Qantas 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

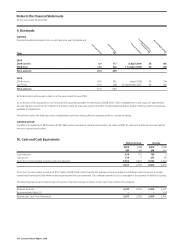

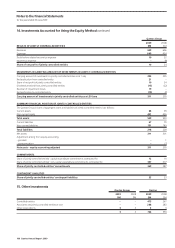

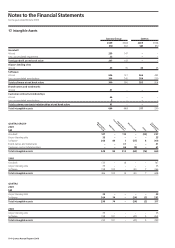

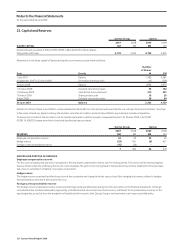

17. Intangible Assets continued

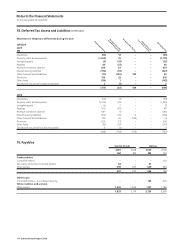

Impairment tests for Cash Generating Units (CGUs) containing goodwill and other intangible assets with indefinite useful lives

The following CGUs have significant carrying amounts of goodwill and other intangible assets with indefinite useful lives:

Qantas Group Qantas

2009 2008 2009 2008

Goodwill $M $M $M $M

Qantas1 39 56 – –

Jetstar 132 91 – –

Jetset Travelworld Group 66 – – –

237 147 – –

Airport landing slots

Qantas 35 35 35 35

Brand names and trademarks

Jetstar 24 – – –

Jetset Travelworld Group 7 – – –

31 – – –

1. The Qantas CGU includes Qantas, Qantas Freight, Qantas Frequent Flyer and Q Catering. As all of these businesses are largely dependent on the Qantas Fleet to generate their revenue, the Qantas Fleet

asset s are tested at the Qantas CGU level including the cash flows and assets of these segments. Q Catering was previously a separate CGU, but has been included in the Qantas CGU in the current year.

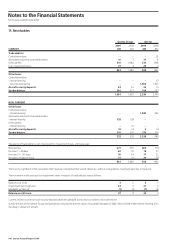

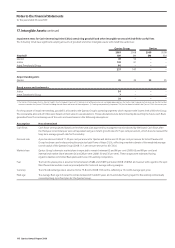

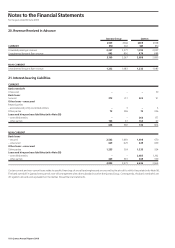

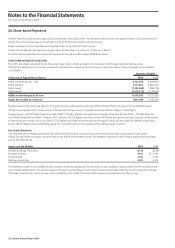

For the purpose of impairment testing, goodwill is allocated to the Qantas Group’s operating segments which represent the lowest level within the Group.

The recoverable amounts of CGUs were based on their value in use calculations. Those calculations were determined by discounting the future cash flows

generated from the continuing use of the units and were based on the following assumptions:

Assumption How determined

Cash flows Cash flows were projected based on the three-year plan approved by management and endorsed by the Board. Cash flows after

the third year or terminal year were extrapolated using a constant growth rate of 2.5 per cent per annum, which does not exceed the

long-term average growth rate for the industry.

Discount rate A pre-tax discount rate of 11.23 per cent per annum for Qantas and Jetstar and 13.05 per cent per annum for Jetset Travelworld

Group has been used in discounting the projected cash flows of these CGUs, reflecting a market estimate of the weighted average

cost of capital of the Qantas Group (2008: 11.1 per cent per annum for all CGUs).

Market share Qantas Group’s domestic market share is expected to remain between 65 and 66 per cent (2008: 65 and 68 per cent) and

international market share between 26 and 28 per cent (2008: 30 and 35 per cent). These ranges were estimated having

regard to Qantas committed fleet plans and those of its existing competitors.

Fuel The fuel into-plane price is assumed to be between US$82 and US$99 per barrel (2008: US$162) and was set with regard to the spot

West Texas Intermediate crude oil price adjusted for historical average refining margins.

Currency The US$:A$ exchange rate is assumed to be 75.8 cents (2008: 93.6 cents), reflecting a 12 month average spot price.

Fleet age The average fleet age is forecast to remain between 8.5 and 8.9 years and is estimated having regard to the existing contractually

committed long-term fleet plan for the Qantas Group.