Supercuts 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

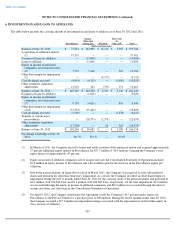

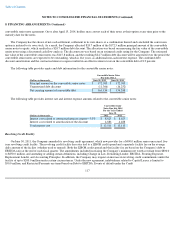

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

reviews the Exchangeable Note with Yamano for changes in circumstances or the occurrence of events that suggest the Company's note may

not be recoverable. The $1.3 million outstanding Exchangeable Note with Yamano as of June 30, 2012 is in good standing with no associated

valuation allowance. The Company has determined the future cash flows of Yamano support the ability to make payments on the Exchangeable

Note. The Exchangeable Note accrues interest at 1.845 percent and interest is payable on September 30, 2012 with the final principal payment.

The Company recorded approximately $0.1 million in interest income related to the Exchangeable Note during fiscal years 2012, 2011, and

2010.

MY Style Note. As of June 30, 2012, the principal amount outstanding under the MY Style Note is $0.7 million (52,164,000 Yen).

Principal payments of 52,164,000 Yen along with accrued interest are due annually on May 31 through May 31, 2013. The Company reviews

the outstanding note with MY Style for changes in circumstances or the occurrence of events that suggest the Company's note may not be

recoverable. The $0.7 million outstanding note with MY Style as of June 30, 2012 is in good standing with no associated valuation allowance.

The Company has determined the future cash flows of MY Style support the ability to make payments on the outstanding note. The MY Style

Note accrues interest at 3.0 percent. The Company recorded less than $0.1 million in interest income related to the MY Style Note during fiscal

years 2012, 2011, and 2010.

As of June 30, 2012, $2.3 million is recorded in the Consolidated Balance Sheet as current assets representing the Company's

Exchangeable Note and outstanding note with MY Style. The exposure to loss related to the Company's involvement with MY Style is the

carrying value of the outstanding notes.

All foreign currency transaction gains and losses on the Exchangeable Note and MY Style Note are recorded through other income within

the Consolidated Statement of Operations. The foreign currency transaction gain (loss) was $0.5, $(1.1), and $3.1 million during fiscal years

2012, 2011, and 2010, respectively.

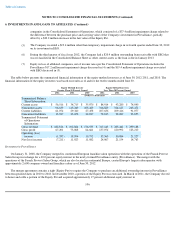

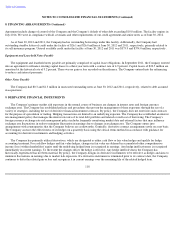

Investment in Hair Club for Men, Ltd.

The Company acquired a 50.0 percent interest in Hair Club for Men, Ltd. through its acquisition of Hair Club in fiscal year 2005. The

Company accounts for its investment in Hair Club for Men, Ltd. under the equity method of accounting. Hair Club for Men, Ltd. operates Hair

Club centers in Illinois and Wisconsin. During fiscal years 2012, 2011, and 2010, the Company recorded income and received dividends of

$0.8 and $1.3 million, $0.6 and $1.1 million, and $0.9 and $1.3 million, respectively. The exposure to loss related to the Company's

involvement with Hair Club for Men, Ltd. is the carrying value of the investment. See Note 17 for discussion of the purchase agreement

subsequent to June 30, 2012 that includes Hair Club for Men, Ltd.

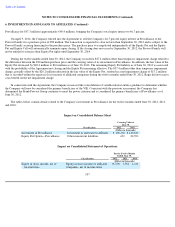

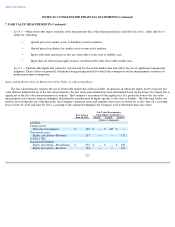

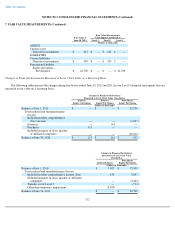

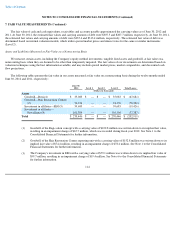

7. FAIR VALUE MEASUREMENTS

The fair value measurement guidance for financial and nonfinancial assets and liabilities defines fair value, establishes a framework for

measuring fair value and expands disclosure requirements about fair value measurements. This guidance defines fair value as the price that

would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or

liability in an orderly transaction between market participants on the measurement date. The fair value hierarchy prescribed by this guidance

contains three levels as follows:

Level 1 —Unadjusted quoted prices that are available in active markets for the identical assets or liabilities at the measurement date.

110