Supercuts 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

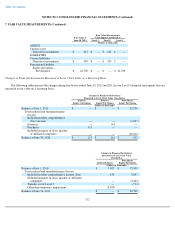

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

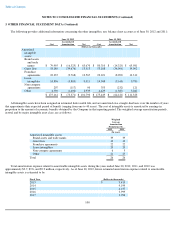

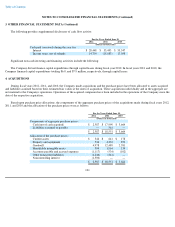

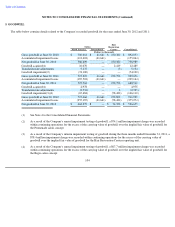

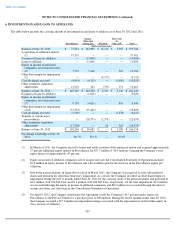

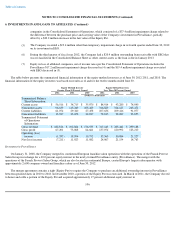

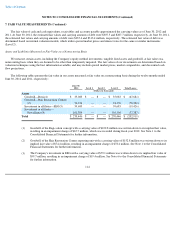

The table below presents the summarized financial information of the equity method investees as of June 30, 2012 2011, and 2010. The

financial information of the equity investees was based on results as of and for the twelve months ended June 30.

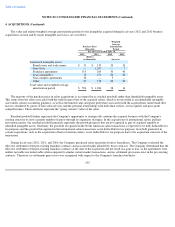

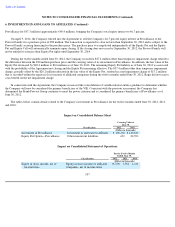

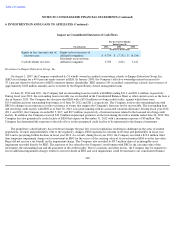

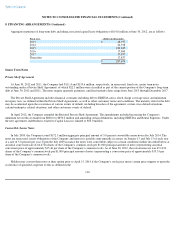

Investment in Provalliance

On January 31, 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost

Salon Group in exchange for a 30.0 percent equity interest in the newly formed Provalliance entity (Provalliance). The merger with the

operations of the Franck Provost Salon Group, which are also located in continental Europe, created Europe's largest salon operator with

approximately 2,600 company-owned and franchise salons as of June 30, 2012.

The merger agreement contains a right (Equity Put) to require the Company to purchase an additional ownership interest in Provalliance

between specified dates in 2010 to 2018. In December 2010, a portion of the Equity Put was exercised. In March of 2011, the Company elected

to honor and settle a portion of the Equity Put and acquired approximately 17 percent additional equity interest in

106

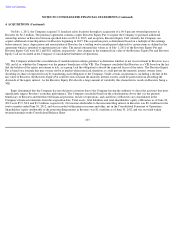

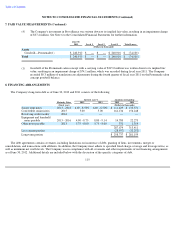

companies in the Consolidated Statement of Operations, which consisted of a $37.4 million impairment charge related to

the difference between the purchase price and carrying value of the Company's investment in Provalliance, partially

offset by a $20.2 million decrease in the fair value of the Equity Put.

(5)

The Company recorded a $19.4 million other than temporary impairment charge in its fourth quarter ended June 30, 2012

on its investment in EEG.

(6) During the third quarter of fiscal year 2012, the Company had a $20.4 million outstanding loan receivable with EEG that

was reclassified in the Consolidated Balance Sheet as other current assets as the loan is due in January 2013.

(7) Equity in loss of affiliated companies, net of income taxes per the Consolidated Statement of Operations includes the

Provalliance $17.2 million net impairment charge discussed in (4) and the $19.4 million impairment charge associated

with EEG discussed in (5).

Equity Method Investee

Greater Than 50 Percent Owned Equity Method Investees

Less Than 50 Percent Owned

2012 2011 2010 2012 2011 2010

(Dollars in thousands)

Summarized Balance

Sheet Information:

Current assets

$

56,516

$

34,715

$

35,070

$

84,914

$

93,280

$

74,040

Noncurrent assets

96,639

113,249

105,469

316,829

314,127

263,472

Current liabilities

61,074

29,340

27,458

107,636

109,416

91,077

Noncurrent liabilities

13,947

33,658

32,017

78,815

98,269

93,055

Summarized Statement

of Operations

Information:

Gross revenue

$

182,326

$

192,864

$

176,535

$

317,143

$

283,442

$

299,188

Gross profit

67,201

73,068

64,661

137,074

120,992

123,210

Operating (loss)

income

(1,335

)

18,994

19,752

35,569

30,084

21,227

Net (loss) income

(7,211

)

11,023

11,082

24,067

21,154

14,763