Qantas 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

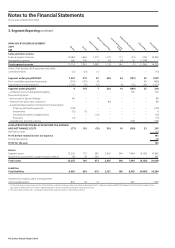

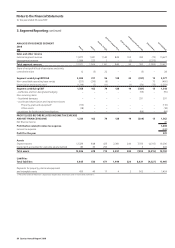

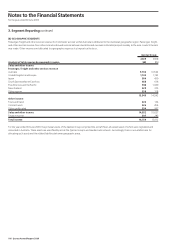

101 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

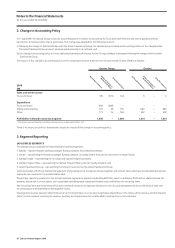

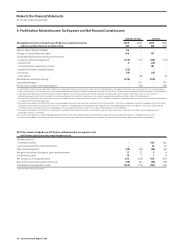

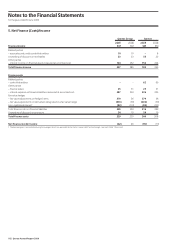

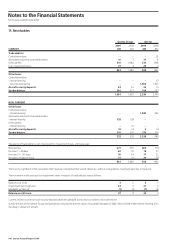

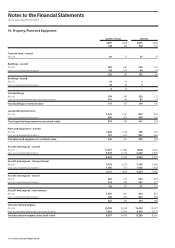

4. Profit before Related Income Tax Expense and Net Finance (Costs)/Income

Qantas Group Qantas

(A) Significant items included in profit before related income tax 2009 2008 2009 2008

expense and net finance (costs)/income $M $M $M $M

Gain on sale of Qantas Holidays1 86 – – –

Change in frequent flyer estimates2 164 – 157 –

Accelerated depreciation and impairment losses:

– property, plant and equipment3 (139) (110) (135) (110)

– investments4 4 – (15) –

– controlled entity impairment reversal – – 181 –

– goodwill and other intangible assets4 (22) – – –

– provisions (13) – (13) –

– other assets – (18) – (9)

Redundancies and restructuring5 (106) – (104) –

Liquidated damages6 – 291 – 291

Provisions for freight cartel investigations7 – (64) – (64)

1. In July 2008, the Qantas Group sold Qantas Holidays Limited and Qantas Business Travel Pty Limited to Jet set Travelworld Ltd in exchange for a 58 per cent ownership interest in the combined group.

A gain of $86 million, after transaction costs, was recognised on disposal of Qantas Holidays Limited and Qantas Business Travel P t y Limited to Jetset Travelworld Ltd. Refer to Note 27 for fur ther details.

2. During the year ended 30 June 2009, the Qantas Group changed its estimate of the fair value of a frequent flyer point and breakage which resulted in $164 million (Qantas: $157 million) of

additional revenue of which $8 4 million relates to a non-recurring benefit arising from the direct earn conversion implemented during the year. Refer to N ote 1 for fur ther details.

3. In A pril 2009, the Qantas Group announced its intentions to reduce capacity and ground or retire certain aircraft. In addition to these plans to ground cer tain aircraft the Qantas Group has disposed of

a number of other aircraf t during the year.

4. During the year ended 30 June 2009, the Qantas Group recorded impairment losses on certain investment s of $15 million (Qantas: $15 million) and goodwill and other intangible assets of $22 million

following a review of the carrying value of these assets. In addition, immediately prior to the acquisition of Orangestar Investment Holdings Pte Limited (“Orangestar”), the Qantas Group reversed

$19 million of prior year impairment losses recorded against the carrying value of the investment in Orangestar. Refer to Note 27 for further details.

5. During the year ended 30 June 2009, as part of the plans to reduce capacity, the Qantas Group announced plans to restructure the business. These plans resulted in restructuring expenses of

$10 6 million (Qantas: $104 million).

6. During the year ended 30 June 2008, liquidated damages of $291 million were recognised for contracted amounts expec ted to be receivable due to delays in the deliver y of new aircraft.

7. During the year ended 30 June 20 08, provisions of $64 million were recognised for estimated liabilities associated with freight cartel investigations. Refer to Note 29 for fur ther details.

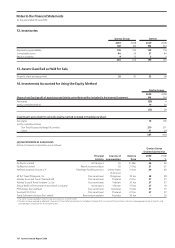

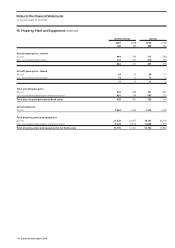

(B) Other items included in profit before related income tax expense and

net finance (costs)/income requiring disclosure

Dividend revenue

– controlled entities – – 429 602

– associates and jointly controlled entities – – 20 22

Share-based payments1 (59) (62) (59) (62)

Net gain on disposal of property, plant and equipment 17 15 6 4

Government grants 10 7 1 4

Net foreign currency gains/(losses) 542 (168) 444 (133)

Restructuring (excluding significant items) (49) (90) (49) (90)

Cancellable operating lease rentals (224) (175) (167) (140)

1. Refer to N ote 24 for fur ther details.