Supercuts 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

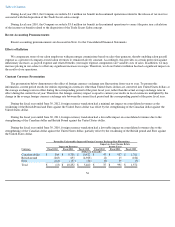

The primary factors for the decrease in total assets as of June 30, 2012 compared to June 30, 2011 were the goodwill impairment charges

related to the Regis salon concept and Hair Restoration Centers reporting unit, a $17.2 million net impairment charge associated with the

Agreement to sell the Company's 46.7 percent equity interest in Provalliance to the Provost family, and a $19.4 million impairment charge

associated with our investment in EEG. Additionally, total assets decreased as a result of the accelerated depreciation expense associated with

the adjustment to the useful life of the Company's internally developed POS. Partially offsetting the decrease in total assets were cash flows

from operations.

The $74.1 million goodwill impairment charge related to the Promenade salon concept, a $31.2 million valuation reserve on the note

receivable due from the purchaser of Trade Secret, and a $9.2 million impairment on the Company's investment in MY Style, partially offset by

cash flows from operations, were the primary factors for the decrease in total assets as of June 30, 2011 compared to June 30, 2010.

Cash flows from operations, partially offset by the $35.3 million goodwill impairment charge related to the Regis salon concept were the

primary factors for the increase in total assets as of June 30, 2010 compared to June 30, 2009.

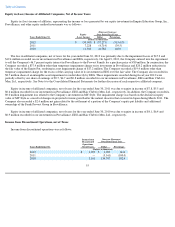

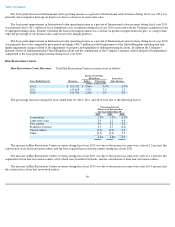

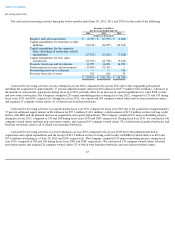

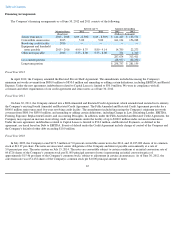

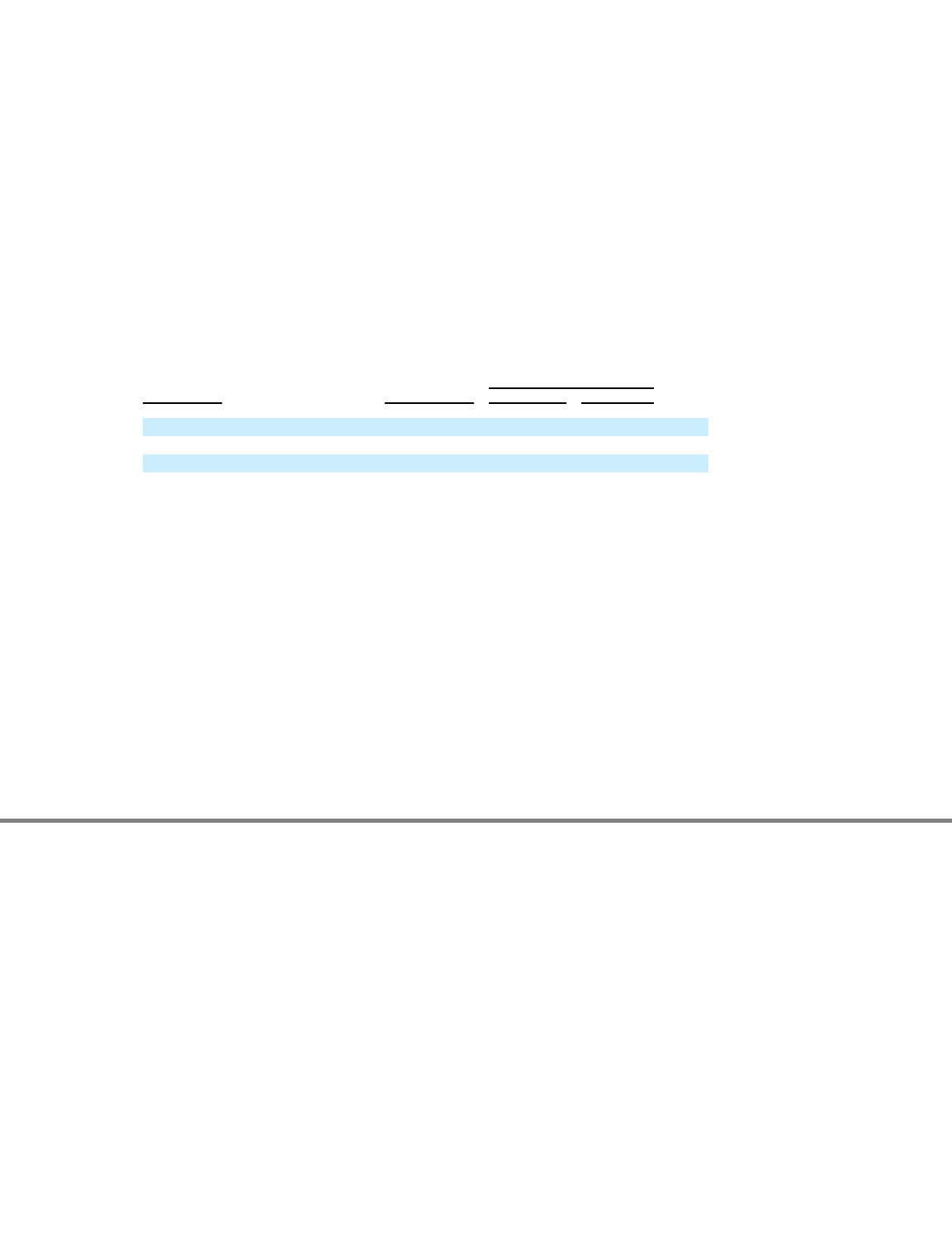

Total shareholders' equity at June 30, 2012, 2011, and 2010 was as follows:

During the twelve months ended June 30, 2012, equity decreased primarily as a as a result of the non-cash goodwill impairment charges

related to the Regis salon concept and Hair Restoration Centers reporting unit, a $17.2 million net impairment charge associated with the

Agreement to sell the Company's 46.7 percent equity interest in Provalliance to the Provost family, a $19.4 million impairment charge

associated with our investment in EEG, and $24.3 million of foreign currency translation.

During the twelve months ended June 30, 2011, equity increased primarily as a result of $30.4 million of foreign currency translation and

$9.6 million of stock based compensation, partially offset by $11.5 million of dividends and $8.9 million of net loss.

During the twelve months ended June 30, 2010, equity increased primarily as a result of the issuance of the $163.6 million in common

stock, the $24.7 million ($15.2 million net of tax) equity component of the convertible debt, stock based compensation of $9.3 million and the

$42.7 million of earnings during fiscal year 2010. Partially offsetting the increase was a non-cash goodwill impairment charge of $35.3 million

related to our Regis salon concept, $9.1 million of dividends, $8.2 million in equity issuance costs and $5.4 million of foreign currency

translation adjustments.

63

(Decrease) Increase Over

Prior Fiscal Year

Shareholders'

Equity

As of June 30, Dollar Percentage

(Dollars in thousands)

2012

$

889,157

$

(143,462

)

(13.9

)%

2011

1,032,619

19,326

1.9

2010

1,013,293

210,433

26.2