Supercuts 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

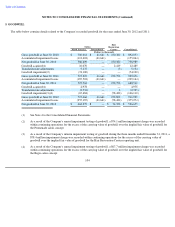

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

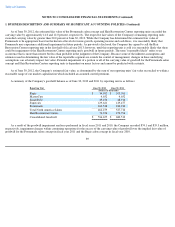

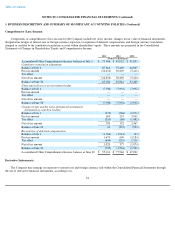

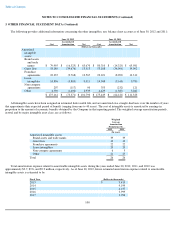

3. OTHER FINANCIAL STATEMENT DATA

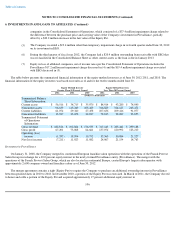

The following provides additional information concerning selected balance sheet accounts as of June 30, 2012 and 2011:

99

2012 2011

(Dollars in thousands)

Accounts receivable

$

32,810

$

28,631

Less allowance for doubtful accounts

(1,232

)

(1,482

)

$

31,578

$

27,149

Other current assets:

Prepaids

$

32,179

$

29,705

Notes receivable, primarily affiliates

29,043

2,413

$

61,222

$

32,118

Property and equipment:

Land

$

3,864

$

3,864

Buildings and improvements

48,017

47,907

Equipment, furniture and leasehold improvements

794,353

775,527

Internal use software

106,264

94,507

Equipment, furniture and leasehold improvements

under capital leases

84,757

88,297

1,037,255

1,010,102

Less accumulated depreciation and amortization

(656,512

)

(611,669

)

Less amortization of equipment, furniture and

leasehold improvements under capital leases

(57,683

)

(50,622

)

$

323,060

$

347,811

Investment in and loans to affiliates:

Equity

-

method investments

$

166,176

$

258,930

Noncurrent loans to affiliates

—

2,210

$

166,176

$

261,140

Other assets:

Notes receivable, net

$

1,584

$

1,072

Other noncurrent assets

57,904

57,328

$

59,488

$

58,400

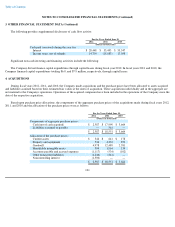

Accrued expenses:

Payroll and payroll related costs

$

80,649

$

89,788

Insurance

19,410

19,127

Deferred compensation

26,055

6,180

Deferred revenues

9,054

8,313

Taxes payable

5,673

8,113

Other

31,741

35,800

$

172,582

$

167,321

Other noncurrent liabilities:

Deferred income taxes

$

38,266

$

55,208

Deferred rent

52,773

53,102

Deferred benefits

39,178

58,150

Insurance

32,459

30,925

Equity put options

794

22,700

Other

8,509

17,210

$

171,979

$

237,295