Supercuts 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

31

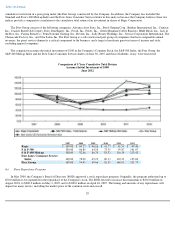

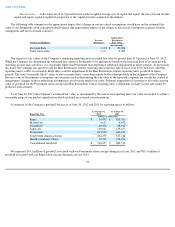

Company's Regis salon concept was recorded in fiscal year 2010. An impairment charge of $41.7 million

associated with the Company's United Kingdom salon division was recorded in fiscal year 2009.

• During fiscal year 2012, the Company recorded incremental depreciation expense of $16.2 million ($10.2 million

net of tax or $0.18 per diluted share) associated with the adjustment at June 30, 2011 to the useful life of the

Company's internally developed POS system.

• During fiscal year 2012, the Company recorded $9.8 million in senior management restructuring and other

severance charges.

• Loss development was recorded in fiscal years 2012, 2011, 2010, 2009, and 2008 related to a change in estimate

of the Company's self insurance accruals, primarily prior years' workers' compensation claims reserves. Site

operating expenses increased by $0.7 and $1.4 million, and decreased by $1.7, $9.9, and $6.9 million in fiscal

years 2012, 2011, 2010, 2009, and 2008, respectively, as a result of the change in estimate.

• During fiscal year 2011, the Company recorded a $31.2 million valuation reserve related to the note receivable

with the purchaser of Trade Secret.

• Charges of $2.1 and $5.7 million were recorded in fiscal years 2010 and 2009, respectively associated with

disposal charges and lease termination fees related to the closure of salons other than in the normal course of

business.

• During fiscal year 2011, the Company settled a legal claim with the former owner of Hair Club for $1.7 million.

Fiscal year 2010 included a $5.2 million charge related to the settlement of two legal claims regarding certain

guest and employee matters.

• Operating income from the deconsolidated European franchise salon operations was $5.1 million in fiscal year

2008.

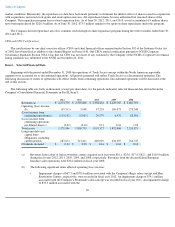

(c) The following significant items affected (loss) income from continuing operations and (loss) income from continuing

operations per diluted share:

• During fiscal year 2012, the Company recorded a net $17.2 million other than temporary net impairment charge

within equity in (loss) income of affiliated companies associated with the Agreement to sell the Company's

46.7 percent equity interest in Provalliance to the Provost Family for a purchase price of €80 million. During

fiscal year 2012, the Company recorded a $19.4 million other than temporary impairment on its investment in

EEG and also recorded $8.7 million for the Company's share of an intangible asset impairment recorded by EEG.

During fiscal year 2011, the Company recorded a $9.2 million other than temporary impairment on its investment

in preferred shares of Yamano and premium paid at the time of it initial investment in MY Style. Impairment

charges of $25.7 and $7.8 million associated with the Company's investment in Provalliance and for the full

carrying value of our investment in and loans to Intelligent Nutrients, LLC were recorded in fiscal year 2009.

• During fiscal year 2012, the Company recorded $1.1 million of other income associated with a favorable legal

settlement.

• During fiscal year 2011, the Company recognized a net gain of approximately $2.4 million representing the

settlement of a portion of the company's equity put liability and additional ownership of the Frank Provost Group

in Provalliance, for the March 2011 acquisition of the approximately 17 percent additional ownership interest in

Provalliance.

• Fiscal year 2010 includes interest expense of $18.0 million related to make-whole payments and other fees

associated with the repayment of private placement debt.