Supercuts 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

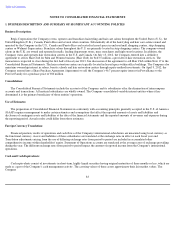

Table of Contents

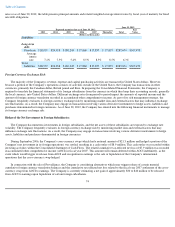

rates or as of June 30, 2012, the table presents principal amounts and related weighted-average interest rates by fiscal year of maturity for fixed

rate debt obligations.

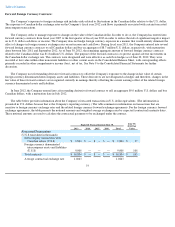

Foreign Currency Exchange Risk:

The majority of the Company's revenue, expense and capital purchasing activities are transacted in United States dollars. However,

because a portion of the Company's operations consists of activities outside of the United States, the Company has transactions in other

currencies, primarily the Canadian dollar, British pound and Euro. In preparing the Consolidated Financial Statements, the Company is

required to translate the financial statements of its foreign subsidiaries from the currency in which they keep their accounting records, generally

the local currency, into United States dollars. Different exchange rates from period to period impact the amounts of reported income and the

amount of foreign currency translation recorded in accumulated other comprehensive income. As part of its risk management strategy, the

Company frequently evaluates its foreign currency exchange risk by monitoring market data and external factors that may influence exchange

rate fluctuations. As a result, the Company may engage in transactions involving various derivative instruments to hedge assets, liabilities and

purchases denominated in foreign currencies. As of June 30, 2012, the Company has entered into the following financial instruments to manage

its foreign currency exchange risk:

Hedge of the Net Investment in Foreign Subsidiaries:

The Company has numerous investments in foreign subsidiaries, and the net assets of these subsidiaries are exposed to exchange rate

volatility. The Company frequently evaluates its foreign currency exchange risk by monitoring market data and external factors that may

influence exchange rate fluctuations. As a result, the Company may engage in transactions involving various derivative instruments to hedge

assets, liabilities and purchases denominated in foreign currencies.

During September 2006, the Company's cross-currency swap (which had a notional amount of $21.3 million and hedged a portion of the

Company's net investment in its foreign operations) was settled, resulting in a cash outlay of $8.9 million. This cash outlay was recorded within

investing activities within the Consolidated Statement of Cash Flows. The related cumulative tax-

effected net loss of $7.9 million was recorded

in accumulated other comprehensive income (AOCI) in fiscal year 2007. This amount will remain deferred within AOCI indefinitely, as the

event which would trigger its release from AOCI and recognition in earnings is the sale or liquidation of the Company's international

operations that the cross-currency swap hedged.

In connection with the sale of Provalliance, the Company is considering alternatives which may trigger release of certain material

cumulative foreign currency translation balances and the cumulative tax-effected net loss related to the fiscal year 2007 settlement of the cross-

currency swap from AOCI to earnings. The Company is currently estimating a net gain of approximately $30 to $40 million to be released

from AOCI to earnings upon liquidation of certain foreign subsidiaries.

74

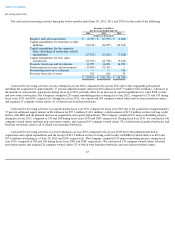

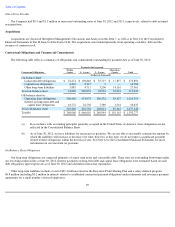

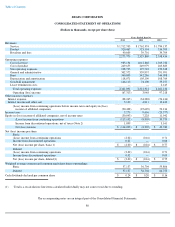

June 30, 2012

Expected maturity date as of June 30, 2012

Fair

Value

2013 2014 2015 2016 2017

Thereafter

Total

(Dollars in thousands)

Liabilities

Long

-term

debt:

Fixed rate

$

28,937

$

24,918

$

180,245

$

17,860

$

17,857

$

17,857

$

287,674

$

307,478

Average

interest

rate

7.4

%

7.5

%

5.4

%

8.5

%

8.5

%

8.5

%

6.3

%

Total

liabilities

$

28,937

$

24,918

$

180,245

$

17,860

$

17,857

$

17,857

$

287,674

$

307,478