Supercuts 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

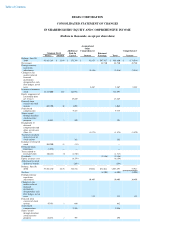

Forward Foreign Currency Contracts:

The Company's exposure to foreign exchange risk includes risks related to fluctuations in the Canadian dollar relative to the U.S. dollar.

The exposure to Canadian dollar exchange rates on the Company's fiscal year 2012 cash flows is primarily associated with certain forecasted

intercompany transactions.

The Company seeks to manage exposure to changes in the value of the Canadian dollar. In order to do so, the Company has entered into

forward currency contracts from fiscal year 2007 to the first quarter of fiscal year 2013 in order to reduce the risk of significant negative impact

on its U.S. dollar cash flows or income. The Company does not hedge foreign currency exposure in a manner that would entirely eliminate the

effect of changes in foreign currency exchange rates on net income and cash flows. During fiscal year 2011, the Company entered into several

forward foreign currency contracts to sell Canadian dollars and buy an aggregate of $8.7 million U.S. dollars, respectively, with maturation

dates between July 2011 and September 2012. As of June 30, 2012, the remaining aggregate amount of forward foreign currency contracts

related to the Canadian dollar was $1.8 million U.S. dollars .The purpose of the forward contracts is to protect against adverse movements in

the Canadian dollar exchange rate. The contracts were designated and were effective as cash flow hedges as of June 30, 2012. They were

recorded at fair value within other noncurrent liabilities or other current assets in the Consolidated Balance Sheet, with corresponding offsets

primarily recorded in other comprehensive income (loss), net of tax. See Note 9 to the Consolidated Financial Statements for further

discussion.

The Company uses freestanding derivative forward contracts to offset the Company's exposure to the change in fair value of certain

foreign currency denominated intercompany assets and liabilities. These derivatives are not designated as hedges and therefore, changes in the

fair value of these forward contracts are recognized currently in earnings thereby offsetting the current earnings effect of the related foreign

currency denominated assets and liabilities.

In June 2012, the Company entered into a freestanding derivative forward contract to sell an aggregate $9.0 million U.S. dollars and buy

Canadian dollars, with a maturation date in July 2012.

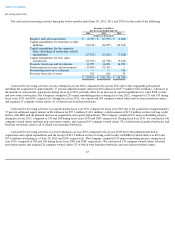

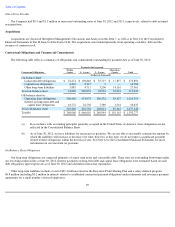

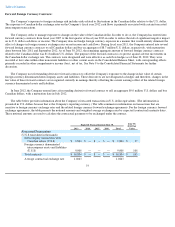

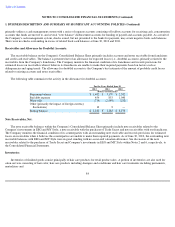

The table below provides information about the Company's forecasted transactions in U.S. dollar equivalents. (The information is

presented in U.S. dollars because that is the Company's reporting currency.) The table summarizes information on transactions that are

sensitive to foreign currency exchange rates and the related foreign currency forward exchange agreements. For the foreign currency forward

exchange agreements, the table presents the notional amounts and weighted average exchange rates by expected (contractual) maturity dates.

These notional amounts are used to calculate the contractual payments to be exchanged under the contract.

75

Expected Transaction date June 30,

June 30,

2012 Fair

Value

2013 2014 2015 2016 Total

Forecasted Transactions

(U.S.$ equivalent in thousands)

Intercompany transactions with

Canadian salons (U.S.$)

$

1,804

$

—

$

—

$

—

$

1,804

$

37

Foreign currency denominated

intercompany assets and liabilities

(U.S.$)

9,000

—

—

—

9,000

108

Total contracts

$

10,804

$

—

$

—

$

—

$

10,804

$

145

Average contractual exchange rate

1.0243

1.0243