Supercuts 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

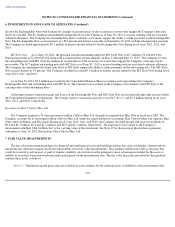

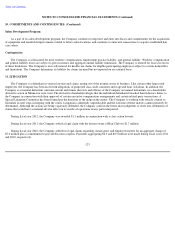

8. FINANCING ARRANGEMENTS (Continued)

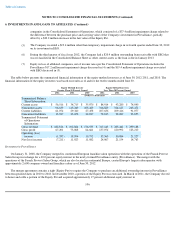

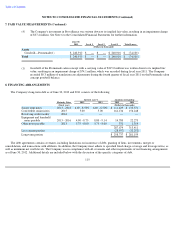

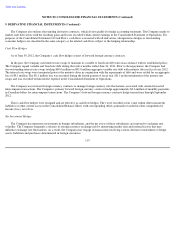

Aggregate maturities of long-term debt, including associated capital lease obligations of $14.8 million at June 30, 2012, are as follows:

Senior Term Notes

Private Shelf Agreement

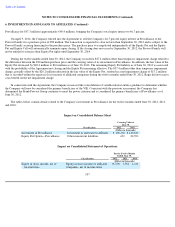

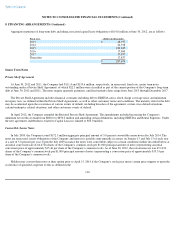

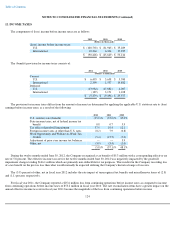

At June 30, 2012 and 2011, the Company had $111.4 and $133.6 million, respectively, in unsecured, fixed rate, senior term notes

outstanding under a Private Shelf Agreement, of which $22.1 million were classified as part of the current portion of the Company's long-term

debt at June 30, 2012 and 2011. The notes require quarterly payments, and final maturity dates range from June 2013 through December 2017.

The Private Shelf Agreement includes financial covenants including debt to EBITDA ratios, fixed charge coverage ratios and minimum

net equity tests (as defined within the Private Shelf Agreement), as well as other customary terms and conditions. The maturity date for the debt

may be accelerated upon the occurrence of various events of default, including breaches of the agreement, certain cross-default situations,

certain bankruptcy related situations, and other customary events of default.

In April 2012, the Company amended the Restated Private Shelf Agreement. The amendments included increasing the Company's

minimum net worth covenant from $800.0 to $850.0 million and amending certain definitions, including EBITDA and Rental Expenses. Under

the new agreement, indebtedness related to Capital Leases is limited to $50.0 million.

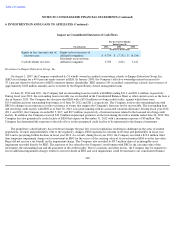

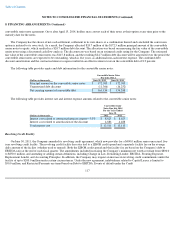

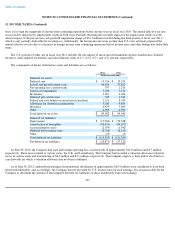

Convertible Senior Notes

In July 2009, the Company issued $172.5 million aggregate principal amount of 5.0 percent convertible senior notes due July 2014. The

notes are unsecured, senior obligations of the Company and interest is payable semi-annually in arrears on January 15 and July 15 of each year

at a rate of 5.0 percent per year. Upon the July 2009 issuance the notes were convertible subject to certain conditions further described below at

an initial conversion rate of 64.6726 shares of the Company's common stock per $1,000 principal amount of notes (representing an initial

conversion price of approximately $15.46 per share of the Company's common stock). As of June 30, 2012, the conversion rate was 65.1432

shares of the Company's common stock per $1,000 principal amount of notes (representing a conversion price of approximately $15.35 per

share of the Company's common stock).

Holders may convert their notes at their option prior to April 15, 2014 if the Company's stock price meets certain price triggers or upon the

occurrence of specified corporate events as defined in the

116

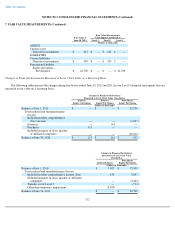

Fiscal year (Dollars in thousands)

2013

$

28,937

2014

24,918

2015

180,245

2016

17,860

2017

17,857

Thereafter

17,857

$

287,674