Supercuts 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

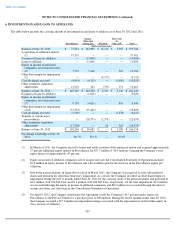

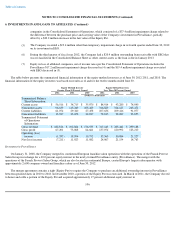

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

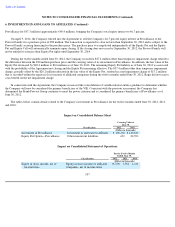

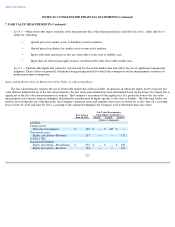

Impact on Consolidated Statement of Cash Flows

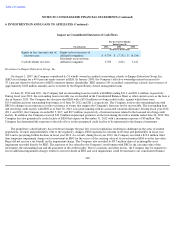

Investment in Empire Education Group, Inc.

On August 1, 2007, the Company contributed its 51 wholly-owned accredited cosmetology schools to Empire Education Group, Inc.

(EEG) in exchange for a 49.0 percent equity interest in EEG. In January 2008, the Company's effective ownership interest increased to

55.1 percent related to the buyout of EEG's minority interest shareholder. EEG operates 105 accredited cosmetology schools, has revenues of

approximately $180 million annually and is overseen by the Empire Beauty School management team.

At June 30, 2012 and 2011, the Company had an outstanding loan receivable with EEG totaling $11.4 and $21.4 million, respectively.

During fiscal year 2012, the outstanding loan receivable was reclassified in the Consolidated Balance Sheet as other current assets as the loan is

due in January 2013. The Company has also provided EEG with a $15.0 million revolving credit facility, against which there were

$15.0 million and zero outstanding borrowings as of June 30, 2012 and 2011, respectively. The Company reviews the outstanding loan with

EEG for changes in circumstances or the occurrence of events that suggest the Company's loan may not be recoverable. The outstanding loan

and revolving credit facility with EEG as of June 30, 2012 is in good standing with no associated valuation allowance. During fiscal year 2012,

2011, and 2010, the Company recorded $0.5, $0.7, and $0.7 million, respectively, of interest income related to the loan and revolving credit

facility. In addition, the Company received $10.0 million in principal payments on the loan during the twelve months ended June 30, 2012. The

Company has also guaranteed a credit facility of EEG that expires on December 31, 2012 with a maximum exposure of $9 million. The

Company has determined the exposure to the risk of loss on the guaranteed credit facility to be immaterial to the financial statements.

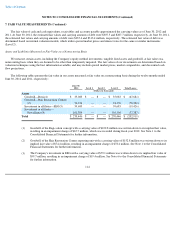

The proprietary school industry has seen broad changes the past few years in regulations resulting in challenges in the areas of student

populations, revenue and profitability. Due to the regulatory changes, EEG experienced a decline in revenue and profitability in fiscal year

2012 and is projecting further declines in fiscal year 2013. As a result, during fiscal year 2012, the Company recorded a $19.4 million other

than temporary impairment charge on its investment in EEG for the excess of the carrying value of its investment in EEG over the fair value.

Regis did not receive a tax benefit on the impairment charge. The Company also recorded its $8.7 million share of an intangible asset

impairment recorded directly by EEG. The exposure to loss related to the Company's involvement with EEG is the carrying value of the

investment, the outstanding loan and the guarantee of the credit facility. Due to economic and other factors, the Company may be required to

record additional impairment charges related to our investment in EEG and such impairments could be material to our consolidated balance

108

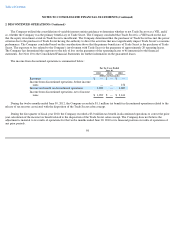

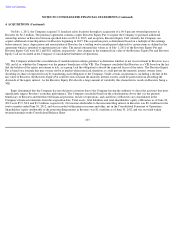

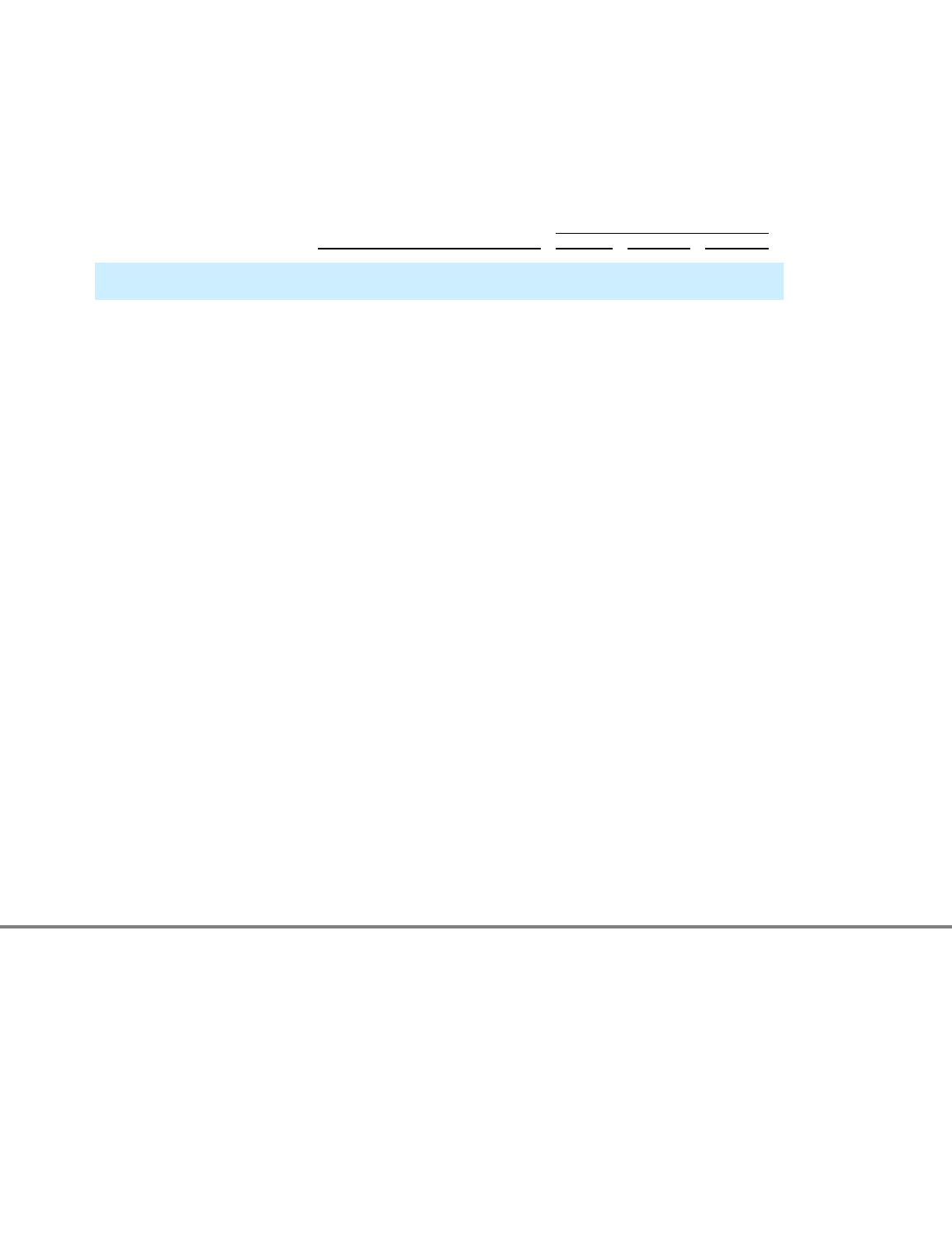

For the Twelve Months

Ended June 30,

Classification 2012 2011 2010

(Dollars in thousands)

Equity in loss (income), net of

income taxes

Equity in loss (income) of

affiliated companies

$

9,759

$

(7,752

)

$

(4,134

)

Cash dividends received

Dividends received from

affiliated companies

2,769

4,814

1,141