Qantas 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

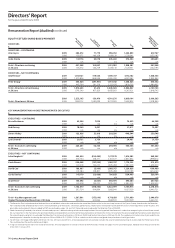

69 Qantas Annual Report 2009

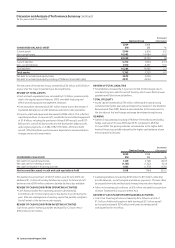

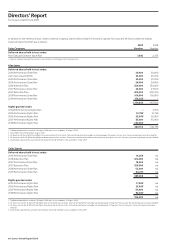

FIXED ANNUAL REMUNERATION

Executives

FAR is a guaranteed salary level. Cash FAR, as disclosed in the remuneration tables, excludes salary sacrifice components such as motor vehicles and

superannuation.

FAR is set with reference to market data, reflecting the scope of the role and the performance of the person in the role. FAR is reviewed annually and

overall reflects a middle-of-the-market approach, as compared to similar comparative roles within Australia, with particular reference to large public

companies for the most senior roles.

With the exception of increases linked to promotions and changes in roles, there has been a general freeze in Executive FAR since May 2008.

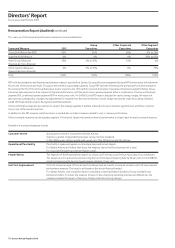

Non-Executive Directors

Non-Executive Director FAR is determined within an aggregate Directors’ fee pool limit. An annual total pool of $2.5 million was approved by shareholders

at the 2004 AGM. FAR comprises Director’s fees, Committee fees and superannuation. In addition to FAR, Non-Executive Directors are paid a travel

allowance when travelling on international flights of greater than six hours to attend Board and Committee Meetings.

Non-Executive Directors’ remuneration reflects the responsibilities of Non-Executive Directors and is determined based on the advice of independent

remuneration consultants.

Non-Executive Directors do not receive any performance related remuneration.

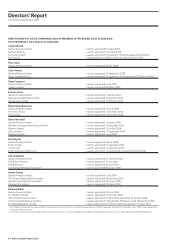

The Non-Executive Director fee structure (including superannuation) is disclosed in the table below and has not been revised since 2007:

Board Committees1

Chairman2 Member Chairman Member

Annual fees $544,000 $136,000 $54,400 $27,200

1. Committees include the Audit Committee, Remuneration Committee, Nominations Committee and Safety, Environment & Security Committee.

2. The Chairman does not receive any additional fees for serving on, or chairing, any Board Committee.

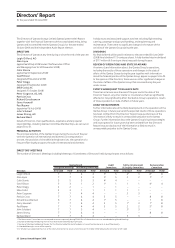

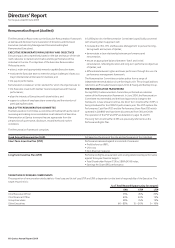

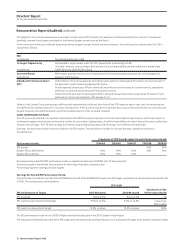

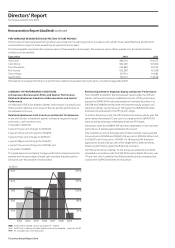

SHORT TERM INCENTIVE PLAN

The STIP was introduced on 1 July 2009 for the 2009/10 performance year and replaces both the PCP and PSP. It was approved by the Board at its June

2009 Meeting following an extensive review of the Remuneration Framework, which takes into consideration the views of key stakeholders on the

structure and operation of the incentive plans at Qantas.

A key principle of the STIP is that performance is assessed against an appropriate balance of Group and business segment measures and both financial and

non-financial measures. Accordingly, the performance scorecard for corporate roles is based on Qantas Group financial and non-financial measures. The

performance scorecard for business segment roles is based on a mix of both Qantas Group measures and tailored business segment measures. This is a key

change from prior years where the performance hurdles under the PCP and PSP focussed on Group measures. The change was introduced to promote

greater accountability for business segment results.

A minimum of one third of any award under this plan will be deferred into Qantas shares with a two year vesting period.

Directors’ Report

for the year ended 30 June 2009

Remuneration Report (Audited) continued

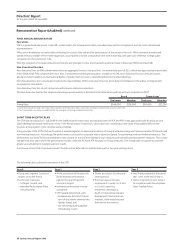

Year 0

•GroupandSegmentScorecard

targets set by the Board.

•SetforeachExecutive:

–‘attarget’reward;and

– individual Performance Plans

(including KPIs).

Year 1

•Attheconclusionoftheyear,the

Board assesses performance

against Group and Segment

Scorecard targets.

•Individualperformancereviews

completed.

•STIPrewarddetermined,with:

– between one third and 100 per

cent of any reward deferred into

Qantasshares;and

– the remaining reward payable

immediately in cash.

Year 3

•AnySharesawardedattheendof

year 1 vest at the end of year 3.

•Sharesmaythenbesold,subject

to compliance with the employee

Share Trading Policy.

Year 2

•Sharesaresubjecttoatwoyear

vesting period.

•IfanExecutiveterminates

employment in years 2 or 3 and

is a Good Leaver (e.g.

retirement, redundancy,

death or total and permanent

disablement), then shares are

released, otherwise shares are

forfeited on termination.

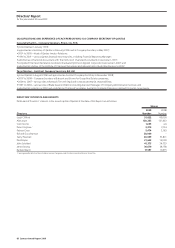

The following table outlines the operation of the STIP: