Supercuts 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 08/29/12 for the Period Ending 06/30/12

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 08/29/12 for the Period Ending 06/30/12 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

... on which registered 41-0749934 (I.R.S. Employer Identification No.) 55439 (Zip Code) Common Stock, par value $0.05 per share Preferred Share Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None New York Stock Exchange New York Stock Exchange Indicate by check mark if... -

Page 3

... of the registrant's definitive Proxy Statement for the annual meeting of shareholders to be held on October 25, 2012 (the "2012 Proxy Statement") (to be filed pursuant to Regulation 14A within 120 days after the registrant's fiscal year-end of June 30, 2012) are incorporated by reference into... -

Page 4

..., and Director Independence Principal Accounting Fees and Services Exhibits and Financial Statement Schedules 28 30 32 72 76 77 78 141 141 141 142 142 142 142 142 143 148 Business Executive Officers of the Registrant Risk Factors Unresolved Staff Comments Properties Legal Proceedings Mine Safety... -

Page 5

... July 13, 2012, the Company entered into a definitive agreement to sell its Hair Club for Men and Women business (Hair Club) for $163.5 million, a provider of hair restoration services. The transaction is expected to close during the first half of fiscal year 2013. Regis Corporation is listed on the... -

Page 6

... Franchising Program Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Hair Restoration Business Strategy Affiliated Ownership Interest Corporate Trademarks Corporate Employees... -

Page 7

... core salon business. On July 13, 2012, the Company entered into a definitive agreement to sell Hair Club for $163.5 million, a provider of hair restoration services. The transaction is expected to close during the first half of fiscal year 2013. Industry Overview: Management estimates that annual... -

Page 8

...exit strategy for independent salon owners and operators, which affords the Company numerous opportunities for continued selective acquisitions. Salon Business Strategy: The Company's long-term goal is to provide high quality, affordable hair care services and products to a wide range of mass market... -

Page 9

... can offer employee benefit programs, training and career path opportunities that are often superior to its smaller competitors. Centralized Control Over Salon Operations. During fiscal year 2012 the Company implemented a new field structure to support our long-term strategy. The Company manages its... -

Page 10

...Puerto Rico. The Company's international salon operations consist of 398 hair care salons located in Europe, primarily in the United Kingdom. The number of new salons expected to be opened within the upcoming fiscal year is discussed within Management's Discussion and Analysis of Financial Condition... -

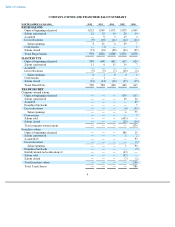

Page 11

... COMPANY-OWNED AND FRANCHISE SALON SUMMARY NORTH AMERICAN SALONS: 2012 2011 2010 2009 2008 REGIS SALONS Open at beginning of period Salons constructed Acquired Less relocations Salon openings Conversions Salons closed Total, Regis Salons MASTERCUTS Open at beginning of period Salons constructed... -

Page 12

...Contents NORTH AMERICAN SALONS: 2012 2011 2010 2009 2008 SMARTSTYLE/COST CUTTERS IN WALMART Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open at... -

Page 13

...914 3,313 INTERNATIONAL SALONS(1): 2012 2011 2010 2009 2008 Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Affiliated joint ventures Salons closed Total company-owned salons Franchise salons: Open at... -

Page 14

... INTERNATIONAL SALONS(1): 2012 2011 2010 2009 2008 Affiliated joint ventures(3) Salons closed Total franchise salons Total, International Salons TOTAL SYSTEM WIDE SALONS Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings... -

Page 15

... company-owned and franchise salons operating in strip centers across North America under the following concepts: Supercuts. The Supercuts concept provides consistent, high quality hair care services and professional products to its guests at convenient times and locations and at a reasonable price... -

Page 16

... $8,800. Average annual salon revenues in a company-owned Supercuts salon which has been open five years or more are approximately $270,000. The Supercuts franchise salons provide consistent, high quality hair care services and professional products to guests at convenient times and locations and at... -

Page 17

...prominent high-street locations and offer a full range of custom hairstyling, cutting, coloring and waving, as well as professional hair care products. The initial capital investment required is approximately £500,000. Average annual salon revenues for a salon which has been open five years or more... -

Page 18

... operations, personnel management, marketing fundamentals and financial controls. Existing franchisees receive training, counseling and information from the Company on a continuous basis. The Company provides store managers and stylists with extensive technical training for Supercuts franchises... -

Page 19

... Company's high-traffic locations and receive a steady source of new business from walk-in guests. In addition, the Company offers a career path with the opportunity to move into managerial and training positions within the Company. Salon Design: The Company's salons are designed, built and operated... -

Page 20

...Company has a salon, there are competitors offering similar hair care services and products at similar prices. The Company faces competition from smaller chains of salons such as Great Clips, Fantastic Sams and Sport Clips and within malls from companies which operate salons within department stores... -

Page 21

...metropolitan areas. The following table sets forth the number of company-owned and franchise hair restoration centers opened at the beginning and end of each of the last five fiscal years, as well as the number of centers opened, closed, relocated and acquired during each of these periods: 2012 2011... -

Page 22

... subsidiaries with the Franck Provost Salon Group created a newly formed entity, Provalliance. The Franck Provost Salon Group management structure has a proven platform to build and acquire company-owned stores as well as a strong franchise operating group that is positioned for expansion. In March... -

Page 23

... compensation. The Company believes that the current trend is for government regulation of franchising to increase over time. However, such laws have not had, and the Company does not expect such laws to have, a significant effect on the Company's operations. In Canada, the Company's franchise... -

Page 24

... patterns to our salons and hair restoration centers can be adversely impacted by increases in unemployment rates and decreases in discretionary income levels. If we continue to have negative same-store sales our business and results of operations may be affected. Our success depends, in part... -

Page 25

...Increased advisory fees. On July 13, 2012, the Company entered into a definitive agreement to sell its Hair Club for Men and Women business (Hair Club), a provider of hair restoration services. The transaction is expected to close during the first half of fiscal year 2013. Changes in our management... -

Page 26

... to control our expense structure. Failure to manage our cost of product, labor and benefit rates, advertising and marketing expenses, operating lease costs, other store expenses or indirect spending could delay or prevent us from achieving increased profitability or otherwise adversely affect... -

Page 27

...with other companies in the hair salon and beauty school businesses in order to maintain and expand our operations in the United States, Asia and continental Europe. If our joint venture partners are unwilling or unable to devote their financial resources or marketing and operational capabilities to... -

Page 28

... of our management information systems to perform as we anticipate, or to meet the continuously evolving needs of our business, could disrupt our business and may adversely affect our operating results. In fiscal year 2012 the Company began the process of implementing a new point-of-sale system in... -

Page 29

...more additional five year periods. Salons operating within department stores in Canada and Europe operate under license agreements, while freestanding or shopping center locations in those countries have real property leases comparable to the Company's domestic locations. The Company also leases the... -

Page 30

...Matters; Performance Graph Regis common stock is listed and traded on the New York Stock Exchange under the symbol "RGS." The accompanying table sets forth the high and low closing bid quotations for each quarter during fiscal years 2012 and 2011 as reported by the New York Stock Exchange (under the... -

Page 31

... Corporation International, The Cheesecake Factory, Inc., and Ulta Salon, Inc. The Peer Group is a self-constructed peer group of companies that have comparable annual revenues, the guest service element is a critical component to the business, and a target of moderate guests in terms of income... -

Page 32

.... The following significant items affected operating (loss) income: • Impairment charges of $67.7 and $78.4 million associated with the Company's Regis salon concept and Hair Restoration Centers, respectively, were recorded in fiscal year 2012. An impairment charge of $74.1 million associated with... -

Page 33

... operations and (loss) income from continuing operations per diluted share: • During fiscal year 2012, the Company recorded a net $17.2 million other than temporary net impairment charge within equity in (loss) income of affiliated companies associated with the Agreement to sell the Company... -

Page 34

... of Regis Salons, MasterCuts, SmartStyle, Supercuts and Cost Cutters. Our international salon operations include 398 salons located in Europe, primarily in the United Kingdom. Hair Club for Men and Women includes 98 North American locations, including 29 franchise locations. During fiscal year 2012... -

Page 35

... 13, 2012, the Company entered into a definitive agreement to sell its Hair Club for Men and Women business (Hair Club), a provider of hair restoration services. The transaction is expected to close during the first half of fiscal year 2013. CRITICAL ACCOUNTING POLICIES The Consolidated Financial... -

Page 36

... to our investment in EEG. In addition, during fiscal year 2012 we recorded a net $17.2 million other than temporary net impairment charge associated with the Share Purchase Agreement to sell the Company's 46.7 percent equity interest in Provalliance to the Provost Family for a purchase price of... -

Page 37

... for the Regis and Hair Restoration Centers reporting units might become impaired in future periods. As a result of the Company's annual impairment testing of goodwill during the fourth quarter of fiscal year 2012, a $67.7 million impairment charge was recorded within continuing operations for the... -

Page 38

... during the fiscal year 2012 interim impairment test of the Hair Restoration Centers reporting unit are outlined below: Annual revenue growth. Annual revenue growth is primarily driven by assumed same-store sales rates of approximately positive 1.0 to positive 3.0 percent. Other considerations... -

Page 39

...the Hair Restoration Centers reporting unit incurs its own overhead. Long-term growth. conditions. A long-term growth rate of 2.5 percent was applied to terminal cash flow based on anticipated economic Discount rate. A discount rate of 12.0 percent based on the weighted average cost of capital that... -

Page 40

... level of revenue growth, operating income and cash flows, it is reasonably likely that Promenade may experience additional impairment in future periods. As previously disclosed, the Company has agreed to sell the Hair Restoration Centers reporting unit in the first half of fiscal year 2013... -

Page 41

...See Note 4 to the Consolidated Financial Statements for further information. Self-Insurance Accruals The Company uses a combination of third party insurance and self-insurance for a number of risks including workers' compensation, health insurance, employment practice liability and general liability... -

Page 42

... consider new claims and developments associated with existing claims for each open policy period. As certain claims can take years to settle, the Company has multiple policy periods open at any point in time. Income Taxes In determining income for financial statement purposes, management must... -

Page 43

...and average ticket price, resulting in a decrease in consolidated same-store sales of 3.1 percent. Partially offsetting the decrease in revenues was the benefit of the additional day from leap year. The Company recorded goodwill impairment charges of $67.7 and $78.4 million associated with our Regis... -

Page 44

...-time costs with implementing the Company's new strategy. The Company recorded $1.8 million in deferred compensation expense associated with amending the deferred compensation contracts such that the benefits are based on years of service and employees' compensation as of June 30, 2012. The Company... -

Page 45

.... Consolidated revenues primarily include revenues of company-owned salons, product and equipment sales to franchisees, hair restoration center revenues, and franchise royalties and fees. As compared to the prior fiscal year, consolidated revenues decreased 2.2 percent during fiscal year 2012 and... -

Page 46

... the Years Ended June 30, 2011 (Dollars in thousands) 2012 2010 North American salons: Regis MasterCuts SmartStyle Supercuts Promenade(2) Total North American Salons International salons Hair restoration centers Consolidated revenues Percent change from prior year Salon same-store sales decrease... -

Page 47

... in same-store guest visits. Partially offsetting the decrease was growth due to new and acquired salons during the twelve months ended June 30, 2011, price increases, sales mix as the company continues to increase hair color and waxing services, and the weakening of the United States dollar against... -

Page 48

... of our franchise salons during the twelve months ended June 30, 2012. The increase in royalties and fees was also due to same-store sales increases at franchise locations. Total franchise locations open at June 30, 2011 and 2010 were 1,965 (including 29 franchise hair restoration centers) and 2,053... -

Page 49

... in salon health insurance costs due to lower claims were offset by decreased productivity in our North American segment and an increase in the cost of labor within our Hair Restoration Centers segment. The basis point decrease in service margins as a percent of service revenues during fiscal year... -

Page 50

... product revenues during fiscal year 2012 was primarily due to an increase in the cost of hair systems in our Hair Restoration Centers segment and increases in freight costs due to higher fuel prices. Partially offsetting the basis point decrease was a reduction in commissions paid to new employees... -

Page 51

... fiscal year 2010 was due to a planned reduction in retail commissions paid to new employees on retail product sales. Site Operating Expenses This expense category includes direct costs incurred by our salons and hair restoration centers, such as on-site advertising, workers' compensation, insurance... -

Page 52

... initiatives implemented by the Company. Rent Rent expense, which includes base and percentage rent, common area maintenance and real estate taxes, was as follows: (Decrease) Increase Over Prior Fiscal Year Expense as % of Consolidated Revenues Dollar Percentage (Dollars in thousands) Basis Point... -

Page 53

... to the Regis salon concept and Hair Restoration Centers reporting units, respectively, during fiscal year 2012. Due to the continuation of a decrease in same-store sales, the estimated fair value of the Regis salon operations was less than the carrying value of this concept's net assets, including... -

Page 54

... for the Hair Restoration Centers reporting unit. The Company recorded a $74.1 million goodwill impairment charge related to the Promenade salon concept during fiscal year 2011. Due to lower than expected earnings and same-store sales, the estimated fair value of the Promenade salon operations was... -

Page 55

... interest expense due to decreased debt levels. Interest Income and Other, net Interest income and other, net was as follows: Increase (Decrease) Over Prior Fiscal Year Income as % of Consolidated Revenues Dollar Percentage (Dollars in thousands) Years Ended June 30, Interest Basis Point(1) 2012... -

Page 56

... corresponding periods of the prior fiscal year. The basis point change for fiscal year 2011 is not applicable due to the income tax benefit in fiscal year 2011 compared to income tax expense in fiscal year 2010. The basis point increase in our overall effective income tax rate for fiscal year 2012... -

Page 57

..., Net of Income Taxes Equity in (loss) income of affiliates, representing the income or loss generated by our equity investment in Empire Education Group, Inc., Provalliance, and other equity method investments was as follows: (Decrease) Increase Over Prior Fiscal Year Equity (Loss) Income Dollar... -

Page 58

... accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements. Effects of Inflation We compensate some of our salon employees with percentage commissions based on sales they generate, thereby enabling salon payroll expense as a percent of company-owned salon revenues... -

Page 59

... internal management structure, we report three segments: North American salons, International salons and Hair Restoration Centers. Significant results of operations are discussed below with respect to each of these segments. North American Salons North American Salon Revenues. Total North American... -

Page 60

...fiscal year 2011. The basis point increase was also due to improved service margins, partially offset by negative leverage in fixed cost categories due to negative same-store sales. The basis point decrease in North American salon operating income as a percent of North American salon revenues during... -

Page 61

... plan to close underperforming salons in the United Kingdom. International Salon Operating Income. Operating income for the International salons was as follows: Years Ended June 30, Operating Income Operating (Decrease) Increase Over Prior Income Fiscal Year as % of Basis Total Point(1) Dollar... -

Page 62

... in same-store sales. The basis point improvement in International salon operating income as a percent of International salon revenues during fiscal year 2011 was primarily due to $2.1 million of lease termination costs recognized during fiscal year 2010 associated with the Company's planned closure... -

Page 63

... Restoration Centers operating income as a percent of Hair Restoration Centers revenues during the twelve months ended June 30, 2011 was primarily due to an increase in the cost of hair systems and expenses associated with a legal claim. Partially offsetting the basis point decrease was a benefit... -

Page 64

... of new stores, remodel certain existing stores, acquire salons and purchase inventory. Guests pay for salon services and merchandise in cash at the time of sale, which reduces our working capital requirements. Total assets at June 30, 2012, 2011, and 2010 were as follows: (Decrease) Increase Over... -

Page 65

...in total assets as of June 30, 2012 compared to June 30, 2011 were the goodwill impairment charges related to the Regis salon concept and Hair Restoration Centers reporting unit, a $17.2 million net impairment charge associated with the Agreement to sell the Company's 46.7 percent equity interest in... -

Page 66

...Fiscal year 2012 cash provided by operating activities was lower than fiscal year 2011 cash provided by operating activities due to a $51.8 million decrease in cash provided by operating assets and liabilities primarily due to the timing of accruals and a reduction in the amount received for income... -

Page 67

... hair restoration centers (all of which were franchise buybacks). Cash used by investing activities was lower during fiscal year 2010 compared to fiscal year 2009 due to the planned reduction in acquisitions and capital expenditures and the receipt of $15.0 million on the revolving credit facility... -

Page 68

... locations (excluding franchise buybacks) consisted of the following number of locations in each concept: Years Ended June 30, 2011 Constructed Acquired 2012 Constructed Acquired 2010 Constructed Acquired Regis MasterCuts SmartStyle Supercuts Promenade International Hair restoration centers... -

Page 69

... semi-annually at a rate of 5.0 percent per year. The notes mature on July 15, 2014. The notes are convertible subject to certain conditions at an initial conversion rate of 64.6726 shares of the Company's common stock per $1,000 principal amount of notes (representing an initial conversion price of... -

Page 70

...interest expense within the Consolidated Statement of Operations. The remaining proceeds were used for general corporate purposes including the repayment of bank debt. In connection with the offering above, the Company amended the Fourth Amended and Restated Credit Agreement, the Term Loan Agreement... -

Page 71

... 2012. Interest payments on long-term debt and capital lease obligations were estimated based on each debt obligation's agreed upon rate as of June 30, 2012 and scheduled contractual repayments. Other long-term liabilities include a total of $21.2 million related to the Executive Profit Sharing Plan... -

Page 72

... estate contracts, financial agreements, definitive agreement entered into during July 2012 to sell Hair Club, credit facility of EEG that matures on December 31, 2012 with a maximum exposure of $9 million, agreements to provide services, and agreements to indemnify officers, directors and employees... -

Page 73

... subject to our compliance with the terms and conditions of such facility, including minimum net worth and other covenants and requirements. At June 30, 2012, we were in compliance with all covenants and other requirements of our credit agreement and senior notes. Financing Financing activities are... -

Page 74

...other factors not listed above. The ability of the Company to meet its expected revenue target is dependent on salon acquisitions, new salon construction and same-store sales increases, all of which are affected by many of the aforementioned risks. Additional information concerning potential factors... -

Page 75

...risk management quarterly and makes adjustments in accordance with market conditions and the Company's short and long-term borrowing needs. The Company had outstanding fixed rate debt balances of $287.7 and $313.4 million at June 30, 2012 and June 30, 2011, respectively. Interest Rate Swap Contracts... -

Page 76

... the Company is required to translate the financial statements of its foreign subsidiaries from the currency in which they keep their accounting records, generally the local currency, into United States dollars. Different exchange rates from period to period impact the amounts of reported income and... -

Page 77

...effect of changes in foreign currency exchange rates on net income and cash flows. During fiscal year 2011, the Company entered into several forward foreign currency contracts to sell Canadian dollars and buy an aggregate of $8.7 million U.S. dollars, respectively, with maturation dates between July... -

Page 78

...: Management's Statement of Responsibility for Financial Statements and Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Balance Sheet as of June 30, 2012 and 2011 Consolidated Statement of Operations for each of the three years... -

Page 79

...of internal control over financial reporting. The Company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting... -

Page 80

... designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies... -

Page 81

...of Contents REGIS CORPORATION CONSOLIDATED BALANCE SHEET (Dollars in thousands, except per share data) June 30, 2012 2011 ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Deferred income taxes Income tax receivable Other current assets Total current assets Property and... -

Page 82

Table of Contents REGIS CORPORATION CONSOLIDATED STATEMENT OF OPERATIONS (Dollars in thousands, except per share data) Years Ended June 30, 2011 2012 2010 Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and ... -

Page 83

...market value of financial instruments designated as cash flow hedges, net of taxes Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program 43,881,364 $ 2,194 Additional Paid-In Capital $ 151,394 Accumulated Other Comprehensive Income... -

Page 84

... adjustments Changes in fair market value of financial instruments designated as cash flow hedges, net of taxes Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program Recognition of deferred compensation and other, net of taxes (Note... -

Page 85

... Income tax receivable Other current assets Other assets Accounts payable Accrued expenses Other noncurrent liabilities Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Proceeds from sale of assets Asset acquisitions, net of cash acquired... -

Page 86

... FINANCIAL STATEMENTS 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Business Description: Regis Corporation (the Company) owns, operates and franchises hairstyling and hair care salons throughout the United States (U.S.), the United Kingdom (U.K.), Canada, Puerto Rico... -

Page 87

... Financial Statements. Inventories: Inventories of finished goods consist principally of hair care products for retail product sales. A portion of inventories are also used for salon services consisting of hair color, hair care products including shampoo and conditioner and hair care treatments... -

Page 88

... STATEMENTS (Continued) 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) relaxers. Inventories are stated at the lower of cost or market, with cost determined on a weighted average cost basis. Physical inventory counts are performed annually. Product and service... -

Page 89

... our investment in MY Style. See further discussion within Note 6 to the Consolidated Financial Statements. Self-Insurance Accruals: The Company uses a combination of third party insurance and self-insurance for a number of risks including workers' compensation, health insurance, employment practice... -

Page 90

... consider new claims and developments associated with existing claims for each open policy period. As certain claims can take years to settle, the Company has multiple policy periods open at any point in time. As the workers' compensation accrual is the majority of the self-insurance accrual... -

Page 91

...quarter of fiscal year 2012, a $67.7 million impairment charge was recorded within continuing operations for the excess of the carrying value of goodwill over the implied fair value of the goodwill for the Regis salon concept. The Regis salon concept reported same-store sales of negative 4.0 percent... -

Page 92

... level of revenue growth, operating income and cash flows, it is reasonably likely that Promenade may experience additional impairment in future periods. As previously disclosed, the Company has agreed to sell the Hair Restoration Centers reporting unit in the first half of fiscal year 2013... -

Page 93

...the Company's annual impairment analysis of long-lived assets, the following impairment charges were recognized during fiscal years 2012, 2011, and 2010, respectively, related primarily to the carrying value of certain salons' property and equipment within our North American, International, and Hair... -

Page 94

... of Operations and recorded at the time product is shipped to franchise locations. The related cost of product sold to franchisees is included within cost of product in the Consolidated Statement of Operations. Company-owned hair restoration center revenues stem primarily from servicing hair systems... -

Page 95

... FINANCIAL STATEMENTS (Continued) 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Shipping and Handling Costs: Shipping and handling costs are incurred to store, move and ship product from the Company's distribution centers to company-owned and franchise locations... -

Page 96

... such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as incurred. Sales Taxes: Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company's Consolidated Statement of Operations. Income Taxes: Deferred... -

Page 97

...CONSOLIDATED FINANCIAL STATEMENTS (Continued) 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Comprehensive (Loss) Income: Components of comprehensive (loss) income for the Company include net (loss) income, changes in fair value of financial instruments designated... -

Page 98

... period. Awards granted do not contain acceleration of vesting terms for retirement of eligible recipients. Total compensation cost for stock-based payment arrangements totaled $7.6, $9.6, and $9.3 million for the fiscal years ended June 30, 2012, 2011 and 2010, respectively. Cash retained for share... -

Page 99

... FINANCIAL STATEMENTS (Continued) 1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Employee Termination Expense: During fiscal year 2012, the Company reduced the home office workforce by approximately 120 employees. The Company recorded $9.8 million in senior... -

Page 100

... financial position, results of operations or cash flows. However, it will require changing the Company's presentation and disclosure of comprehensive income. Disclosures about Offsetting Assets and Liabilities In December 2011, the FASB issued new accounting disclosure requirements about the nature... -

Page 101

...Consolidated Financial Statements for further information on the guaranteed leases. The income from discontinued operations is summarized below: For the Years Ended June 30, 2012 2011 2010 (Dollars in thousands) Revenues Income from discontinued operations, before income taxes Income tax benefit on... -

Page 102

...: Equity-method investments Noncurrent loans to affiliates Other assets: Notes receivable, net Other noncurrent assets Accrued expenses: Payroll and payroll related costs Insurance Deferred compensation Deferred revenues Taxes payable Other Other noncurrent liabilities: Deferred income taxes... -

Page 103

... FINANCIAL STATEMENT DATA (Continued) The following provides additional information concerning the other intangibles, net, balance sheet account as of June 30, 2012 and 2011: June 30, 2012 Accumulated Amortization June 30, 2011 Accumulated Amortization Cost Net Cost (Dollars in thousands) Net... -

Page 104

... CONSOLIDATED FINANCIAL STATEMENTS (Continued) 3. OTHER FINANCIAL STATEMENT DATA (Continued) The following provides supplemental disclosures of cash flow activity: For the Years Ended June 30, 2012 2011 2010 (Dollars in thousands) Cash paid (received) during the year for: Interest Income taxes, net... -

Page 105

... further represents the Company's opportunity to strategically combine the acquired business with the Company's existing structure to serve a greater number of guests through its expansion strategies. In the acquisitions of international salons and hair restoration centers, the residual goodwill... -

Page 106

... FINANCIAL STATEMENTS (Continued) 4. ACQUISITIONS (Continued) On July 1, 2011, the Company acquired 31 franchise salon locations through its acquisition of a 60.0 percent ownership interest in Roosters for $2.3 million. The purchase agreement contains a right, Roosters Equity Put, to require... -

Page 107

... of Contents NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 5. GOODWILL The table below contains details related to the Company's recorded goodwill for the years ended June 30, 2012 and 2011: Hair Salons Restoration North America International Centers (Dollars in thousands) Consolidated... -

Page 108

...recorded through the interest income and other, net, line items in the Consolidated Statement of Operations. On April 9, 2012, the Company entered into the Agreement to sell the Company's 46.7 percent equity interest in Provalliance to the Provost Family for a purchase price of â,¬80 million. During... -

Page 109

... 2012 2011 2010 2012 2011 2010 (Dollars in thousands) Summarized Balance Sheet Information: Current assets Noncurrent assets Current liabilities Noncurrent liabilities Summarized Statement of Operations Information: Gross revenue Gross profit Operating (loss) income Net (loss) income Investment... -

Page 110

... is recorded within the equity in (loss) income of affiliated companies during the twelve months ended June 30, 2012. Regis did not receive a tax benefit on the net impairment charge. In connection with the Agreement, the Company reassessed the consolidation of variable interest entities guidance... -

Page 111

... interest increased to 55.1 percent related to the buyout of EEG's minority interest shareholder. EEG operates 105 accredited cosmetology schools, has revenues of approximately $180 million annually and is overseen by the Empire Beauty School management team. At June 30, 2012 and 2011, the Company... -

Page 112

...a proxy to vote such number of the Company's shares such that the other shareholder would have voting control of 51.0 percent of the common stock of EEG. The Company accounts for EEG as an equity investment under the voting interest model. During fiscal years ended June 30, 2012, 2011, and 2010, the... -

Page 113

... of Hair Club in fiscal year 2005. The Company accounts for its investment in Hair Club for Men, Ltd. under the equity method of accounting. Hair Club for Men, Ltd. operates Hair Club centers in Illinois and Wisconsin. During fiscal years 2012, 2011, and 2010, the Company recorded income and... -

Page 114

... FINANCIAL STATEMENTS (Continued) 7. FAIR VALUE MEASUREMENTS (Continued) Level 2 -Other observable inputs available at the measurement date, other than quoted prices included in Level 1, either directly or indirectly, including Quoted prices for similar assets or liabilities in active markets... -

Page 115

... in (loss) income of affiliated companies Balance at June 30, 2012 $ - $ - $ 22,700 - - 117 - 117 $ - 161 - - 161 $ (1,845) - - (20,222) 633 $ Changes in Financial Instruments Measured at Level 3 Fair Value Classified as Provalliance Preferred Shares Equity Put Option (Dollars in thousands... -

Page 116

... as Level 3 as there are no quoted market prices and minimal market participant data for preferred shares of similar rating. The fair value of the preferred shares is based on the financial health of Yamano Holding Corporation and terms within the preferred share agreement which allow the Company to... -

Page 117

... to its implied fair value, resulting in an impairment charge of $67.7 million, which was recorded during fiscal year 2012. See Note 1 to the Consolidated Financial Statements for further information. Goodwill of the Hair Restoration Centers reporting unit with a carrying value of $152.8 million was... -

Page 118

... (Continued) (4) The Company's investment in Provalliance was written down to its implied fair value, resulting in an impairment charge of $37.4 million. See Note 6 to the Consolidated Financial Statements for further information. June 30, 2011 Level 1 Level 2 Level 3 (Dollars in thousands) Total... -

Page 119

... unsecured, fixed rate, senior term notes outstanding under a Private Shelf Agreement, of which $22.1 million were classified as part of the current portion of the Company's long-term debt at June 30, 2012 and 2011. The notes require quarterly payments, and final maturity dates range from June 2013... -

Page 120

... FINANCIAL STATEMENTS (Continued) 8. FINANCING ARRANGEMENTS (Continued) convertible senior note agreement. On or after April 15, 2014, holders may convert each of their notes at their option at any time prior to the maturity date for the notes. The Company has the choice of net-cash settlement... -

Page 121

... of business are changes in interest rates and foreign currency exchange rates. The Company has established policies and procedures that govern the management of these exposures through the use of a variety of strategies, including the use of derivative financial instrument contracts. By policy, the... -

Page 122

... derivative contracts, which do not qualify for hedge accounting treatment. The Company marks to market such derivatives with the resulting gains and losses recorded within current earnings in the Consolidated Statement of Operations. For purposes of the Consolidated Statement of Cash Flows, cash... -

Page 123

... outlay of $8.9 million. This cash outlay was recorded within investing activities within the Consolidated Statement of Cash Flows. The related cumulative tax-effected net loss of $7.9 million was recorded in accumulated other comprehensive income (AOCI) in fiscal year 2007. The amount will remain... -

Page 124

..., the Company is required to pay additional rent based on a percent of sales in excess of a predetermined amount and, in most cases, real estate taxes and other expenses. Rent expense for the Company's international department store salons is based primarily on a percent of sales. The Company also... -

Page 125

... classified in the royalties and fees caption of the Consolidated Statement of Operations. Total rent expense, excluding rent expense on premises subleased to franchisees, includes the following: 2012 2011 (Dollars in thousands) 2010 Minimum rent Percentage rent based on sales Real estate taxes and... -

Page 126

... of equipment and leasehold improvements related to future salon locations, and continues to enter into transactions to acquire established hair care salons. Contingencies: The Company is self-insured for most workers' compensation, employment practice liability, and general liability. Workers... -

Page 127

... of the following: 2012 2011 2010 U.S. statutory rate (benefit) State income taxes, net of federal income tax benefit Tax effect of goodwill impairment Foreign income taxes at other than U.S. rates Work Opportunity and Welfare-to-Work Tax Credits Adjustment of prior year income tax balances Other... -

Page 128

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 12. INCOME TAXES (Continued) taxes is less than the magnitude of income from continuing operations before income taxes in fiscal year 2010. The annual effective tax rate was favorably impacted by employment credits in both years. Partially offsetting... -

Page 129

... 13. BENEFIT PLANS Regis Retirement Savings Plan The Company maintains a defined contribution 401(k) plan, the Regis Retirement Savings Plan (RRSP Plan). The RRSP Plan is a defined contribution profit sharing plan with a 401(k) feature that is intended to qualify with the Internal Revenue Code (Code... -

Page 130

... covering full-time and part-time employees of the Company who have at least one year of eligible service, 1,000 hours of service during the Plan year, are employed by the Employer on the last day of the Plan year and are employed at the home office or distribution centers, or as area or regional... -

Page 131

... deferred compensation contracts. Compensation associated with these agreements is charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement of Operations totaled $5.9, $2.5 and $2.2 million for fiscal years 2012, 2011... -

Page 132

... of the plans, for the fiscal years ended June 30, 2012, 2011, and 2010, included the following: 2012 2011 2010 (Dollars in thousands) RRSP Plan profit sharing Executive Plan profit sharing ESPP FSPP Deferred compensation contracts 14. SHAREHOLDERS' EQUITY Net (Loss) Income Per Share: $ - $ 1,907... -

Page 133

... method: 2012 2011 (Dollars in thousands) 2010 Net (loss) income from continuing operations available to common shareholders Effect of dilutive securities: Interest on convertible debt Net (loss) income from continuing operations for diluted earnings per share Stock-based Compensation Award Plans... -

Page 134

..., time of exercise, exercise price and on disposition of any shares acquired through exercise of the options. Stock options were granted at not less than fair market value on the date of grant. The Board of Directors determines the 2000 Plan participants and establishes the terms and conditions of... -

Page 135

... options of 651,578 at June 30, 2012 had an intrinsic value (the amount by which the stock price exceeded the exercise or grant date price) of zero and a weighted average remaining contractual term of 3.4 years. Exercisable options of 593,288 at June 30, 2012 had an intrinsic value of zero and... -

Page 136

... the respective award recipient is no longer an employee of the Company or serves on the Board of Directors. Outstanding SARs of 733,800 at June 30, 2012 had a total intrinsic value of $0.1 million and a weighted average remaining contractual term of 3.8 years. Exercisable SARs of 579,790 at June 30... -

Page 137

... the strike price at the time of the grant. The Company uses historical data to estimate pre-vesting forfeiture rates. Compensation expense included in income before income taxes related to stock- based compensation was $7.6, $9.6, and $9.3 million for the three years ended June 30, 2012, 2011, and... -

Page 138

...As of June 30, 2012, the Company owned, franchised or held ownership interests in approximately 12,600 worldwide locations. The Company's locations consisted of 9,340 North American salons (located in the U.S., Canada and Puerto Rico), 398 international salons, 98 hair restoration centers, and 2,811... -

Page 139

...are located primarily in office and professional buildings within larger metropolitan areas. Based on the way the Company manages its business, it has reported its North American salons, International salons, and Hair Restoration Centers as three separate reportable segments. The accounting policies... -

Page 140

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. SEGMENT INFORMATION (Continued) For the Year Ended June 30, 2011 Salons North America Hair Restoration Unallocated International Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees $ 1,588,690... -

Page 141

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. SEGMENT INFORMATION (Continued) For the Year Ended June 30, 2010 Salons North America Hair Restoration Unallocated International Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees $ 1,605,979... -

Page 142

... 6 in this Form 10-K for explanations of items, which impacted fiscal year 2011 revenues, operating and net income. (a) Expense of $67.7 million ($55.2 million net of tax) was recorded in the fourth quarter ended June 30, 2012 related to our Regis salon concept goodwill impairment. Expense of $78... -

Page 143

quarter ended December 31, 2011 related to our Hair Restoration Centers reporting unit goodwill impairment. Expense of $74.1 million ($50.8 million net of tax) was recorded in the third quarter ended March 31, 2011 related to our Promenade salon concept goodwill impairment due to recent performance ... -

Page 144

... agreement to sell Hair Club to Aderans, Co., Ltd. for cash of $163.5 million excluding closing adjustments and transaction fees. Subsequent to fiscal year 2012, the net assets of Hair Club to be sold met the accounting criteria to be classified as held for sale and will be aggregated and reported... -

Page 145

... the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to management, including the chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure... -

Page 146

... Company's 2012 Proxy Statement, and is incorporated herein by reference. The Company has adopted a code of ethics, known as the Code of Business Conduct & Ethics that applies to all employees, including the Company's chief executive officer, chief financial officer, directors and executive officers... -

Page 147

... Company and Hair Club Group Inc. (Incorporated by reference to Exhibit 2 of the Company's Report on Form 10-Q filed on February 9, 2005, for the quarter ended December 31, 2004.) Stock Purchase Agreement dated as of January 26, 2009 between Regis Corporation, Trade Secret, Inc. and Premier Salons... -

Page 148

..., between the Company and Information Leasing Corporation. (Incorporated by reference to Exhibit 10(ee) of the Company's Report on Form 10-K filed on September 10, 2004, for the year ended June 30, 2004.) Lease Agreement commencing October 1, 2005, between the Company and France Edina, Property, LLP... -

Page 149

... Company's Report on Form 8-K filed July 6, 2009.) Amendment No. 8 to Amend and Restated Private Shelf Agreement between Regis Corporation and Prudential Investment Management, Inc., The Prudential Insurance Company of America, Pruco Life Insurance Company, Pruco Life Insurance Company of New Jersey... -

Page 150

...2004 Long Term Incentive Plan as Amended and Restated, effective October 28, 2011, (Incorporated by reference to Appendix A of the Company's Report on Form DEF14A filed September 14, 2010.) 10(z(*) Amendment to Amended and Restated Senior Officer Employment and Deferred Compensation Agreement, dated... -

Page 151

...DEF(**) XBRL Taxonomy Extension Definition Linkbase (*) (**) Management contract, compensatory plan or arrangement required to be filed as an exhibit to the Company's Report on Form 10-K. The XBRL related information in Exhibit 101 to this Annual Report on Form 10-K shall not be deemed "filed" for... -

Page 152

...) By /s/ BRENT A. MOEN Brent A. Moen, Senior Vice President, Chief Financial Officer (Principal Financial and Accounting Officer) DATE: August 29, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 153

Table of Contents /s/ JEFFREY C. SMITH Date: August 29, 2012 Jeffrey C. Smith, Director /s/ STEPHEN E. WATSON Date: August 29, 2012 Stephen E. Watson, Director /s/ DAVID P. WILLIAMS Date: August 29, 2012 David P. Williams, Director 149 -

Page 154

-

Page 155

..., the " Shelf Agreement "), between Regis Corporation, a Minnesota corporation (the " Company "), on the one hand, and Prudential Investment Management, Inc. (" PIM "), The Prudential Insurance Company of America, Pruco Life Insurance Company, Pruco Life Insurance Company of New Jersey and the other... -

Page 156

... four percent (4%) of Net Worth determined as of the end of the most recently ended fiscal quarter; and provided , further , that such Liens may not secure the Credit Agreement, the Term Loan Agreement or other Indebtedness to a bank, insurance company or other financial institution in excess of... -

Page 157

... and (ii) adding a new sentence to the end thereof that reads as follows: "For purposes of the foregoing, " Material Debt Agreement " means any agreement (or group of related agreements) under which the Company and/or any Subsidiary at any time incurs (directly, by assumption, by operation of law or... -

Page 158

... by income, plus (v) any non-cash interest expense on Indebtedness convertible into shares of common stock of the Company plus (c) the amount of any other charge in respect of non-recurring expenses for such period arising in connection with acquisitions, to the extent approved by the Required... -

Page 159

.... "Rental Expense" means, for any period, the sum of (a) all store rental payments (excluding lease termination payments), (b) all common area maintenance payments and (c) all real estate taxes paid by the Company and its Subsidiaries, in each case, with respect to non-franchised store location (and... -

Page 160

...") by certain Subsidiaries of the Company in favor of the holders of the Notes) hereby ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise, under the Guaranty Agreement. Each Guarantor hereby consents to the terms and conditions of this letter and reaffirms... -

Page 161

SECTION 7. Counterparts, Section Titles. This letter may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of ...meaning or content of any kind whatsoever and are not a part of the agreement between the parties hereto. [signature pages follow] 7 -

Page 162

...LIFE INSURANCE COMPANY UNION SECURITY INSURANCE COMPANY PHYSICIANS MUTUAL INSURANCE COMPANY FARMERS NEW WORLD LIFE INSURANCE COMPANY ZURICH AMERICAN INSURANCE COMPANY SECURITY BENEFIT LIFE INSURANCE COMPANY, INC BAYSTATE INVESTMENTS, LLC ING LIFE INSURANCE AND ANNUITY COMPANY MEDICA HEALTH PLANS MTL... -

Page 163

GIBRALTAR LIFE INSURANCE CO., LTD. By: Prudential Investment Management (Japan), Inc., as Investment Manager By: Prudential Investment Management, Inc., as Sub-Adviser By: /s/ Peter Pricco Vice President [Signature Page to Amendment No. 8 to Amended and Restated Private Shelf Agreement] -

Page 164

... Towne Center, Inc* B. Great Expectations Precision Haircutters of Northlake Mall, Inc* Regis International Ltd . 3. 4. 5. 6. 7. 8. 9. Minnesota Minnesota Delaware Delaware Florida Florida Delaware Delaware New York Delaware Canada Federal 100.00% Regis Corporation 100.00% Regis Corporation 55... -

Page 165

e. Hair Club for Men, Ltd. f. Hair Club for Men of Milwaukee, Ltd. g. TTEM, LLC* h. HCMA Staffing, LLC Illinois Wisconsin Delaware Delaware 50.00% Hair Club for Men, Ltd., Inc. 50.00% Hair Club for Men, Ltd., Inc. 100.00% Hair Club for Men, Ltd., Inc. 100.00% Hair Club for Men, Ltd., Inc. -

Page 166

...Regis Corporation Jurisdiction % Ownership Structure i. 8045950 Canada, Inc. 13. Salon Management Corporation A. Salon Management Corporation of New York* 14. Regis Netherlands, Inc 15. Roger Merger Subco LLC 16. RGS International SNC A. Regis International Holdings SARL 1. Regis Holdings (Canada... -

Page 167

SCHEDULE 8G AGREEMENTS RESTRICTING DEBT Fourth Amended and Restated Credit Agreement Dated as of June 30, 2011 Among Regis Corporation, JPMorgan Chase Bank, N.A., Bank of America, N.A., The Bank of Tokyo-Mitsubishi UFJ, Ltd., U.S. Bank National Association, Wells Fargo Bank, N.A., Fifth Third Bank, ... -

Page 168

SCHEDULE 8G-2 MORE RESTRICTIVE AGREEMENTS Fourth Amended and Restated Credit Agreement Dated as of June 30, 2011 Among Regis Corporation, JPMorgan Chase Bank, N.A., Bank of America, N.A., The Bank of Tokyo-Mitsubishi UFJ, Ltd., U.S. Bank National Association, Wells Fargo Bank, N.A., Fifth Third Bank... -

Page 169

... this agreement, Regis will pay you: 1) 2) 3) All compensation you have earned through and including the last day of your employment; Any accrued but unused PTO benefit; and Vested profit sharing, deferred compensation and 401(k) benefits in accordance with the terms and conditions of those plans... -

Page 170

...contributions to employment plans such as 401(k) or any employee stock purchase plan. Regis shall issue an IRS Form W-2 for the full amount of this payment. One payment in the gross amount of Thirty Thousand Two Hundred Five and 63/100 Dollars ($30,205.63) representing the cost of COBRA payments for... -

Page 171

...) business days after all of the following have occurred: (a) receipt by Regis of the signed agreements; and (b) expiration of the rescission periods referred to in paragraphs 8 and 9. If you do not sign this agreement or if you sign and rescind this agreement, you will not receive the Total Payment... -

Page 172

... obligations hereunder, that for a period of 24 months following Employee's separation from service with Regis and its affiliates, Employee will not, directly or indirectly, be involved in the ownership, operation or franchising of any licensed beauty salon(s), nor will employee consult with or for... -

Page 173

Employee may rescind this Separation Agreement within fifteen (15) calendar days to reinstate any claims under the MHRA. To be effective, any rescission within the relevant time period must be in writing and delivered to Employer, in care of Ms. Katherine M. Merrill, 7201 Metro Boulevard, ... -

Page 174

..., where applicable. 17. 18. IN WITNESS WHEREOF, the parties hereto have executed this Separation and Non-Disparagement Agreement and General Release as of the day and year first above written. Dated: May 9, 2012 /s/ David Bortnem Employee (print name): REGIS CORPORATION: Dated: May 10, 2012 By... -

Page 175

...3115038 Canada, Inc. Hair Club for Men, Ltd. Hair Club for Men of Milwaukee, Ltd. TTEM, LLC* HCMA Staffing, LLC 8045950 Canada, Inc. Salon Management Corporation Salon Management Corporation of New York* Regis Netherlands, Inc Roger Merger Subco LLC RGS International SNC Regis International Holdings... -

Page 176

Company Name Country or State of Incorporation/Formation Regis Merger SARL Provalliance, SAS Provost Participations SAS Mark Anthony, Inc. *Inactive Entities Luxemburg France France North Carolina -

Page 177

...33-44867 and 33-89882) of Regis Corporation of our report dated August 29, 2012 relating to the consolidated financial statements and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. /s/ PRICEWATERHOUSECOOPERS LLP PricewaterhouseCoopers LLP Minneapolis... -

Page 178

...financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. (b) August 29, 2012 /s/ Daniel J. Hanrahan Daniel J. Hanrahan, President and Chief Executive Officer -

Page 179

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. (b) August 29, 2012 /s/ Brent A. Moen Brent A. Moen, Senior Vice President and Chief Financial Officer -

Page 180

...complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and The information contained in the Annual Report on Form 10-K fairly presents, in all material respects, the financial condition and results of operations of the Registrant. August 29, 2012 /s/ Daniel... -

Page 181

... of the Securities Exchange Act of 1934; and The information contained in the Annual Report on Form 10-K fairly presents, in all material respects, the financial condition and results of operations of the Registrant. August 29, 2012 /s/ Brent A. Moen Brent A. Moen, Senior Vice President and Chief...