Qantas 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 Qantas Annual Report 2009

Directors’ Report

for the year ended 30 June 2009

The Remuneration Report sets out the Executive Remuneration Framework

at Qantas and discloses the remuneration of Directors and Disclosed

Executives (includes Key Management Personnel and Highest

Remunerated Executives).

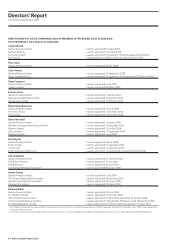

EXECUTIVE REMUNERATION PHILOSOPHY AND OBJECTIVES

Executive pay is set competitively, based on the size and nature of the role

(with reference to market benchmarks) and the performance of the

individual in the role. The objectives of the Executive Remuneration

Philosophy are to:

•attract,retainandappropriatelyrewardacapableExecutiveteam;

•motivatetheExecutiveteamtomeettheuniquechallengesitfacesasa

majorinternationalairlinebasedinAustralia;and

•linkpaytoperformance.

Remuneration includes an ‘at risk’ element for which the objectives are to:

•linkExecutiverewardwithQantas’businessobjectivesandfinancial

performance;

•aligntheinterestsofExecutiveswithshareholders;and

•supportacultureofemployeeshareownershipandtheretentionof

participating Executives.

ROLE OF THE REMUNERATION COMMIT TEE

The Remuneration Committee (a committee of the Board) has the role of

reviewing and making recommendations on all elements of Executive

Remuneration at Qantas to ensure they are appropriate from the

perspectives of governance, disclosure, reward levels and market

conditions.

In fulfilling its role, the Remuneration Committee is specifically concerned

with ensuring that its approach will:

•motivatetheCEO,CFOandExecutiveManagementtopursuethelong-

termgrowthandsuccessofQantas;

•demonstrateaclearrelationshipbetweenperformanceand

remuneration;

•ensureanappropriatebalancebetween‘fixed’and‘atrisk’

remuneration,reflectingtheshortandlong-termperformanceobjectives

ofQantas;and

•differentiatebetweenhigherandlowerperformersthroughtheuseofa

performance management framework.

The Remuneration Committee considers advice from a range of

independent external advisors in performing its role. The principal advisors

referred to are PricewaterhouseCoopers, Ernst & Young and the Hay Group.

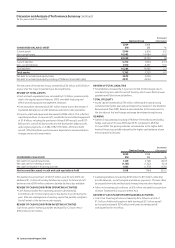

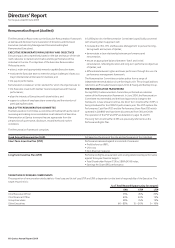

THE REMUNERATION FRAMEWORK

During 2009, the Remuneration Committee performed an extensive

review of the Remuneration Framework. In June 2009, the Remuneration

Committee recommended and the Board approved a change to the

framework. A new annual incentive, the Short Term Incentive Plan (STIP), is

being introduced for the 2009/10 performance year. The STIP replaces the

Performance Cash Plan (PCP) and the Performance Share Plan (PSP) which

operated in 2008/09 and have been discontinued from 30 June 2009.

The operation of the PCP and PSP are detailed on pages 72 and 73.

The Long Term Incentive Plan (LTIP) was previously referred to as the

Performance Rights Plan.

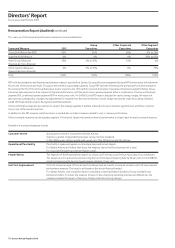

The Remuneration Framework comprises:

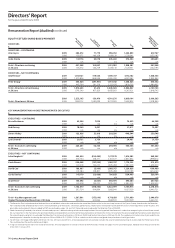

Fixed Annual Remuneration (FAR) Set based on the scope of the role and performance of the individual.

Short Term Incentive Plan (STIP) Performance assessed against a scorecard of measures:

•Protbeforetax(PBT);

•Unitcost;

•Non-nancialmeasures.

Long Term Incentive Plan (LTIP) Performance Rights are awarded, with vesting determined by performance

against three year financial targets:

•TotalShareholderReturn(TSR)vsS&P/ASX100index;

•EarningsPerShare(EPS)performance.

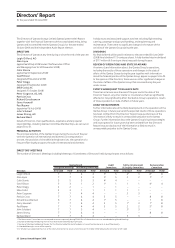

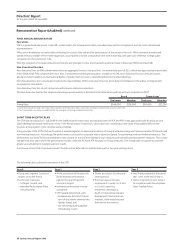

TARGET MIX OF REWARD COMPONENTS

The proportion of remuneration attributable to ‘fixed’ pay and ‘at risk’ pay (STIP and LTIP) is dependent on the level of responsibility of the Executive. The

target reward mix is:

% of Total Reward Opportunity (‘at target’)

FAR STIP LTIP

ChiefExecutiveOfcer 35% 45% 20%

ChiefFinancialOfcer 45% 40% 15%

GroupExecutives 50% 35% 15%

OtherExecutives 60–85% 15–30% 0–10%

Remuneration Report (Audited)