Qantas 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Qantas Annual Report 2009

Contents

PAGE

DIRECTORS’ REPORT 63

(INCLUDES THE REMUNERATION REPORT)

INCOME STATEMENTS 84

BALANCE SHEETS 85

STATEMENTS OF CHANGES IN EQUITY 86

CASH FLOW STATEMENTS 88

NOTES TO THE FINANCIAL STATEMENTS 89

1. Statement of Significant Accounting Policies 89

2. Change in Accounting Policy 97

3. Segment Reporting 97

4. Profit before Related Income Tax Expense and Net Finance (Costs)/Income 101

5. Net Finance (Costs)/Income 102

6. Income Tax 103

7. Auditors’ Remuneration 104

8. Earnings per Share 104

9. Dividends 105

10. Cash and Cash Equivalents 105

11. Receivables 106

12. Inventories 107

13. Assets Classified as Held for Sale 107

14. Investments Accounted for Using the Equity Method 107

15. Other Investments 109

16. Property, Plant and Equipment 110

17. Intangible Assets 114

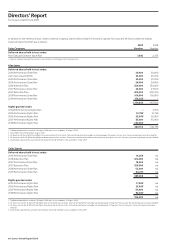

18. Deferred Tax Assets and Liabilities 116

19. Payables 117

20. Revenue Received in Advance 118

21. Interest-bearing Liabilities 118

22. Provisions 119

23. Capital and Reserves 121

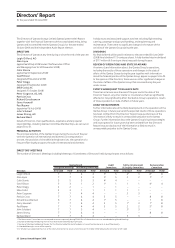

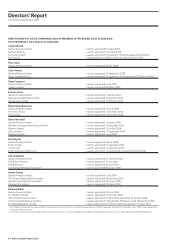

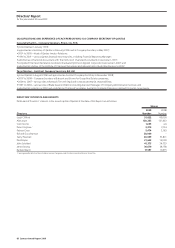

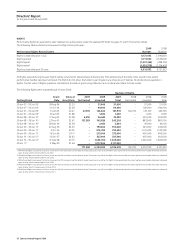

24. Share-based Payments 122

25. Derivatives and Hedging Instruments 124

26. Notes to the Cash Flow Statements 125

27. Acquisitions and Disposals of Controlled Entities 126

28. Commitments 127

29. Contingent Liabilities 128

30. Superannuation 130

31. Related Parties 131

32. Particulars in Relation to Controlled Entities as at 30 June 2009 139

33. Deed of Cross Guarantee 141

34. Financial Risk Management 143

35. Events Subsequent to Balance Date 148

DIRECTORS’ DECLARATION 149

INDEPENDENT AUDITOR’S REPORT 150

SHAREHOLDER INFORMATION 151

SUSTAINABILITY STATISTICS AND POLICIES (INCLUDING INDEPENDENT REVIEW REPORT) 152

FINANCIAL CALENDAR AND ADDITIONAL INFORMATION 160

REGISTERED OFFICE 160