Supercuts 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

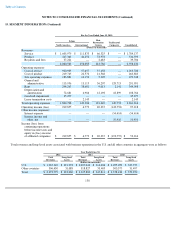

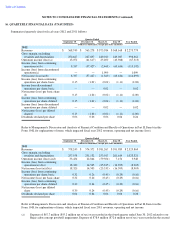

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

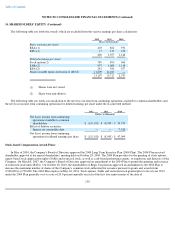

14. SHAREHOLDERS' EQUITY (Continued)

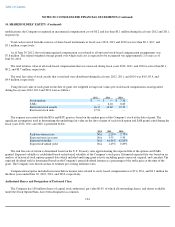

modifications, the Company recognized an incremental compensation cost of $0.2 and less than $0.1 million during fiscal years 2012 and 2011,

respectively.

Total cash received from the exercise of share-based instruments in fiscal years 2012, 2011 and 2010 was less than $0.1, $0.7, and

$3.1 million, respectively.

As of June 30, 2012, the total unrecognized compensation cost related to all unvested stock-based compensation arrangements was

$7.8 million. The related weighted average period over which such cost is expected to be recognized was approximately 2.6 years as of

June 30, 2012.

The total intrinsic value of all stock-based compensation that was exercised during fiscal years 2012, 2011, and 2010 was less than $0.1,

$0.2, and $0.7 million, respectively.

The total fair value of stock awards that vested and were distributed during fiscal years 2012, 2011, and 2010 was $4.8, $5.4, and

$4.9 million, respectively.

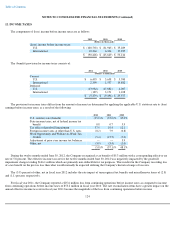

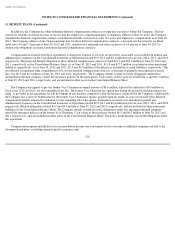

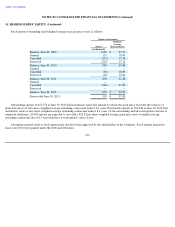

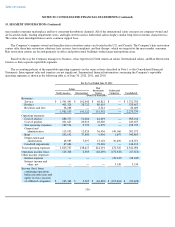

Using the fair value of each grant on the date of grant, the weighted average fair values per stock-based compensation award granted

during fiscal years 2012, 2011 and 2010 were as follows:

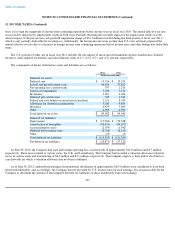

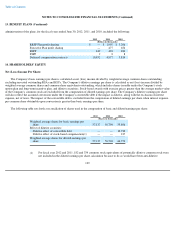

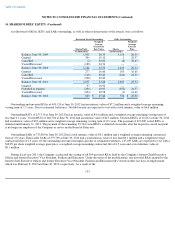

The expense associated with the RSA and RSU grants is based on the market price of the Company's stock at the date of grant. The

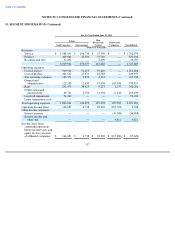

significant assumptions used in determining the underlying fair value on the date of grant of each stock option and SAR grant issued during the

fiscal years 2012, 2011 and 2010 is presented below:

The risk free rate of return is determined based on the U.S. Treasury rates approximating the expected life of the options and SARs

granted. Expected volatility is established based on historical volatility of the Company's stock price. Estimated expected life was based on an

analysis of historical stock options granted data which included analyzing grant activity including grants exercised, expired, and canceled. The

expected dividend yield is determined based on the Company's annual dividend amount as a percentage of the strike price at the time of the

grant. The Company uses historical data to estimate pre-vesting forfeiture rates.

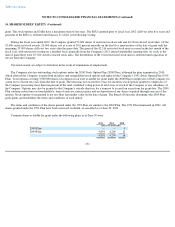

Compensation expense included in income before income taxes related to stock- based compensation was $7.6, $9.6, and $9.3 million for

the three years ended June 30, 2012, 2011, and 2010, respectively.

Authorized Shares and Designation of Preferred Class:

The Company has 100 million shares of capital stock authorized, par value $0.05, of which all outstanding shares, and shares available

under the Stock Option Plans, have been designated as common.

134

2012 2011 2010

Stock options

$

—

$

—

$

7.36

SARs

—

6.26

8.60

Restricted stock awards

16.15

16.60

19.12

Restricted stock units

17.96

—

—

2012 2011 2010

Risk

-

free interest rate

N/A

2.29

%

2.79

%

Expected term (in years)

N/A

5.50

5.50

Expected volatility

N/A

44.00

%

42.00

%

Expected dividend yield

N/A

1.45

%

0.85

%