Supercuts 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

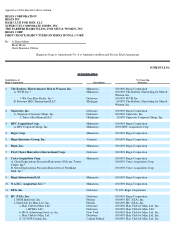

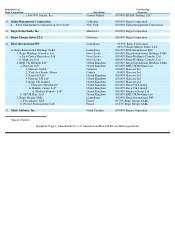

“(as such Schedule 8G may have been modified from time to time by written supplements thereto delivered by the Company and

accepted in writing by Prudential)”

1.9. Paragraph 8G of the Shelf Agreement is further amended by amending and restating the fourth sentence thereof to read as

follows:

“

The Company is not party to any agreement evidencing or pertaining to Debt of the Company in an outstanding or committed amount

in excess of $20,000,000 which includes any operation or financial covenant which is more favorable to a lender or other beneficiary

than those set forth in paragraph 6 hereof, except as set forth in the agreements listed on Schedule 8G-2 attached hereto (as such

Schedule 8G-2 may have been modified from time to time by written supplements thereto delivered by the Company and accepted in

writing by Prudential).”

1.10. Paragraph 8G of the Shelf Agreement is further amended by replacing the reference to “paragraph 5F” in the last sentence

thereof with “paragraph 6E”.

1.11. Paragraph 10B of the Shelf Agreement is amended by adding, or amending and restating, as applicable, the following

definitions in their entirety to read as follows:

“Credit Agreement” shall mean that certain Credit Agreement dated as of June 30, 2011 among the Company, various

financial institutions, JPMorgan Chase Bank, N.A., as Administrative Agent, and the other agents named therein, as amended,

supplemented or modified from time to time in accordance with the terms thereof.

“EBITDA” means, for any period, for the Company and its Subsidiaries on a consolidated basis, determined in accordance

with generally accepted accounting principles, the total, without duplication, of

(a) net income (or net loss) for such period, excluding any gains or losses from sales of assets and any extraordinary non-

cash

gains or losses during such period ( provided that the net income of any Person that is not a Subsidiary of the Company shall be

included in the consolidated net income of the Company only to the extent of the amount of cash dividends or distributions paid by

such Person to the Company or to a consolidated Subsidiary of the Company), plus

(b) to the extent included in the determination of such net income (or net loss), the sum, without duplication, of (i) all

amounts treated as expenses for depreciation (including, without duplication, non-cash losses (net of non-cash gains) upon the closing

and abandonment of any non-franchised store locations), plus (ii) all amounts treated as expenses for interest paid or accrued, plus

(iii)

all amounts treated as expenses for amortization of intangibles of any kind, plus (iv) all taxes paid or accrued and unpaid on or

measured by income, plus (v) any non-

cash interest expense on Indebtedness convertible into shares of common stock of the Company

plus

(c) the amount of any other charge in respect of non-recurring expenses for such period arising in connection with

acquisitions, to the extent approved by the Required Holders; plus

4