Supercuts 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. OTHER FINANCIAL STATEMENT DATA (Continued)

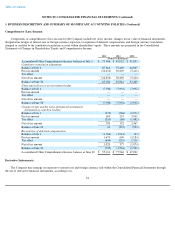

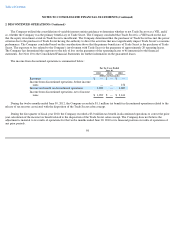

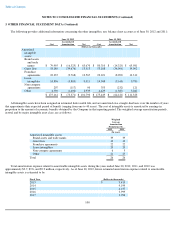

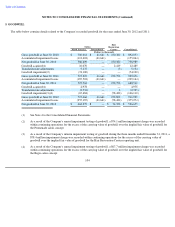

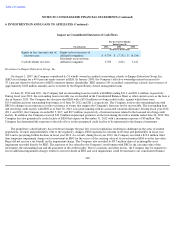

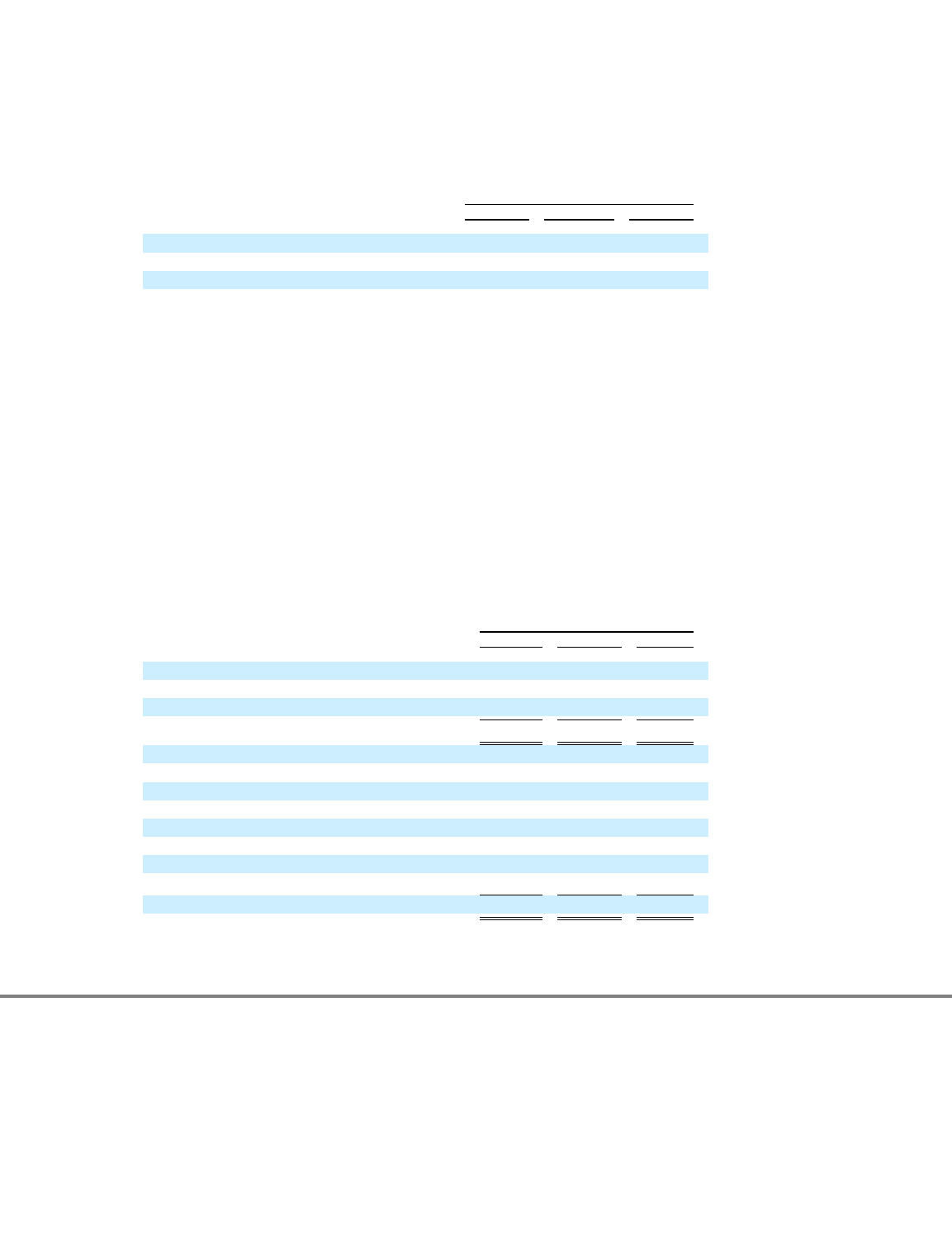

The following provides supplemental disclosures of cash flow activity:

Significant non-cash investing and financing activities include the following:

The Company did not finance capital expenditures through capital leases during fiscal year 2012. In fiscal years 2011 and 2010, the

Company financed capital expenditures totaling $6.0, and $7.9 million, respectively, through capital leases.

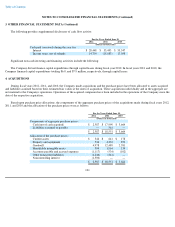

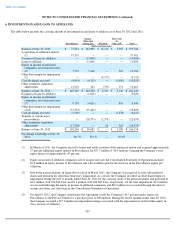

4. ACQUISITIONS

During fiscal years 2012, 2011, and 2010, the Company made acquisitions and the purchase prices have been allocated to assets acquired

and liabilities assumed based on their estimated fair values at the dates of acquisition. These acquisitions individually and in the aggregate are

not material to the Company's operations. Operations of the acquired companies have been included in the operations of the Company since the

date of the respective acquisition.

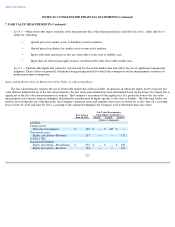

Based upon purchase price allocations, the components of the aggregate purchase prices of the acquisitions made during fiscal years 2012,

2011, and 2010 and the allocation of the purchase prices were as follows:

101

For the Years Ended June 30,

2012 2011 2010

(Dollars in thousands)

Cash paid (received) during the year for:

Interest

$

28,448

$

33,493

$

53,547

Income taxes, net of refunds

14,754

(15,083

)

17,058

For the Years Ended June 30,

2012 2011 2010

(Dollars in thousands)

Components of aggregate purchase prices:

Cash (net of cash acquired)

$

2,587

$

17,990

$

3,664

Liabilities assumed or payable

—

561

—

$

2,587

$

18,551

$

3,664

Allocation of the purchase prices:

Current assets

$

344

$

641

$

178

Property and equipment

534

4,232

873

Goodwill

4,978

12,489

2,581

Identifiable intangible assets

594

1,964

134

Accounts payable and accrued expenses

(1,117

)

(534

)

(102

)

Other noncurrent liabilities

(1,246

)

(241

)

—

Noncontrolling interest

(1,500

)

—

—

$

2,587

$

18,551

$

3,664