to Purchase Agreement No. 1951, dated December 7, 2007 (filed as Exhibit 10.21(as) to Continental's Form 10-K for the year... -

Page 146

....1 for the quarter ended September 30, 2013, Commission file number 1-06033, and incorporated herein by reference) *^10.152 UAL United Aircraft General Terms Agreement, dated October 10, 1997, by and among Continental and Boeing (filed as Exhibit 10.15 to Continental's Form 10-K for the year ended... -

Page 147

...10-Q for the quarter ended June 30, 2002, Commission file number 1-10323, and incorporated herein by reference) *^10.163 UAL United Supplemental Agreement No. 10 to Purchase Agreement No. 2061, dated November 4, 2003 (filed as Exhibit 10.26(j) to Continental's Form 10-K for the year ended December... -

Page 148

...10-Q for the quarter ended September 30, 2010, Commission file number 1-10323, and incorporated herein by reference) *^10.174 UAL United Letter Agreement 6-1162-CHL-048, dated February 8, 2002, by and among Continental and Boeing (filed as Exhibit 10.44 to Continental's Form 10-K for the year ended... -

Page 149

..., and incorporated herein by reference) United Purchase Agreement No. PA-03784, dated July 12, 2012, between The Boeing Company and United Air Lines, Inc. (filed as Exhibit 10.1 to UAL's Form 10-Q for the quarter ended September 30, 2012, Commission file number 1-06033, and incorporated herein by... -

Page 150

... the quarter ended September 30, 2013, Commission file number 1-06033, and incorporated herein by reference) *^10.194 UAL United Letter Agreement No. 6-1162-KKT-080, dated July 12, 2012, among Boeing, United Continental Holdings, Inc., United Air Lines, Inc., and Continental Airlines, Inc. (filed as... -

Page 151

... Data File 101 UAL United The following materials from each of United Continental Holdings, Inc.'s and United Airlines, Inc.'s Annual Reports on Form 10-K for the year ended December 31, 2013, formatted in XBRL (Extensible Business Reporting Language): (i) the Statements of Consolidated Operations... -

Page 152

...regard to ctmtlative voting rights) to elect a majority of the Board. 1.6 "Chief Executive Officer" means the Chief Execttive Officer of the Corporation. 1.7 "Common Stock" means the Common Stock, par valte $0.01 per share, of the Corporation. 1.8 "Corporation" means United Continental Holdings, Inc... -

Page 153

...for the election of Directors and the transaction of other btsiness at an hotr and date as shall be determined by the Board and designated in the notice of meeting. 2.2 Special Meetings . la) A special meeting of the Stockholders may be called by li) both the Chief Execttive Officer and the Chairman... -

Page 154

... Special Meeting Reqtest, lB) the "highest tender offer price or stated amotnt of the consideration offered for the stbject sectrity" shall refer to the closing sales price of Common Stock on the New York Stock Exchange lor any stccessor thereto) on stch date lor, if stch date is not a trading day... -

Page 155

... or its Special Meeting Reqtest at any time prior to the Stockholder Reqtested Special Meeting by written revocation delivered to the Secretary of the Corporation at the principal execttive offices of the Corporation. There shall be no reqtirement to hold a special meeting land the Board may cancel... -

Page 156

... Secretary of the Corporation lstch date of delivery being the "Delivery Date"). Notwithstanding the foregoing, a Stockholder Reqtested Special Meeting need not be held if li) the Board has called or calls a meeting of Stockholders to be held within 90 days after the Delivery Date and the btsiness... -

Page 157

... the foregoing, if the ntmber of nominees exceeds the ntmber of directors to be elected at any meeting of Stockholders as of the date that is ten l10) days prior to the date the Corporation files its definitive proxy statement with the Sectrities and Exchange Commission lregardless of whether or not... -

Page 158

... fix and annotnce at the meeting the time of the opening and the closing of the polls for each matter tpon which the Stockholders will vote at a meeting. 2.9 Conduct of Stockholders' Meetings . The Chief Execttive Officer or the Chairman of the Board, as designated by the Board, or, in their absence... -

Page 159

...year's anntal meeting; provided, however, that in the event that the date of the anntal meeting is advanced by more than 30 days, or delayed by more than 60 days, from stch anniversary date, notice by the Stockholder to be timely mtst be so delivered, or mailed and received, not later than the close... -

Page 160

... stock of the Corporation by, manage the risk of share price changes for, or increase or decrease the voting power of, stch Proposing Person with respect to the shares of any class or series of the capital stock of the Corporation, or which provides, directly or indirectly, the opporttnity to profit... -

Page 161

...'s written consent to being named in the proxy statement as a nominee and to serving as a Director if elected); and lii) liii) a description of all direct and indirect compensation and other material monetary agreements, arrangements and tnderstandings dtring the past three years, and any other... -

Page 162

... be elected to the Board at the anntal meeting is increased and there is no ptblic annotncement by the Corporation naming all of the nominees for Director or specifying the size of the increased Board made by the Corporation at least ten days before the last day a Stockholder cotld otherwise deliver... -

Page 163

...10. To be timely, a Stockholder's notice shall be delivered to, or mailed and received by, the Secretary at the principal execttive offices of the Corporation not earlier than the one htndred twentieth day prior to the date of stch Management Reqtested Special Meeting and not later than the close of... -

Page 164

... meeting by means of remote commtnication, a record of stch vote or other action shall be maintained by the Corporation. ARTICLE 3 Board Of Directors 3.1 Number and Term of Office. The ntmber and term of office of Directors on the Board shall be determined as provided in the Restated Certificate... -

Page 165

... and the Chief Execttive Officer at any meeting of the Board, the Board may appoint from among its members a Chairman of the Board pro tempore, who shall preside at stch meeting, except where otherwise provided by law. 3.11 Resignation . Any Director may resign at any time tpon notice given in... -

Page 166

... provided in the Restated Certificate, tnless sooner discharged by the affirmative vote of a majority of the votes entitled to be cast by the Entire Board, members of each committee of the Board shall hold office tntil the organization meeting of the Board in the next stbseqtent year and tntil their... -

Page 167

... at any stated meeting of any committee of the Board. lb) Special meetings of any committee of the Board may be called at any time by the chairman of stch committee or by any two members of stch committee. Notice of a special meeting of any committee of the Board shall set forth a description... -

Page 168

... Corporation. Any officer may also be elected to another office or offices. 5.2 Term of Office. Stbject to the provisions of the Restated Certificate or these Restated Bylaws, so far as practicable, each officer shall be elected at the organization meeting of the Board in each year, and shall hold... -

Page 169

... shall have stch other powers and dtties as he or she may be called tpon by the Board to perform. 5.6 Chief Executive Officer . The Chief Execttive Officer shall have general and active control of the btsiness and affairs of the Corporation and, in the absence of the Chairman lor if there be none... -

Page 170

...any member of the Board or execttive officer of the Corporation, as stch terms are tsed in Section 13lk) of the Exchange Act and the rtles and regtlations promtlgated theretnder. ARTICLE 6 Stock And Transfers Of Stock 6.1 Stock Certificates . The Common Stock shall be tncertificated. The shares of... -

Page 171

... of any change, conversion or exchange of stock or for the ptrpose of any other lawftl action, the Board is atthorized, from time to time, to fix, in advance, a record date, which shall not be more than sixty l60) nor less than ten l10) days before the date of stch Stockholder meeting, nor more... -

Page 172

... be declared by the Board at any regtlar or special meeting and may be paid in cash or in property or in shares of the capital stock. Before paying any dividend or making any distribttion of profits, the Directors may set apart ott of any ftnds of the Corporation available for dividends a reserve or... -

Page 173

... herein, if any provision contained herein is inconsistent with or conflicts with a provision of the Restated Certificate, stch provision herein shall be stperseded by the inconsistent provision in the Restated Certificate, to the extent necessary to give effect to stch provision in the Restated... -

Page 174

...regard to cumulative voting rights) to elect a majority of the Board. 1.6 "Chief Executive Officer" means the Chief Executive Officer of the Corporation. 1.7 "Common Stock" means the Common Stock, par value $0.01 per share, of the Corporation. 1.8 "Corporation" means United Continental Holdings, Inc... -

Page 175

...for the election of Directors and the transaction of other business at an hour and date as shall be determined by the Board and designated in the notice of meeting. 2.2 Special Meetings . (a) A special meeting of the Stockholders may be called by (i) both the Chief Executive Officer and the Chairman... -

Page 176

... Special Meeting Request, (B) the "highest tender offer price or stated amount of the consideration offered for the subject security" shall refer to the closing sales price of Common Stock on the New York Stock Exchange (or any successor thereto) on such date (or, if such date is not a trading day... -

Page 177

... or its Special Meeting Request at any time prior to the Stockholder Requested Special Meeting by written revocation delivered to the Secretary of the Corporation at the principal executive offices of the Corporation. There shall be no requirement to hold a special meeting (and the Board may cancel... -

Page 178

... of the Corporation (such date of delivery being the "Delivery Date"). Notwithstanding the foregoing, a Stockholder Requested Special Meeting need not be held if (i) the Board has called or calls a meeting of Stockholders to be held within 90 days after the Delivery Date and the business of such... -

Page 179

... at his or her address as it appears on the stock ledger of the Corporation. Every notice of a meeting of Stockholders shall state the place, date and hour of the meeting and the purpose or purposes for which the meeting is called. 2.5 Waivers of Notice. Notwithstanding any other provision... -

Page 180

... fix and announce at the meeting the time of the opening and the closing of the polls for each matter upon which the Stockholders will vote at a meeting. 2.9 Conduct of Stockholders' Meetings . The Chief Executive Officer or the Chairman of the Board, as designated by the Board, or, in their absence... -

Page 181

..., not later than the close of business on the tenth day following the day on which public announcement of the date of such annual meeting is first made by the Corporation. In no event shall any adjournment of an annual meeting or the announcement thereof commence a new time period (or extend any... -

Page 182

..., Section 14(a) of the Exchange Act by way of a solicitation statement filed on Schedule 14A), agreement, arrangement, understanding or relationship pursuant to which such Proposing Person has or shares a right to vote any shares of any class or series of the capital stock of the Corporation; (ii) -

Page 183

... stock of the Corporation by, manage the risk of share price changes for, or increase or decrease the voting power of, such Proposing Person with respect to the shares of any class or series of the capital stock of the Corporation, or which provides, directly or indirectly, the opportunity to profit... -

Page 184

...'s written consent to being named in the proxy statement as a nominee and to serving as a Director if elected); and (ii) (iii) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other... -

Page 185

... the event that the number of Directors to be elected to the Board at the annual meeting is increased and there is no public announcement by the Corporation naming all of the nominees for Director or specifying the size of the increased Board made by the Corporation at least ten days before the last... -

Page 186

... timely, a Stockholder's notice shall be delivered to, or mailed and received by, the Secretary at the principal executive offices of the Corporation not earlier than the one hundred twentieth day prior to the date of such Management Requested Special Meeting and not later than the close of business... -

Page 187

... entitled to vote at such meeting, arranged in alphabetical order, and showing the address of each Stockholder and the number of shares registered in such Stockholder's name. Such list shall be produced and kept available at the times and places required by law. The stock ledger shall be the only... -

Page 188

... business may be transacted at any stated meeting. 3.73.6 Special Meetings . Special meetings of the Board shall be held whenever called by the Secretary, at the direction of any three Directors, or by the Chairman, or, in the event that the office of the Chairman is vacant, by the Chief Executive... -

Page 189

... are no Directors in office, then an election of Directors may be held in the manner provided by statute. 3.153.14 Directors' Fees. The Board shall have authority to determine, from time to time, the amount of compensation that shall be paid to its members for attendance at meetings of the Board or... -

Page 190

... to which such service guarantees next day delivery, not later than on the day that is the second business day immediately preceding the day of such meeting, or (b) by facsimile, telex, telegram or electronic mail, not later than twenty-four (24) hours before the time of such meeting. If sent by... -

Page 191

...of Directors who are neither officers nor employees of the Corporation or of any of its affiliated corporations. (b) Subject to the provisions of the DGCL and these Restated Bylaws, the Executive Committee shall have and may exercise all the powers of the Board in the management of the business and... -

Page 192

... shall have such other powers and duties as he or she may be called upon by the Board to perform. 5.6 Chief Executive Officer . The Chief Executive Officer shall have general and active control of the business and affairs of the Corporation and, in the absence of the Chairman (or if there be none... -

Page 193

...that the Board may change such designation, or if the President fails or is unable to make such designation, the Board may make such designation at a regular or special meeting called for that purpose. 5.10 Secretary. The Secretary shall attend to the giving of notice of all meetings of Stockholders... -

Page 194

...any member of the Board or executive officer of the Corporation, as such terms are used in Section 13(k) of the Exchange Act and the rules and regulations promulgated thereunder. ARTICLE 6 Stock And Transfers Of Stock 6.1 Stock Certificates . The Common Stock shall be uncertificated. The shares of... -

Page 195

... of any change, conversion or exchange of stock or for the purpose of any other lawful action, the Board is authorized, from time to time, to fix, in advance, a record date, which shall not be more than sixty (60) nor less than ten (10) days before the date of such Stockholder meeting, nor more... -

Page 196

... be declared by the Board at any regular or special meeting and may be paid in cash or in property or in shares of the capital stock. Before paying any dividend or making any distribution of profits, the Directors may set apart out of any funds of the Corporation available for dividends a reserve or... -

Page 197

... herein, if any provision contained herein is inconsistent with or conflicts with a provision of the Restated Certificate, such provision herein shall be superseded by the inconsistent provision in the Restated Certificate, to the extent necessary to give effect to such provision in the Restated... -

Page 198

... January 1, 2014, Except As Otherwise Provided Herein) I. General A. Purpose. United Continental Holdings, Inc. (the "Company") sponsors this United Continental Holdings, Inc. Profit Sharing Plan (the "Plan") for the benefit of certain employees of United Air Lines, Inc., Continental Airlines, Inc... -

Page 199

... agreement between United Air Lines, Inc. and the Association of Flight Attendants, (2) any employee of Continental Micronesia, Inc. on the U.S. payroll, and (3) any employee designated by the Employer as an expatriate. Employer. "Employer" means United Airlines, Inc., Continental Airlines... -

Page 200

... Employee Group" means those Domestic Employees of an Employer whose participation in the Plan is governed by the Fleet Service Employees 2013-2016 Agreement , Passenger Service Employees 2013-2016 Agreement , and Storekeeper Employees 2013-2016 Agreement between the Company and the International... -

Page 201

... in the Plan is governed by the United Pilot Agreement between United Airlines, Inc. and the Air Line Pilots In the Service of United Airlines, Inc. as Represented by the Air Line Pilots Association, International . Plan. "Plan" means the United Continental Holdings, Inc. Profit Sharing Plan as set... -

Page 202

...accordance with the Employer's employment policies and regulations, including under an "early out" program in which the Company specifies (or otherwise determines in its sole discretion) that the Employee is to be considered retired for purposes of this Plan. Total Revenue. "Total Revenue" means the... -

Page 203

.... Profit Sharing Awards. A. Annual Threshold. After the end of each Award Year, if the Company's PrerTax Profit for that year exceeds ten million dollars ($10,000,000), Awards will be determined in accordance with Section III.B. If this threshold is not met, no Awards will be payable under the Plan... -

Page 204

... Employee Group during the calendar year, the Qualified Employee's Wages while a member of each Employee Group shall be distinguished and applied to the appropriate formula under Section III.B. Determination of Wages. Subject to the provisions of Appendix A, the Company's Executive Vice President... -

Page 205

...(m) of the Code or the calendar year in which the officer separates from service with the Company and all affiliates. Payment of Awards for any employee group shall be made as a profit sharing contribution to the applicable Employerrsponsored 401(k) plan if required under the terms of the applicable... -

Page 206

... under the terms of a collective bargaining agreement. VI. Miscellaneous. A. No Contract of Employment, etc. Neither this Plan nor any award under the Plan constitutes a contract of employment and participation in the Plan will not give any employee the right to be retained in the service of the... -

Page 207

...WITNESS WHEREOF, the Company has caused this amendment and restatement of the Plan to be executed on its behalf, effective as of January 1, 2014, except as otherwise provided herein. UNITED CONTINENTAL HOLDINGS, INC. /s/ Michael P. Bonds Michael P. Bonds Executive Vice President Human Resources and... -

Page 208

...applicable Plan Year (other than judicial or administrative awards of grievance pay or back pay (including settlements thereof)) delayed activation pay bypass pay check pilot premium pay double town salary expense senior/junior manning pay operational integrity pay temporary reclass pay Hawaiian... -

Page 209

...the U.S. Bankruptcy Code payments made to employees domiciled outside of the United States that are in lieu of Employer contributions to a retirement plan any amount counted as wages under this Plan or any other profit sharing plan for a prior Award Year. A-3. Special Crediting Rule . For purposes... -

Page 210

...Pursuant to the United Continental Holdings, Inc. 2008 Incentive Compensation Plan This Restricted Share Award Notice (this "Award Notice") is provided pursuant to the United Continental Holdings, Inc. 2008 Incentive Compensation Plan (the "Plan"), and sets forth the terms and conditions of an award... -

Page 211

... Event" means your Termination of Employment on the date upon which a Change of Control occurs or within two (2) years thereafter under circumstances which would permit you to receive a cash severance payment pursuant to an employment agreement between you and the Company or an Affiliate or, if... -

Page 212

... prior to the date of your Termination of Employment, your rights with respect to such Restricted Shares shall immediately terminate upon your Termination of Employment, and you will be entitled to no further payments or benefits with respect thereto. SECTION 5. Non-Transferability of Restricted... -

Page 213

... all non-public information relating to the Company or any of its Affiliates (including but not limited to all marketing, alliance, social media, advertising, and sales plans and strategies; pricing information; financial, advertising, and product development plans and strategies; compensation and... -

Page 214

..., to limit the protection of any applicable law or policy of the Company or its Affiliates that relates to the protection of trade secrets or confidential or proprietary information. (b) Non-Solicitation of Employees . During Grantee's employment and for the one-year period following termination of... -

Page 215

... market that includes passenger transportation and services, air cargo services, repair and maintenance of aircraft and staffing services for third parties, logistics management and consulting, private jet operations and fuel deployment and management, and that the Company's business plan... -

Page 216

... with its Business Partners and providers of goods or services or other business affiliates or that could otherwise interfere with the Company's business. (g) Non-Disparagement . Grantee agrees during and following employment not to make, or cause to be made, any statement, observation, or... -

Page 217

... and the Restricted Shares, and any other award outstanding under the Plan will be forfeited. SECTION 12. Clawback. Notwithstanding any provisions in this Award Notice to the contrary, any portion of the payments and benefits provided under this Award Notice or the sale of Shares shall be subject... -

Page 218

...of the third party administrator of the Plan. By utilizing such third party electronic acceptance process, Grantee understands and agrees that (i) Grantee will be electronically signing and returning this Award Notice to United Continental Holdings, Inc. as of the date entered in the records of such... -

Page 219

... shall be subject to the provisions of Section 7(c) of the Plan). (c) Adequate Time. Grantee acknowledges that Grantee understands the terms and conditions set forth in this Award Notice and has had adequate time to consider whether to agree to them and to consult a lawyer or other advisor of your... -

Page 220

...signing below and returning this Award Notice to United Continental Holdings, Inc., I hereby acknowledge receipt of this Award Notice and the Plan, accept the Restricted Shares granted to me pursuant to this Award Notice, and agree to be bound by the terms and conditions of this Award Notice and the... -

Page 221

... UNITED CONTINENTAL HOLDINGS, INC. LONG-TERM RELATIVE PERFORMANCE PROGRAM WHEREAS, the United Continental Holdings, Inc. Long-Term Relative Performance Program, as amended (the "Program") has heretofore been adopted by the Compensation Committee (the "Committee") of the Board of Directors of United... -

Page 222

... of the Code), eithei: (A) the cumulative Pre-tax Income for the Company for such Performance Period divided by the Company's cumulative revenues (determined on a consolidated basis based on the regularly prepared and publicly available statements of operations of the Company prepared in accordance... -

Page 223

... under the United Continental Holdings, Inc. Long-Term Relative Performance Program (as amended from time to time, the " Program") adopted under the United Continental Holdings, Inc. Incentive Plan 2010 (as amended from time to time, the " Incentive Plan 2010 "). This Award Notice evidences your... -

Page 224

...(Target Level LTIP Percentage) % (Stretch Level LTIP Percentage) 4. Continuous Employment Required . Receipt of a Payment Amount is conditioned on your continuous employment with the Company or its subsidiaries through the last day of the Performance Period (with limited exceptions, as described in... -

Page 225

...Plan. The Company will cease contributing direct contributions to the 401(k) Plan and instead pay them to you in cash if the following occurs: • Your earnings for the year exceed the IRS total annual compensation limit (e.g., $260,000 in 2014) under Section 401(a)(17) of the Internal Revenue Code... -

Page 226

... contributions to the 401(k) Plan and instead pay them to you in cash if the following occurs: • Your earnings as a Management co-worker for the year exceed the IRS total annual compensation limit (e.g., $260,000 in 2014) under Section 401(a)(17) of the Internal Revenue Code and you have made pre... -

Page 227

...in any way the rights of the Company (subject to any written employment contract you may have with the Company) to terminate your employment at any time and for any reason. This Program is a Company policy and is not an employee benefit plan governed by the Employee Retirement Income Security Act of... -

Page 228

... 16, 2013, by and between THE BOEING COMPANY ( Boeing) and UNITED AIRLINES, INC. (a Delaware corporation formerly known as Continental Airlines, Inc. and successor by merger to United Air Lines, Inc.) ( Customer ); WHEREAS, the parties hereto entered into Purchase Agreement No. 3860 dated September... -

Page 229

.... The Purchase Agreement will be deemed to be supplemented to the extent herein provided as of the date hereof and as so supplemented will continue in full force and effect. [The rest of the page is intentionally blank. Signature page follows.] UAL-PA-3860 SA-2, Page 2 BOEING / UNITED AIRLINES... -

Page 230

EXECUTED IN DUPLICATE as of the day and year first written above. THE BOEING COMPANY UNITED AIRLINES, INC. /s/ Gerald Laderman Signature Attorney-in-Fact Title /s/ *** Signature Senior Vice President - Finance, Procurement and Treasurer Title UAL-PA-3860 SA-2, Page 3 BOEING / UNITED AIRLINES,... -

Page 231

... Customer Support Document Engine Escalation/Engine Warranty *** Service Life Policy Components SA-1 CS1. EE1. SLP1. LETTER AGREEMENTS UAL-PA-03860-LA-1209247 787 e-Enabling Open Configuration Matters U AL-PA-03860-LA-1209264 P.A. 3860 TABLE OF CONTENTS, Page 1 of 3 BOEING/UNITED AIRLINES... -

Page 232