Supercuts 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

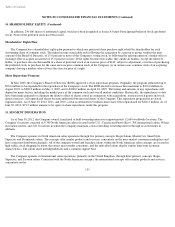

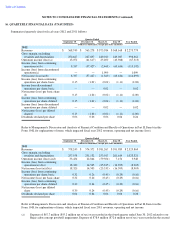

13. BENEFIT PLANS (Continued)

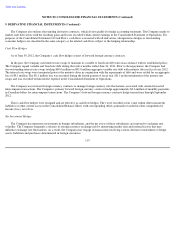

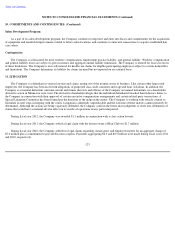

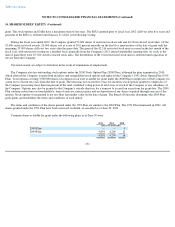

administration of the plans, for the fiscal years ended June 30, 2012, 2011, and 2010, included the following:

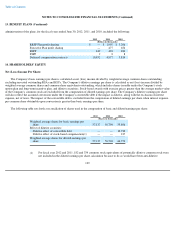

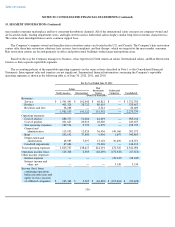

14. SHAREHOLDERS' EQUITY

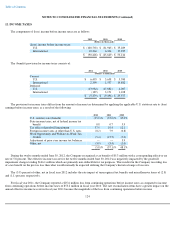

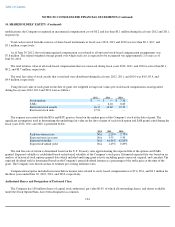

Net (Loss) Income Per Share:

The Company's basic earnings per share is calculated as net (loss) income divided by weighted average common shares outstanding,

excluding unvested outstanding RSAs and RSUs. The Company's dilutive earnings per share is calculated as net (loss) income divided by

weighted average common shares and common share equivalents outstanding, which includes shares issuable under the Company's stock

option plan and long-term incentive plan, and dilutive securities. Stock-

based awards with exercise prices greater than the average market value

of the Company's common stock are excluded from the computation of diluted earnings per share. The Company's dilutive earnings per share

will also reflect the assumed conversion under the Company's convertible debt if the impact is dilutive, along with the exclusion of interest

expense, net of taxes. The impact of the convertible debt is excluded from the computation of diluted earnings per share when interest expense

per common share obtainable upon conversion is greater than basic earnings per share.

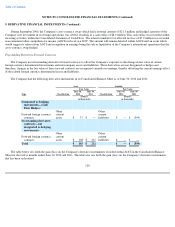

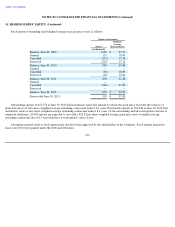

The following table sets forth a reconciliation of shares used in the computation of basic and diluted earnings per share:

129

2012 2011 2010

(Dollars in thousands)

RRSP Plan profit sharing

$

—

$

1,907

$

3,206

Executive Plan profit sharing

—

477

654

ESPP

449

494

484

FSPP

9

8

8

Deferred compensation contracts

10,452

4,977

5,814

2012 2011 2010

(Shares in thousands)

Weighted average shares for basic earnings per

share

57,137

56,704

55,806

Effect of dilutive securities:

Dilutive effect of convertible debt

—

—

10,730

Dilutive effect of stock

-

based compensation(1)

—

—

217

Weighted average shares for diluted earnings per

share

57,137

56,704

66,753

(1) For fiscal year 2012 and 2011, 182 and 334 common stock equivalents of potentially dilutive common stock were

not included in the diluted earnings per share calculation because to do so would have been anti

-

dilutive.