Supercuts 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

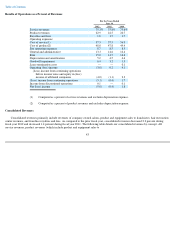

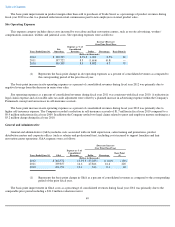

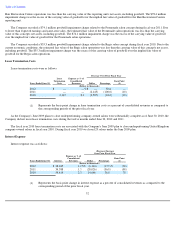

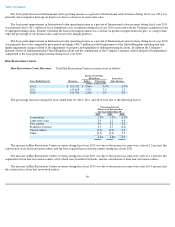

Depreciation and Amortization

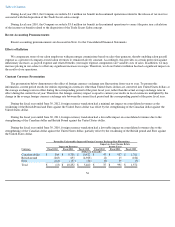

Depreciation and amortization expense (D&A) was as follows:

The basis point increase in D&A as a percent of consolidated revenues during fiscal year 2012 was primarily due to $16.2 million of

accelerated depreciation expense in the current year resulting from the useful life adjustment of the Company's internally developed point-of-

sale system and negative leverage from the decrease in same-store sales. Partially offsetting the basis point increase was the continuation of a

decrease in depreciation expense from the reduction in salon construction beginning in fiscal year 2009 as compared to historical levels prior to

fiscal year 2009.

The basis point decrease in D&A as a percent of consolidated revenues during fiscal year 2011 was primarily due to a decrease in

depreciation expense from a reduction in salon construction beginning in fiscal year 2009 as compared to historical levels prior to fiscal year

2009. The basis point decrease was partially offset by negative leverage from the decrease in same-store sales.

The basis point improvement in D&A as a percent of consolidated revenues during fiscal year 2010 was primarily due to a reduction in the

impairment of property and equipment at underperforming locations as compared to fiscal year 2009. The Company recorded impairment

charges of $6.4 and $10.2 million during fiscal years 2010 and 2009, respectively. Partially offsetting the improvements was a decline due to

negative leverage from the decrease in same-store sales.

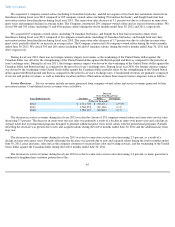

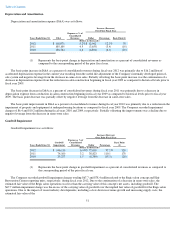

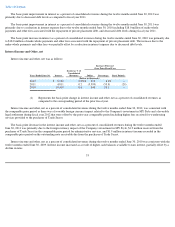

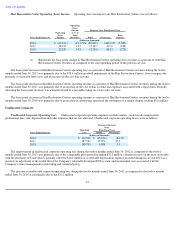

Goodwill Impairment

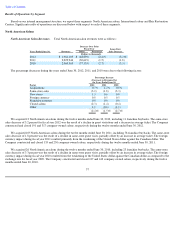

Goodwill impairment was as follows:

The Company recorded goodwill impairment charges totaling $67.7 and $78.4 million related to the Regis salon concept and Hair

Restoration Centers reporting units, respectively, during fiscal year 2012. Due to the continuation of a decrease in same-store sales, the

estimated fair value of the Regis salon operations was less than the carrying value of this concept's net assets, including goodwill. The

$67.7 million impairment charge was the excess of the carrying value of goodwill over the implied fair value of goodwill for the Regis salon

operations. Due to the impact of recent industry developments, including a slow down in revenue growth and increasing supply costs, the

estimated fair value of the

51

Increase (Decrease)

Over Prior Fiscal Year

Years Ended June 30, D&A

Expense as % of

Consolidated

Revenues Dollar Percentage

Basis Point(1)

(Dollars in thousands)

2012

$

118,071

5.2

%

$

12,962

12.3

%

70

2011

105,109

4.5

(3,655

)

(3.4

)

(10

)

2010

108,764

4.6

(6,891

)

(6.0

)

(20

)

(1) Represents the basis point change in depreciation and amortization as a percent of consolidated revenues as

compared to the corresponding period of the prior fiscal year.

Increase (Decrease)

Over Prior Fiscal Year

Years Ended June 30, Goodwill

Impairment

Expense as % of

Consolidated

Revenues Dollar Percentage Basis Point

(1)

(Dollars in thousands)

2012

$

146,110

6.4

%

$

72,010

97.2

%

320

2011

74,100

3.2

38,823

110.1

170

2010

35,277

1.5

(6,384

)

(15.3

)

(20

)

(1) Represents the basis point change in goodwill impairment as a percent of consolidated revenues as compared to

the corresponding period of the prior fiscal year.