Qantas 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

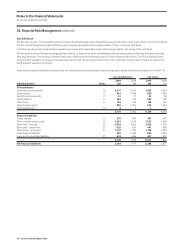

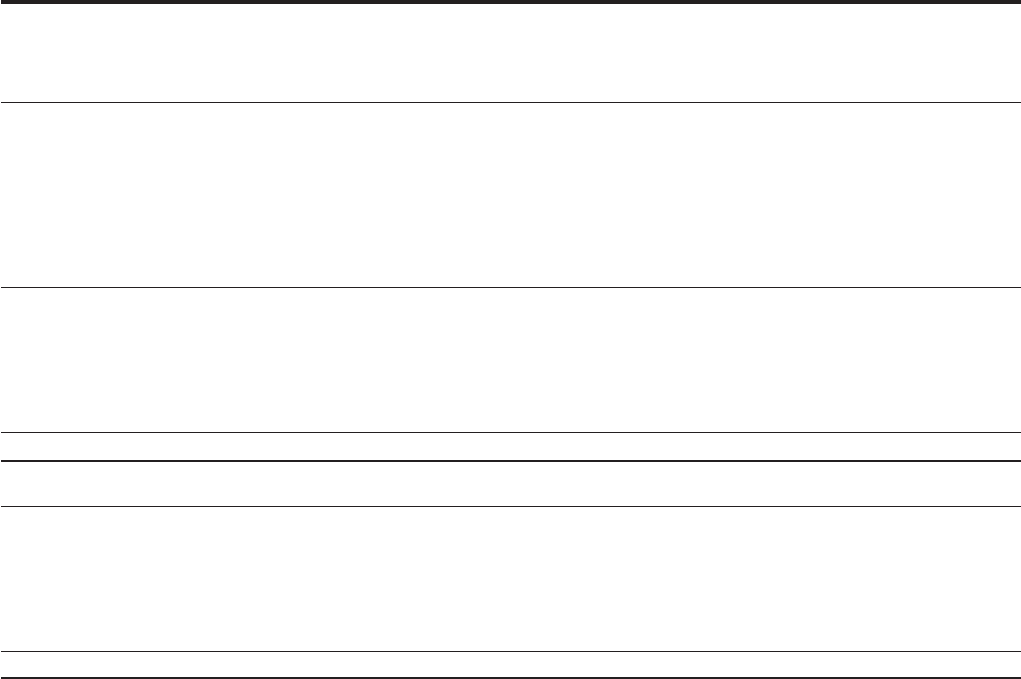

34. Financial Risk Management continued

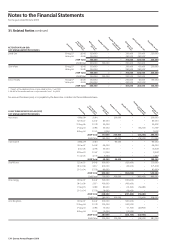

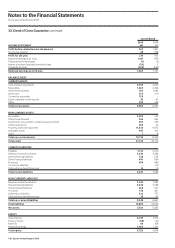

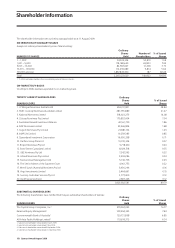

FINANCIAL LIABILITIES

QANTAS

2009

$M

Trade creditors 466 – – 466

Bankloans–secured1 249 1,027 826 2,102

Bankloans–unsecured1 23 641 – 664

Otherloans–unsecured1 78 818 685 1,581

Leaseandhirepurchaseliabilities1 531 1,996 1,750 4,277

Derivatives–inows (270) (1,782) (815) (2,867)

Derivatives–outows 819 2,065 886 3,770

Total financial liabilities 1,896 4,765 3,332 9,993

2008

Tradecreditors 738 – – 738

Bankloans–secured1 134 637 135 906

Bankloans–unsecured1 51 706 – 757

Otherloans–unsecured1 303 703 567 1,573

Leaseandhirepurchaseliabilities1 308 1,673 285 2,266

Derivatives–inows (552) (1,894) (666) (3,112)

Derivatives–outows 1,452 2,651 891 4,994

Total financial liabilities 2,434 4,476 1,212 8,122

1.Recognisednancialliabilitycarryingvaluesareshownpre-hedging.

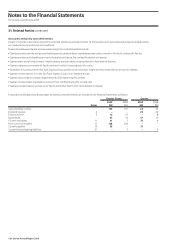

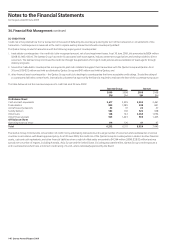

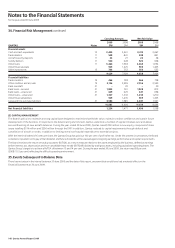

(B) MARKET RISK

TheQantasGrouphasexposuretomarketriskinthefollowingareas:interestrate,foreignexchangeandfuelpricerisks.Thefollowingsection

summarisesQantasGroup’sapproachtomanagingtheserisks.

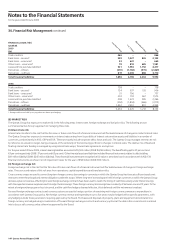

(i) Interest rate risk

Interestrateriskreferstotheriskthatthefairvalueorfuturecashowsofanancialinstrumentwilluctuatebecauseofchangesinmarketinterestrates.

TheQantasGrouphasexposuretomovementsininterestratesarisingfromitsportfolioofinterestratesensitiveassetsandliabilitiesinanumberof

currencies,predominantlyinAUD,GBPandEUR.Theseprincipallyincludecorporatedebt,leasesandcash.TheQantasGroupmanagesinterestraterisk

byreferencetoadurationtarget,beingameasureofthesensitivityoftheborrowingportfoliotochangesininterestrates.Therelativemixofxedand

oatinginterestratefundingismanagedbyusinginterestrateswaps,forwardrateagreementsandoptions.

Fortheyearended30June2009,interest-bearingliabilitiesamountedto$5,503million(2008:$4,160million).Thexed/oatingsplitis37percentand

63percentrespectively(2008:37percentand63percent).Othernancialassetsandliabilitiesincludednancialinstrumentsrelatedtodebttotalling

$81million(liability)(2008:$245million(liability)).ThesenancialinstrumentsarerecognisedatfairvalueoramortisedcostinaccordancewithAASB139.

Financialinstrumentsareshownnetofimpairmentlossesfortheyearof$58million(2008:$59million).

(ii) Foreign exchange risk

Foreignexchangeriskistheriskthatthefairvalueoffuturecashowsofanancialinstrumentwilluctuatebecauseofchangesinforeignexchange

rates.Thesourceandnatureofthisriskarisefromoperations,capitalexpendituresandtranslationrisks.

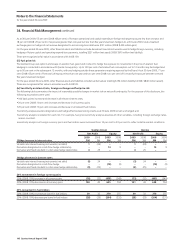

Cross-currencyswapsareusedtoconvertlong-termforeigncurrencyborrowingstocurrenciesinwhichtheQantasGrouphasforecastsufcientsurplusnet

revenuetomeettheprincipalandinterestobligationsundertheswaps.Wherelong-termborrowingsareheldinforeigncurrenciesinwhichtheQantasGroup

derivessurplusnetrevenue,offsettingforwardforeignexchangecontractshavebeenusedtomatchthetimingofcashowsarisingundertheborrowings

withtheexpectedrevenuesurplusesusedtohedgetheborrowings.Theseforeigncurrencyborrowingshaveamaturityofbetweenoneand12years.Tothe

extentaforeignexchangegainorlossisincurred,andthecashowhedgeisdeemedeffective,thisisdeferreduntilthenetrevenueisrealised.

Forwardforeignexchangecontractsandcurrencyoptionsareusedtohedgeaportionofremainingnetforeigncurrencyrevenueorexpenditurein

accordancewithQantasGrouppolicy.Netforeigncurrencyrevenueandexpenditureouttoveyearsmaybehedgedwithinspecicparameters,with

anyhedgingoutsidetheseparametersrequiringapprovalbytheBoard.Purchasesanddisposalsofproperty,plantandequipmentdenominatedina

foreigncurrencyarehedgedusingacombinationofforwardforeignexchangecontractsandcurrencyoptionsatthedatearmcommitmentisentered

intotobuyorsellcurrencyunlessotherwiseapprovedbytheBoard.

1 to 5 Years

More than 5 Years

Total

Less than 1 Year