Qantas 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

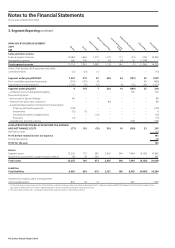

103 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

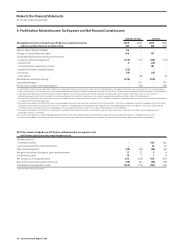

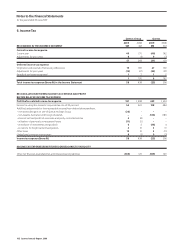

6. Income Tax

Qantas Group Qantas

2009 2008 2009 2008

RECOGNISED IN THE INCOME STATEMENT $M $M $M $M

Current income tax expense

Current year 49 271 (40) 142

Adjustments for prior years 8 (3) 9 (3)

57 268 (31) 139

Deferred income tax expense

Origination and reversal of temporary differences 15 189 27 192

Adjustments for prior years (15) (21) (22) (27)

Benefit of tax losses recognised 1 2 1 2

1 170 6 167

Total income tax expense/(benefit) in the Income Statement 58 438 (25) 306

RECONCILIATION BETWEEN INCOME TA X EXPENSE AND PROFIT

BEFORE REL ATED INCOME TAX EXPENSE

Profit before related income tax expense 181 1,408 459 1,614

Income tax using the domestic corporate tax rate of 30 per cent 54 422 138 484

Add/(less) adjustments for (non-assessable income)/non-deductible expenditure:

– non-assessable gain on sale of Qantas Holidays Group (26) – – –

– non-taxable Australian and foreign dividends – – (134) (187)

– share of net loss/(profit) of associates and jointly controlled entities 5 (8) – –

– utilisation of previously unrecognised losses (11) (5) – –

– writedown of investments and goodwill 6 3 (44) 4

– provisions for freight cartel investigations 3 19 3 19

Other items 19 10 3 (11)

Under/(over) provision in prior years 8 (3) 9 (3)

Income tax expense/(benefit) 58 438 (25) 306

INCOME TAX EXPENSE/(BENEFIT) RECOGNISED DIRECTLY IN EQUITY

Other net financial assets/liabilities and interest-bearing liabilities (189) 129 (189) 129