Supercuts 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

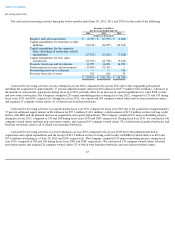

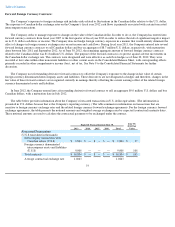

This table excludes the short-term liabilities, other than the current portion of long-term debt, disclosed on our balance sheet as the

amounts recorded for these items will be paid in the next year. We have no unconditional purchase obligations, as defined by long-term

obligations guidance. Also excluded from the contractual obligations table are payment estimates associated with employee health and workers'

compensation claims for which we are self-insured. The majority of our recorded liability for self-insured employee health and workers'

compensation losses represents estimated reserves for incurred claims that have yet to be filed or settled.

The Company has unfunded deferred compensation contracts covering certain management and executive personnel. The deferred

compensation contracts are offered to key executives based on their performance within the Company. Because we cannot predict the timing or

amount of our future payments related to these contracts, such amounts were not included in the table above. Related obligations totaled $24.6

and $11.8 million and are included in accrued liabilities and other noncurrent liabilities, respectively, in the Consolidated Balance Sheet at

June 30, 2012. Refer to Note 13 to the Consolidated Financial Statements for additional information. The Company intends to fund its future

obligations under these arrangements through Company-owned life insurance policies on the participants.

Off-Balance Sheet Arrangements

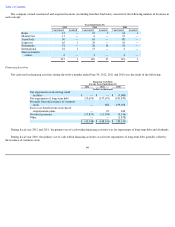

Operating leases primarily represent long-term obligations for the rental of salon and hair restoration center premises, including leases for

company-owned locations, as well as future salon franchisee lease payments of approximately $152.5 million, which are reimbursed to the

Company by franchisees, and the guarantee of approximately 20 salons operated by the purchaser of Trade Secret. Regarding the franchisee

subleases, we generally retain the right to the related salon assets net of any outstanding obligations in the event of a default by a franchise

owner. Management has not experienced and does not expect any material loss to result from these arrangements.

We have forward foreign currency contracts. See Part II, Item 7A, "Quantitative and Qualitative Disclosures about Market Risk," for a

detailed discussion of our derivative instruments. Future net settlements under these agreements are not included in the table above.

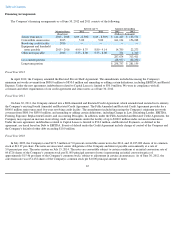

We are a party to a variety of contractual agreements under which we may be obligated to indemnify the other party for certain matters,

which indemnities may be secured by operation of law or otherwise, in the ordinary course of business. These contracts primarily relate to our

commercial contracts, operating leases and other real estate contracts, financial agreements, definitive agreement entered into during July 2012

to sell Hair Club, credit facility of EEG that matures on December 31, 2012 with a maximum exposure of $9 million, agreements to provide

services, and agreements to indemnify officers, directors and employees in the performance of their work. While our aggregate indemnification

obligation could result in a material liability, we are not aware of any current matter that we expect to result in a material liability.

We do not have other unconditional purchase obligations or significant other commercial commitments such as commitments under lines

of credit and standby repurchase obligations or other commercial commitments.

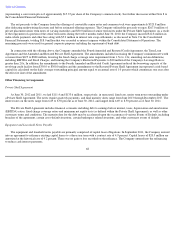

As a part of our salon development program, we continue to negotiate and enter into leases and commitments for the acquisition of

equipment and leasehold improvements related to future salon locations, and continue to enter into transactions to acquire established hair care

salons and businesses.

We do not have any relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured

finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet financial arrangements

or other

70