Qantas 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

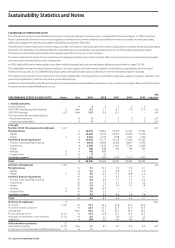

147 Qantas Annual Report 2009

Notes to the Financial Statements

for the year ended 30 June 2009

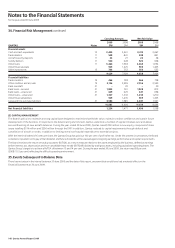

34. Financial Risk Management continued

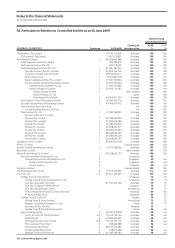

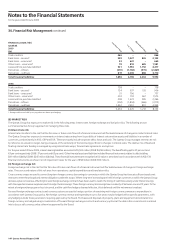

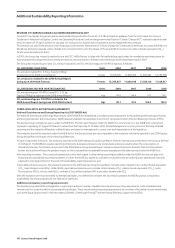

Carrying Amount Fair Value

2009 2008 2009 2008

QANTAS GROUP Notes $M $M $M $M

Financial assets

Cash and cash equivalents 10 3,617 2,599 3,625 2,625

Tradedebtors 11 824 1,085 824 1,085

Aircraft security deposits 11 42 37 42 38

Sundrydebtors 11 582 702 582 702

Other loans 11 128 143 128 143

Other financial assets 905 1,423 905 1,423

Other investments 15 3 3 3 3

6,101 5,992 6,109 6,019

Financial liabilities

Trade creditors 19 597 670 597 670

Other creditors and accruals 19 1,236 1,504 1,236 1,504

Bankloans–secured 21 2,934 1,692 3,029 1,754

Bankloans–unsecured 21 629 629 641 658

Otherloans–unsecured 21 1,307 1,233 1,358 1,290

Othernancialliabilities 909 1,435 909 1,435

Leaseandhirepurchaseliabilities 21 633 606 637 579

8,245 7,769 8,407 7, 89 0

Net financial liabilities 2,14 4 1,777 2,298 1,871

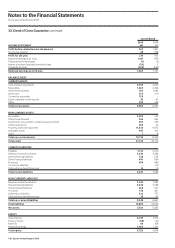

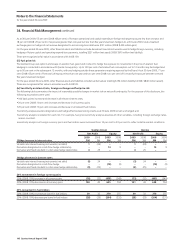

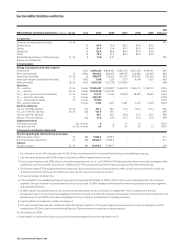

(D) FAIR VALUE

Thefairvalueofcash,cashequivalentsandnon-interest-bearingnancialassetsandliabilitiesapproximatestheircarryingvalueduetotheirshortmaturity.

Thefairvalueofnancialassetsandliabilitiesisdeterminedbyvaluingthematthepresentvalueoffuturecontractedcashows.

Cashowsarediscountedusingstandardvaluationtechniquesattheapplicablemarketyield,havingregardtothetimingofthecashows.

Thefairvalueofforwardforeignexchangeandfuelcontractsisdeterminedastheunrealisedgain/lossatbalancedatebyreferencetomarketexchange

rates and fuel prices. The fair value of interest rate swaps is determined as the present value of future contracted cash flows. Cash flows are discounted

usingstandardvaluationtechniquesattheapplicablemarketyield,havingregardtothetimingofthecashows.Thefairvalueofoptionsisdetermined

using standard valuation techniques.

OthernancialassetsandliabilitiesrepresentthefairvalueofderivativenancialinstrumentsrecognisedonBalanceSheetinaccordancewithAASB139.