Supercuts 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. OTHER FINANCIAL STATEMENT DATA (Continued)

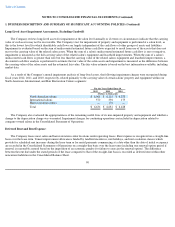

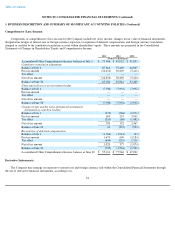

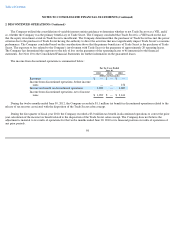

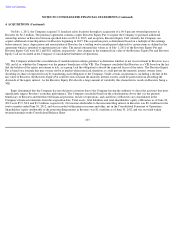

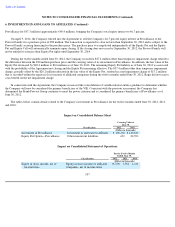

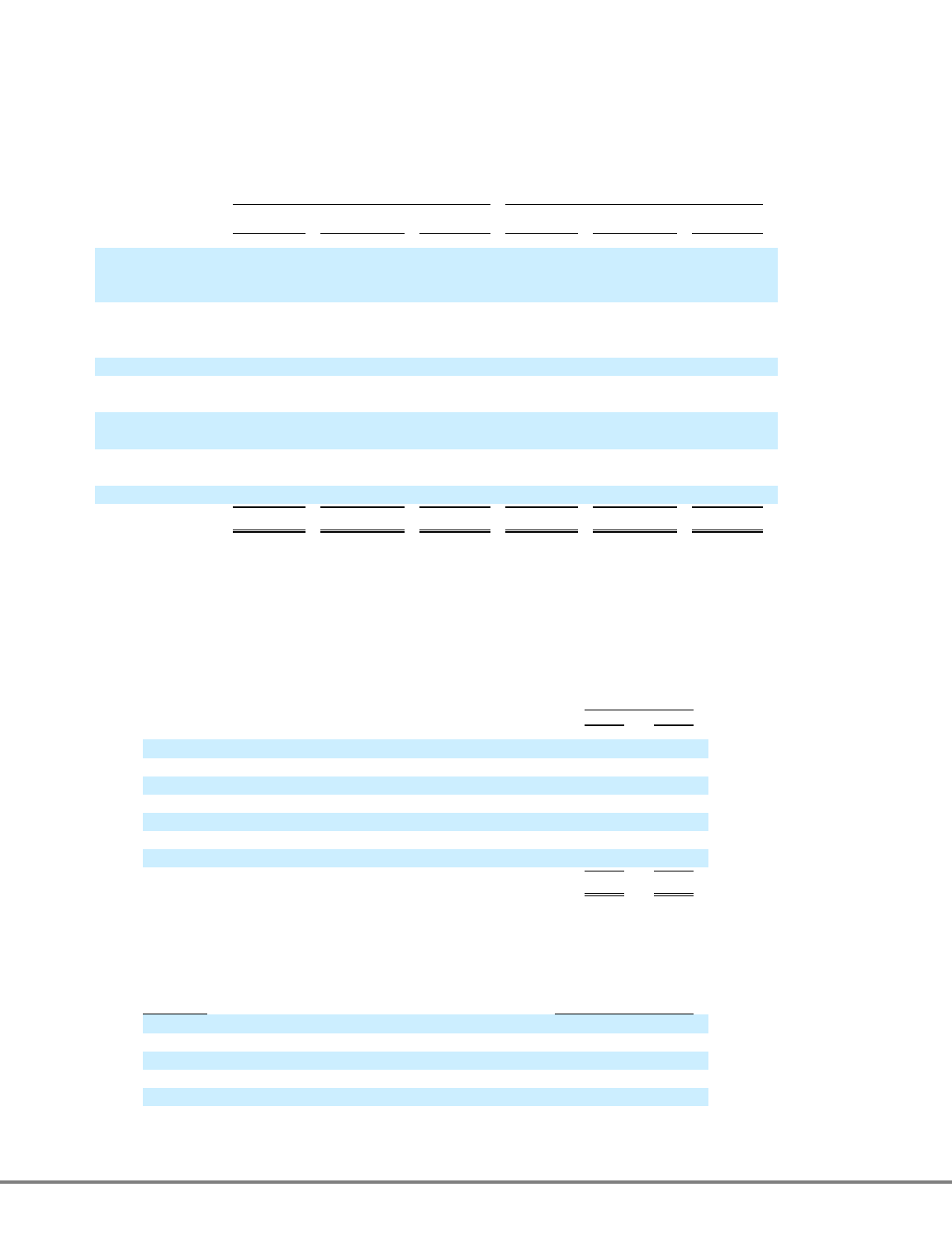

The following provides additional information concerning the other intangibles, net, balance sheet account as of June 30, 2012 and 2011:

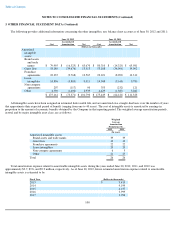

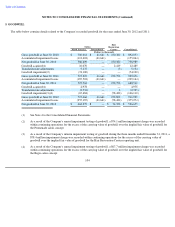

All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years

that approximate their expected period of benefit (ranging from one to 40 years). The cost of intangible assets is amortized to earnings in

proportion to the amount of economic benefits obtained by the Company in that reporting period. The weighted average amortization periods,

in total and by major intangible asset class, are as follows:

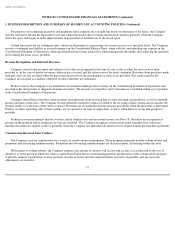

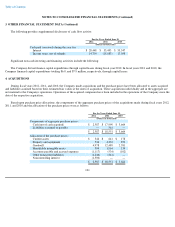

Total amortization expense related to amortizable intangible assets during the years ended June 30, 2012, 2011, and 2010 was

approximately $9.7, $9.8, and $9.9 million, respectively. As of June 30, 2012, future estimated amortization expense related to amortizable

intangible assets is estimated to be:

100

June 30, 2012 June 30, 2011

Cost Accumulated

Amortization Net Cost Accumulated

Amortization Net

(Dollars in thousands)

Amortized

intangible

assets:

Brand assets

and trade

names

$

79,995

$

(16,325

)

$

63,670

$

80,310

$

(14,329

)

$

65,981

Guest lists

53,189

(39,676

)

13,513

53,188

(34,096

)

19,092

Franchise

agreements

22,335

(9,768

)

12,567

22,221

(8,909

)

13,312

Lease

intangibles

14,896

(5,885

)

9,011

14,948

(5,168

)

9,780

Non-compete

agreements

207

(117

)

90

353

(232

)

121

Other

4,539

(1,600

)

2,939

4,429

(1,387

)

3,042

$

175,161

$

(73,371

)

$

101,790

$

175,449

$

(64,121

)

$

111,328

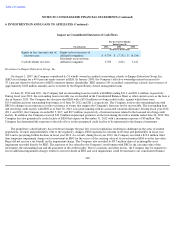

Weighted

Average

Amortization

Period June 30,

2012 2011

(In years)

Amortized intangible assets:

Brand assets and trade names

39

39

Guest lists

10

10

Franchise agreements

22

22

Lease intangibles

20

20

Non

-

compete agreements

6

5

Other

21

25

Total

26

26

Fiscal Year (Dollars in thousands)

2013

$

9,413

2014

9,199

2015

6,157

2016

3,999

2017

3,996