Qantas 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

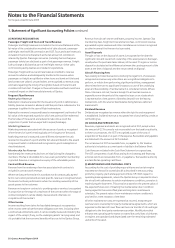

1. Statement of Significant Accounting Policies continued

(Q) INTANGIBLE ASSETS continued

Airport Landing Slots

Airport landing slots are stated at cost less any accumulated impairment

losses. Airport landing slots are allocated to the relevant CGU and are not

amortised as they are considered to have an indefinite useful life and are

tested annually for impairment.

Software

Software is stated at cost less accumulated amortisation and impairment

losses. Software development expenditure, including the cost of materials,

direct labour and other direct costs, is only recognised as an asset when

the Qantas Group controls future economic benefits as a result of the costs

incurred, it is probable that those future economic benefits will eventuate

and the costs can be measured reliably. Amortisation is charged to the

Income Statement on a straight-line basis over the estimated useful life of

three to 10 years.

Brand names and trademarks

Brand names and trademarks are carried at cost less any accumulated

impairment losses. Brand names and trademarks are allocated to the

relevant CGU and are not amortised as they are considered to have an

indefinite useful life and are tested annually for impairment.

Customer contracts/relationships

Customer contracts /relationships are carried at their fair value at the

date of acquisition less accumulated amortisation and impairment

losses. Amortisation is calculated based on the estimated timing of

benefits expected to be received from those assets, which ranges

from 10 to 15 years.

(R) PAYABLES

Liabilities for trade creditors and other amounts payable are carried at cost.

(S) EMPLOYEE BENEFITS

Wages, Salaries, Annual Leave and Sick Leave

Liabilities for employee benefits for wages, salaries, annual leave (including

leave loading) and sick leave vesting to employees expected to be settled

within 12 months of the year end represent present obligations resulting

from employees’ services provided to balance date. The calculation of this

liability is based on remuneration wage and salary rates that the Qantas

Group expects to pay as at balance date including related on-costs, such as

workers’ compensation insurance, superannuation and payroll tax.

Employee Share Plans

The fair value of equity-based entitlements granted to employees after

7 November 2002 is recognised as an employee expense with a

corresponding increase in equity. The fair value is estimated at grant date

and recognised over the period during which the employees become

unconditionally entitled to the equity instrument. The amount recognised

as an expense is adjusted to reflect the actual number of entitlements that

vest, except where forfeiture is only due to share prices not achieving the

threshold for vesting.

Long Service Leave

The provision for employee benefits to long service leave represents the

present value of the estimated future cash outflows to be made resulting

from employees’ services provided to balance date.

The provision is calculated using expected future increases in wage and

salary rates including related on-costs and expected settlement dates

based on staff turnover history and is discounted using the rates attaching

to Australian Government bonds at balance date which most closely match

the terms to maturity of the related liabilities. The unwinding of the

discount is treated as a finance charge.

Defined Contribution Superannuation Plans

The Qantas Group contributes to employee defined contribution

superannuation plans. Contributions to these plans are recognised as an

expense in the Income Statement as incurred.

Defined Benefit Superannuation Plans

Qantas’ net obligation with respect to defined benefit superannuation

plans is calculated separately for each plan. The Qantas Superannuation

Plan has been split based on the divisions which relate to accumulation

members and defined benefit members. Only defined benefit members

are included in Qantas’ net obligation calculations. Obligations of

accumulation members are accrued for as per the above accounting policy.

The calculation estimates the amount of future benefit that employees

have earned in return for their service in the current and prior periods;

that benefit is discounted to determine its present value and the fair

value of any plan assets is deducted.

The discount rate is the yield at balance date on government bonds that

have maturity dates approximating to the terms of Qantas’ obligations.

The calculation is performed by a qualified actuary using the projected

unit credit method.

When the benefits of a plan are improved, the portion of the increased

benefit relating to past service by employees is recognised as an expense

in the Income Statement on a straight-line basis over the average period

until the benefits become vested. To the extent that the benefits

vest immediately, the expense is recognised immediately in the

Income Statement.

All actuarial gains and losses as at 1 July 2004, the date of transition to

IFRS, were recognised. With respect to actuarial gains and losses that arise

subsequent to 1 July 2004, in calculating Qantas’ obligation with respect

to a plan, to the extent that any cumulative unrecognised actuarial gain or

loss exceeds 10 per cent of the greater of the present value of the defined

benefit obligation and the fair value of plan assets, that portion is

recognised in the Income Statement over the expected average remaining

working lives of the active employees participating in the plan. Otherwise,

the actuarial gain or loss is not recognised.

Where the calculation results in plan assets exceeding plan liabilities, the

recognised asset is limited to the net total of any unrecognised actuarial

losses and past service costs and the present value of any future refunds

from the plan or reductions in future contributions to the plan.

Past service cost is the increase in the present value of the defined benefit

obligation for employee services in prior periods, resulting in the current

period from the introduction of, or changes to, post-employment benefits

or other long-term employee benefits. Past service costs may either be

positive (where benefits are introduced or improved) or negative (where

existing benefits are reduced).

Various actuarial assumptions underpin the determination of Qantas’

defined benefit obligation and are discussed in Note 30.

Employee Termination Benefits

Provisions for termination benefits are only recognised when there is a

detailed formal plan for the termination and where there is no realistic

possibility of withdrawal.