Supercuts 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181

|

|

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

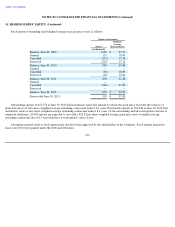

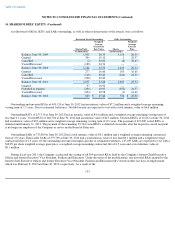

14. SHAREHOLDERS' EQUITY (Continued)

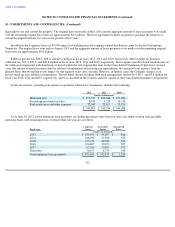

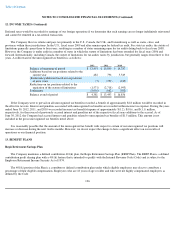

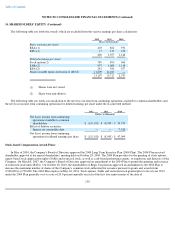

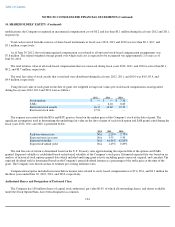

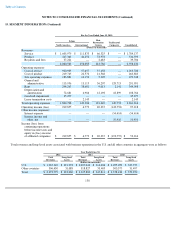

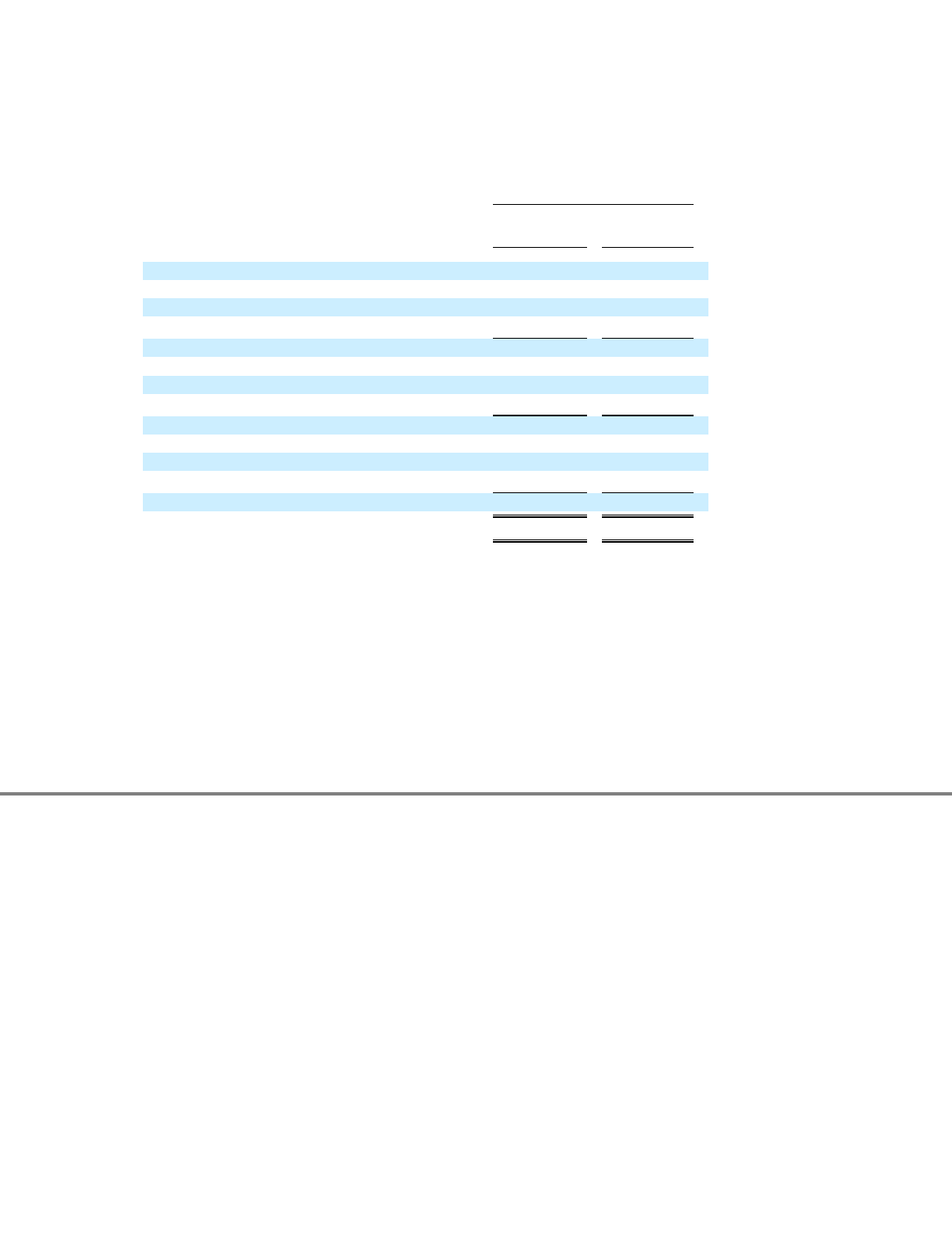

Stock options outstanding and weighted average exercise prices were as follows:

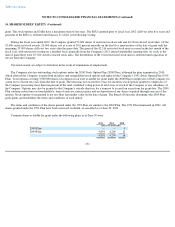

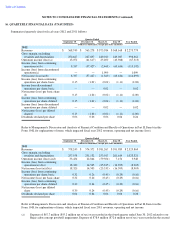

Outstanding options of 651,578 at June 30, 2012 had an intrinsic value (the amount by which the stock price exceeded the exercise or

grant date price) of zero and a weighted average remaining contractual term of 3.4 years. Exercisable options of 593,288 at June 30, 2012 had

an intrinsic value of zero and a weighted average remaining contractual term of 3.0 years. Of the outstanding and unvested options and due to

estimated forfeitures, 54,458 options are expected to vest with a $22.82 per share weighted average grant price and a weighted average

remaining contractual life of 6.5 years that have a total intrinsic value of zero.

All options granted relate to stock option plans that have been approved by the shareholders of the Company. Stock options granted in

fiscal year 2010 were granted under the 2000 and 2004 plan.

132

Options Outstanding

Shares

Weighted

Average

Exercise Price

(in thousands)

Balance, June 30, 2009

1,385

$

25.55

Granted

135

18.90

Cancelled

(337

)

17.74

Exercised

(203

)

15.12

Balance, June 30, 2010

980

29.48

Granted

—

—

Cancelled

(96

)

18.89

Exercised

(46

)

15.04

Balance, June 30, 2011

838

31.48

Granted

—

—

Cancelled

(186

)

27.80

Exercised

—

—

Balance, June 30, 2012

652

$

32.53

Exercisable June 30, 2012

593

$

33.50