Qantas 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

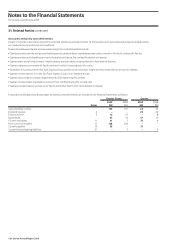

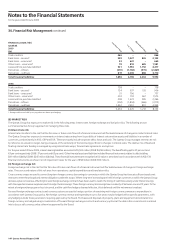

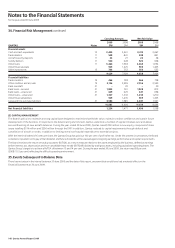

34. Financial Risk Management

Anancialinstrumentisanycontractthatgivesrisetobothanancialassetofoneentityandanancialliabilityorequityinstrumentofanotherentity.

TheQantasGroupissubjecttoliquidity,interestrate,foreignexchange,fuelpriceandcreditrisks.Theserisksareaninherentpartoftheoperationsofan

internationalairline.TheQantasGroupmanagestheseriskexposuresusingvariousnancialinstruments,usingasetofpoliciesapprovedbytheBoard.

Qantas Group policy is not to enter, issue or hold derivative financial instruments for speculative trading purposes.

TheQantasGroupusesdifferentmethodstoassessandmanagedifferenttypesofrisktowhichitisexposed.Thesemethodsincludesensitivityanalysisin

thecaseofinterestrate,foreignexchangeandotherpricerisks,andageinganalysisandsensitivityanalysisforliquidityriskandcreditrisk.

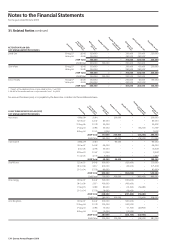

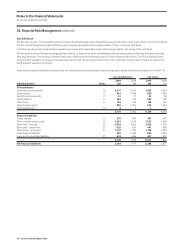

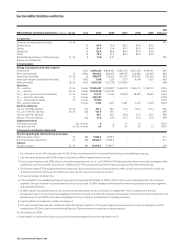

(A) LIQUIDITY RISK

Liquidityriskistheriskthatanentitywillencounterdifcultyinmeetingobligationsassociatedwithnancialliabilities.TheQantasGroupmanages

liquidityriskbytargetingaminimumliquiditylevel,ensuringlong-termcommitmentsaremanagedwithrespecttoforecastavailablecashinow,

maintainingaccesstoavarietyofadditionalfundingsourcesincludingcommercialpaperandstandbyfacilitiesandmanagingmaturityproles.

Thefollowingtablessummarisethecontractualtimingofcashows,includinginterestpayments,ofnancialliabilitiesandderivativeinstruments,

as at 30 June 2009 and 30 June 2008:

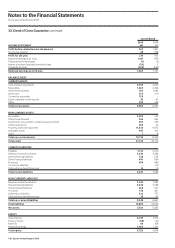

FINANCIAL LIABILITIES

QANTAS GROUP

2009

$M

Trade creditors 597 – – 597

Bankloans–secured1 424 1,769 1,115 3,308

Bankloans–unsecured1 23 641 – 664

Otherloans–unsecured1 78 818 685 1,581

Leaseandhirepurchaseliabilities1 164 344 175 683

Derivatives–inows (270) (1,782) (815) (2,867)

Derivatives–outows 819 2,065 886 3,770

Total financial liabilities 1,835 3,855 2,046 7,736

1.Recognisednancialliabilitycarryingvaluesareshownpre-hedging.

2008

Tradecreditors 670 – – 670

Bankloans–secured1 308 1,472 233 2,013

Bankloans–unsecured1 51 706 – 757

Otherloans–unsecured1 303 703 567 1,573

Leaseandhirepurchaseliabilities1 77 449 161 687

Derivatives–inows (553) (1,893) (665) (3,111)

Derivatives–outows 1,452 2,651 891 4,994

Total financial liabilities 2,308 4,088 1,187 7,583

1.Recognisednancialliabilitycarryingvaluesareshownpre-hedging.

1 to 5 Years

More than 5 Years

Total

Less than 1 Year