Qantas 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Qantas Annual Report 2009

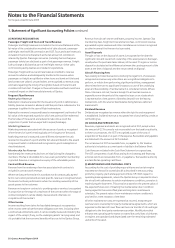

Notes to the Financial Statements

for the year ended 30 June 2009

1. Statement of Significant Accounting Policies continued

(G) REVENUE RECOGNITION

Passenger, Freight and Tours and Travel Revenue

Passenger and freight revenue is included in the Income Statement at the

fair value of the consideration received net of sales discount, passenger

and freight interline/IATA commission and GST. Tours and travel revenue is

included in the Income Statement as the net amount of commission

retained by Qantas. Passenger recoveries (including fuel surcharge on

passenger tickets) are disclosed as part of net passenger revenue. Freight

fuel surcharge is disclosed as part of net freight revenue. Other sales

commissions paid by Qantas are included in expenditure.

Passenger, freight and tours and travel sales are credited to revenue

received in advance and subsequently transferred to revenue when

passengers or freight are uplifted or when tours and travel air tickets and

land content are utilised. Unused tickets are recognised as revenue using

estimates regarding the timing of recognition based on the terms and

conditions of the ticket. Changes in these estimation methods could have

a material impact on the financial statements of Qantas.

Frequent Flyer Revenue

Redemption Revenue

Redemption revenue received for the issuance of points is deferred as a

liability (revenue received in advance) until the points are redeemed or the

passenger is uplifted in the case of flight redemptions.

Redemption revenue is measured based on management’s estimate of the

fair value of the expected awards for which the points will be redeemed.

The fair value of the awards are reduced to take into account the

proportion of points that are expected to expire (breakage).

Marketing Revenue

Marketing revenue associated with the issuance of points is recognised

when the service is performed (typically on the issuance of the point).

Marketing revenue is measured as the difference between the cash

received on issuance of a point and the fair value attributed to the award

component (which is deferred and recognised on point redemption as

described above).

Membership Fee Revenue

Membership fee revenue results from an initial joining fee charged to

members. This fee is refundable for a two week period after membership

is granted. Revenue is recognised on expiry of the refundable period.

Contract Work Revenue

Revenue from the rendering of services associated with contracts is

included in contract work revenue.

Where services performed are in accordance with contractually agreed

terms over a short period and are task specific, revenue is recognised when

the service has been performed or when the resulting ownership of the

goods passes to the customer.

Revenue on long-term contracts to provide goods or services is recognised

in proportion to the stage of completion of the contract when the stage of

contract completion can be reliably measured and otherwise on

completion of the contract.

Other Income

Income resulting from claims for liquidated damages is recognised as

other income when all performance obligations are met, including when

a contractual entitlement exists, it can be reliably measured (including the

impact of the receipt, if any, on the underlying assets’ carrying value) and

it is probable that the economic benefits will accrue to the Qantas Group.

Revenue from aircraft charter and leases, property income, Qantas Club

membership fees, freight terminal and service fees, commission revenue,

age availed surplus revenue and other miscellaneous income is recognised

as other income at the time service is provided.

Asset Disposals

The gain or loss on the disposal of assets is recognised at the date the

significant risks and rewards of ownership of the asset passes to the buyer,

usually when the purchaser takes delivery of the asset. The gain or loss on

disposal is calculated as the difference between the carrying amount of the

asset at the time of disposal and the net proceeds on disposal.

Aircraft Financing Fees

Fees relating to linked transactions involving the legal form of a lease are

recognised as revenue only when there are no significant obligations to

perform, or refrain from performing, significant activities, management

determines there are no significant limitations on use of the underlying

asset and the possibility of reimbursement is considered remote. Where

these criteria are not met, fees are brought to account as revenue or

expenditure over the period of the respective lease or on a basis which

is representative of the pattern of benefits derived from the leasing

transactions, with the unamortised balance being held as a deferred

lease benefit.

Dividend Revenue

Dividends are recognised as revenue when the right to receive payment

is established. Dividend revenue is recognised net of any franking credits or

withholding tax.

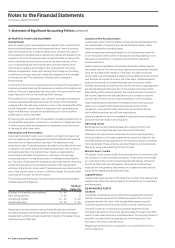

(H) GOODS AND SERVICES TAX

Revenues, expenses and assets are recognised net of GST, except where

the amount of GST incurred is not recoverable from the taxation authority.

In these circumstances, the GST is recognised as part of the cost of

acquisition of the asset or as part of the expense. Receivables and payables

are stated with the amount of GST included.

The net amount of GST recoverable from, or payable to, the taxation

authority is included as a current asset or liability in the Balance Sheet.

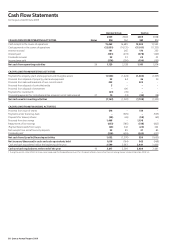

Cash flows are included in the Cash Flow Statement on a gross basis.

The GST components of cash flows arising from investing and financing

activities which are recoverable from, or payable to, the taxation authority

are classified as operating cash flows.

(I) MAINTENANCE AND OVERHAUL COSTS

Accounting for the cost of providing major airframe and certain engine

maintenance checks for owned aircraft is described in the accounting

policy for property, plant and equipment in Note 1(P). With respect to

operating lease agreements, where the Qantas Group is required to return

the aircraft with adherence to certain maintenance conditions, provision is

made during the lease term. This provision is based on the present value of

the expected future cost of meeting the maintenance return condition

having regard to the current fleet plan and long-term maintenance

schedules. The present value of non-maintenance return conditions is

provided for at the inception of the lease.

All other maintenance costs are expensed as incurred, except engine

overhaul costs covered by third party maintenance agreements, which are

expensed on the basis of hours flown as there is a transfer of risk and legal

obligation to the third party maintenance provider. Modifications that

enhance the operating performance or extend the useful lives of airframes

or engines are capitalised and depreciated over the remaining estimated

useful life of the asset.