Supercuts 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Long-Lived Asset Impairment Assessments, Excluding Goodwill:

The Company reviews long-lived assets for impairment at the salon level annually or if events or circumstances indicate that the carrying

value of such assets may not be recoverable. The Company's test for impairment of property and equipment is performed at a salon level, as

this is the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities.

Impairment is evaluated based on the sum of undiscounted estimated future cash flows expected to result from use of the assets that does not

recover the carrying value of the related salon assets. When the sum of a salon's undiscounted estimated future cash flow is zero or negative,

impairment is measured as the full carrying value of the related salon's equipment and leasehold improvements. When the sum of a salon's

undiscounted cash flows is greater than zero but less than the carrying value of the related salon's equipment and leasehold improvements, a

discounted cash flow analysis is performed to estimate the fair value of the salon assets and impairment is measured as the difference between

the carrying value of the salon assets and the estimated fair value. The fair value estimate is based on the best information available, including

market data.

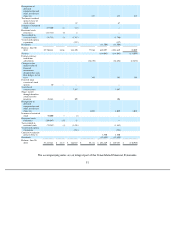

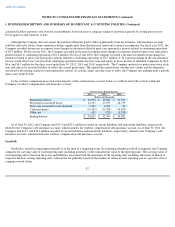

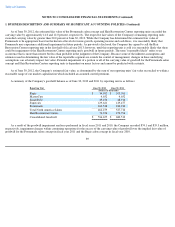

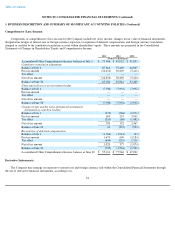

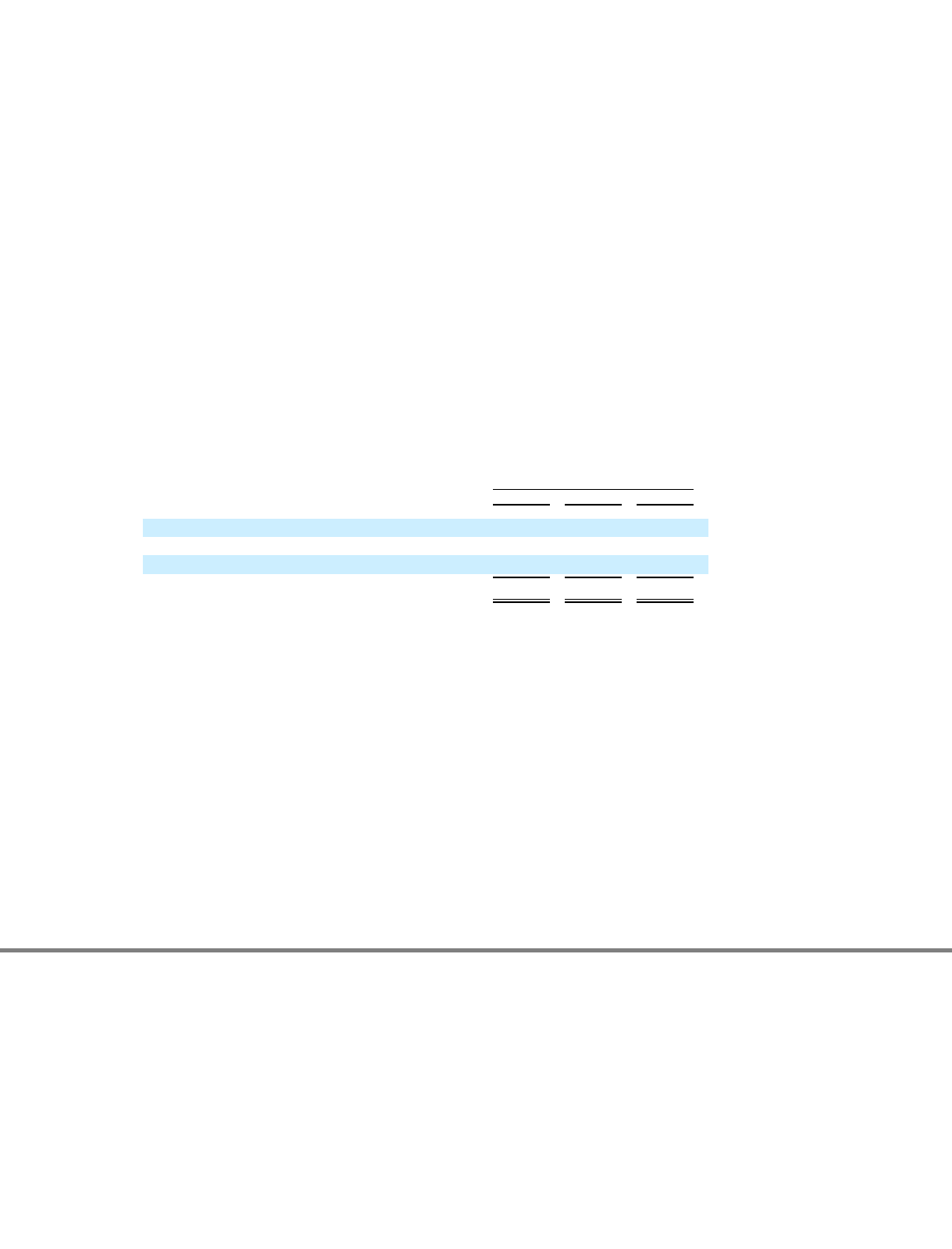

As a result of the Company's annual impairment analysis of long-lived assets, the following impairment charges were recognized during

fiscal years 2012, 2011, and 2010, respectively, related primarily to the carrying value of certain salons' property and equipment within our

North American, International, and Hair Restoration Centers segments:

The Company also evaluated the appropriateness of the remaining useful lives of its non-impaired property and equipment and whether a

change to the depreciation charge was warranted. Impairment charges for continuing operations are included in depreciation related to

company-owned salons in the Consolidated Statement of Operations.

Deferred Rent and Rent Expense:

The Company leases most salon and hair restoration center locations under operating leases. Rent expense is recognized on a straight-line

basis over the lease term. Tenant improvement allowances funded by landlord incentives, rent holidays, and rent escalation clauses which

provide for scheduled rent increases during the lease term or for rental payments commencing at a date other than the date of initial occupancy

are recorded in the Consolidated Statements of Operations on a straight-line basis over the lease term (including one renewal option period if

renewal is reasonably assured based on the imposition of an economic penalty for failure to exercise the renewal option). The difference

between the rent due under the stated periods of the lease compared to that of the straight-line basis is recorded as deferred rent within other

noncurrent liabilities in the Consolidated Balance Sheet.

90

For the Years Ended June 30,

2012 2011 2010

(Dollars in thousands)

North American salons

$

6,066

$

6,115

$

6,253

International salons

570

394

175

Hair restoration centers

—

172

—

Total

$

6,636

$

6,681

$

6,428