Supercuts 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

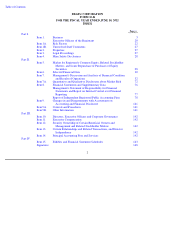

Table of Contents

In January 2008, the Company's effective ownership interest increased to 55.1 percent related to the buyout of EEG's minority interest

shareholder. The Company accounts for the investment in EEG under the equity method of accounting as Empire Beauty School retains

majority voting interest and has full responsibility for managing EEG. The Company recorded a $19.4 million other than temporary impairment

charge in its fourth quarter ended June 30, 2012 on its investment in EEG. Refer to Note 6 to the Consolidated Financial Statements for

additional information.

On January 31, 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost

Salon Group in exchange for a 30.0 percent equity interest in the newly formed entity, Provalliance. The merger agreement contains a right

(Equity Put) to require the Company to purchase additional ownership interest in Provalliance between specified dates in 2010 to 2018. The

merger with the operations of the Franck Provost Salon Group, which are also located in continental Europe, created Europe's largest salon

operator with approximately 2,600 company-owned and franchise salons as of June 30, 2012.

The Company contributed to Provalliance the shares of each of its European operating subsidiaries, other than the Company's operating

subsidiaries in the United Kingdom and Germany. The contributed subsidiaries operate retail hair salons in France, Spain, Switzerland and

several other European countries primarily under the Jean Louis David™ and Saint Algue™ brands.

On February 16, 2009, the Company sold its Trade Secret concept. The Company concluded, after a comprehensive review of its strategic

and financial options, to divest Trade Secret. The sale of Trade Secret included 655 company-owned salons and 57 franchise salons, all of

which had historically been reported within the Company's North America reportable segment.

In March of 2011, the Company elected to honor and settle a portion of the Equity Put and acquired approximately 17 percent additional

equity interest in Provalliance for $57.3 million (approximately € 40.4 million), bringing the Company's total equity interest to 46.7 percent.

On April 9, 2012, the Company entered into the Agreement to sell the Company's 46.7 percent equity interest in Provalliance to the

Franck Provost family (Provost Family) for a purchase price of €80 million. The transaction is expected to close no later than September 30,

2012 and is subject to the Provost Family securing financing for the purchase price. The purchase price was negotiated independently of the

Equity Put and the Equity Put will automatically terminate upon completion of the Agreement. If the completion of the Agreement does not

occur by September 30, 2012, the Provost Family will not be entitled to exercise their Equity Put rights until September 30, 2014. During fiscal

year 2012, the Company recorded a $37.4 million other than temporary impairment charge on its investment in Provalliance and $20.2 million

reduction in the fair value of the Equity Put in conjunction with the Agreement, resulting in a net impairment charge of $17.2 million recorded

within the equity in (loss) income of affiliated companies in the Consolidated Statement of Operations.

During the fiscal year ended June 30, 2012, the Company began reviewing alternatives for non-core assets to focus on our core salon

business. On July 13, 2012, the Company entered into a definitive agreement to sell Hair Club for $163.5 million, a provider of hair restoration

services. The transaction is expected to close during the first half of fiscal year 2013.

Industry Overview:

Management estimates that annual revenues of the hair care industry are approximately $50 to $60 billion in the United States and

approximately $160 billion worldwide. The Company estimates that it holds approximately two percent of the worldwide market. The hair

salon and hair restoration markets are each highly fragmented, with the vast majority of locations independently owned and operated. However,

the influence of salon chains on these markets, both franchise and company-owned, has increased substantially. Management believes that

salon chains will continue to have a significant

5