Supercuts 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Income Taxes

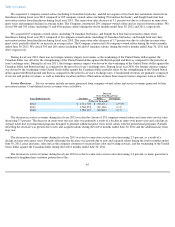

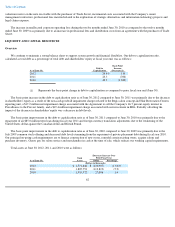

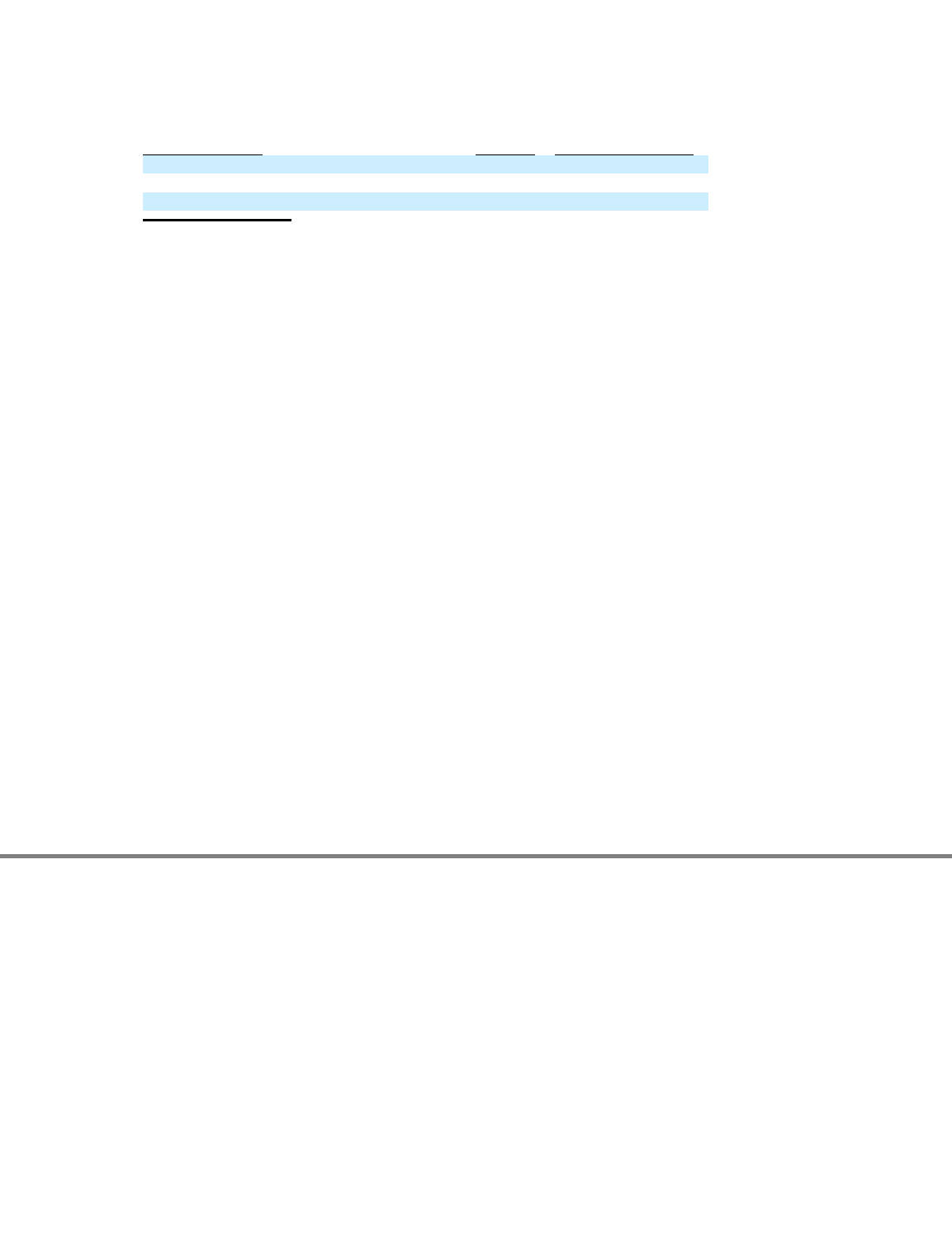

Our reported effective tax rate was as follows:

The basis point increase in our overall effective income tax rate for fiscal year 2012 was primarily due to the impact of the goodwill

impairment charges recorded during fiscal year 2012 as compared to the impact of the goodwill impairment charge recorded during fiscal year

2011. The majority of the goodwill impairment charges recorded during fiscal year 2012 were non-deductible for tax purposes. This adversely

impacted the annual effective tax rate by 37.9% as compared to the prior year impact of 10.4%. Additionally, the impact of employment credits

related to the Small Business and Work Opportunity Act of 2007 resulted in less of a tax benefit to the annual effective tax rate when compared

to the prior year. This was due to the prior year employment credits having a larger favorable impact to the prior year effective tax rate because

of the lower book loss recorded during fiscal year 2011. Absent new legislation being enacted, these credits expired on December 31, 2011.

For fiscal year 2011, the Company reported a $25.6 million loss from continuing operations before income taxes as compared to income

from continuing operations before income taxes of $53.2 and $78.8 million in fiscal years 2010 and 2009, respectively. The rate reconciliation

items have a greater impact on the annual effective income tax rate in fiscal year 2011 as the magnitude of the loss from continuing operations

before income taxes is less than the magnitude of income from continuing operations before income taxes in fiscal year 2010. The annual

effective tax rate was favorably impacted by the employment credits related to the Small Business and Work Opportunity Tax Act of 2007.

Partially offsetting the favorable impact of the employment credits was the adverse impact of the pre-tax non-cash goodwill impairment charge

of $74.1 million recorded during the third quarter of fiscal year 2011, which is only partially deductible for tax purposes. Additionally, the

foreign income taxes at other than U.S. rates adversely impacted the annual effective tax rate due to a decrease in foreign income from

continuing operations before income taxes and other foreign non-deductible items.

The basis point improvement in our overall effective income tax rate for the fiscal year ended June 30, 2010 was primarily due to a

decrease in the impact of the non-cash goodwill impairment charge recorded during the year ended June 30, 2010 compared to the impact of

the non-cash goodwill impairment charge recorded during the year ended June 30, 2009 and an increase in the employment credits received. In

addition, a 0.9 percent decrease in the tax rate was due to adjustments to the income tax balances, which had a smaller impact than the charge

recorded in the prior year related to the adjustment of prior year deferred income taxes.

54

Years Ended June 30, Effective

Rate Basis Point

Increase (Decrease)(1)

2012

(5.8

)%

3,130

2011

(37.1

)

N/A

2010

48.1

(520

)

(1) Represents the basis point change in income tax (benefit) expense as a percent of (loss) income from continuing

operations before income taxes and equity in (loss) income of affiliated companies as compared to the

corresponding periods of the prior fiscal year. The basis point change for fiscal year 2011 is not applicable due to

the income tax benefit in fiscal year 2011 compared to income tax expense in fiscal year 2010.