Supercuts 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

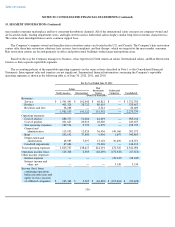

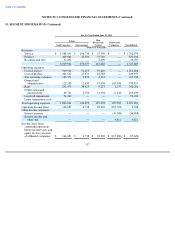

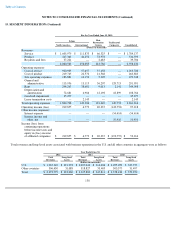

15. SEGMENT INFORMATION (Continued)

mass market consumer marketplace and have consistent distribution channels. All of the international salon concepts are company-owned and

are located in malls, leading department stores, and high-street locations. Individual salons display similar long-term economic characteristics.

The salons share interdependencies and a common support base.

The Company's company-

owned and franchise hair restoration centers are located in the U.S. and Canada. The Company's hair restoration

centers offer three hair restoration solutions; hair systems, hair transplants, and hair therapy, which are targeted at the mass market consumer.

Hair restoration centers are located primarily in office and professional buildings within larger metropolitan areas.

Based on the way the Company manages its business, it has reported its North American salons, International salons, and Hair Restoration

Centers as three separate reportable segments.

The accounting policies of the reportable operating segments are the same as those described in Note 1 to the Consolidated Financial

Statements. Intersegment sales and transfers are not significant. Summarized financial information concerning the Company's reportable

operating segments is shown in the following table as of June 30, 2012, 2011, and 2010:

136

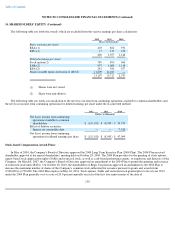

For the Year Ended June 30, 2012

Salons

Hair

Restoration

Centers Unallocated

Corporate

North America International Consolidated

(Dollars in thousands)

Revenues:

Service

$

1,541,491

$

102,400

$

68,812

$

—

$

1,712,703

Product

401,326

38,722

80,419

—

520,467

Royalties and fees

38,288

—

2,321

—

40,609

1,981,105

141,122

151,552

—

2,273,779

Operating expenses:

Cost of service

888,777

53,684

42,693

—

985,154

Cost of product

201,625

20,010

28,020

—

249,655

Site operating expenses

182,524

9,722

6,479

—

198,725

General and

administrative

113,952

12,024

36,436

140,160

302,572

Rent

292,192

37,880

9,036

1,697

340,805

Depreciation and

amortization

68,983

5,297

13,101

30,690

118,071

Goodwill impairment

67,684

—

78,426

—

146,110

Total operating expenses

1,815,737

138,617

214,191

172,547

2,341,092

Operating income (loss)

165,368

2,505

(62,639

)

(172,547

)

(67,313

)

Other income (expense):

Interest expense

—

—

—

(

28,245

)

(28,245

)

Interest income and

other, net

—

—

—

5,130

5,130

Income (loss) from

continuing operations

before income taxes and

equity in (loss) income

of affiliated companies

$

165,368

$

2,505

$

(62,639

)

$

(195,662

)

$

(90,428

)