Qantas 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 Qantas Annual Report 2009

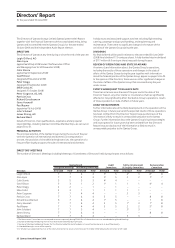

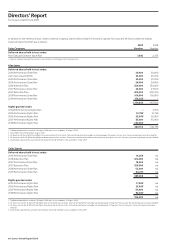

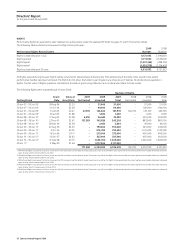

Discussion and Analysis of Performance Summary continued

for the year ended 30 June 2009

Increase/

Qantas Group (decrease)

2009 2008

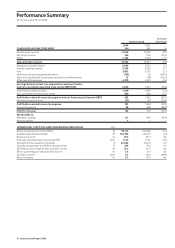

CONDENSED BALANCE SHEET $M $M %

Current assets 5,966 5,616 6.2

Non-current assets 14,083 14,084 <0.0

Total assets 20,049 19,700 1.8

Current liabilities 6,714 7, 604 (11.7)

Non-current liabilities 7,570 6,361 19.0

Total liabilities 14,284 13,965 2.3

Total equity 5,765 5,735 0.5

Net debt to net debt plus equity (ratio) 25:75 24:76

Net debt to net debt plus equity including off Balance Sheet debt (ratio) 49:51 46:54

Increase/

Qantas Group (decrease)

2009 2008

CONDENSED CASH FLOW $M $M %

Net cash from operating activities 1,129 2,128 (46.9)

Net cash used in investing activities (1,163) (1,322) (12.0)

Net cash from/(used) in financing activities 1,052 (1,570) 167.0

Net increase/(decrease) in cash and cash equivalents held 1,018 (764) 233.2

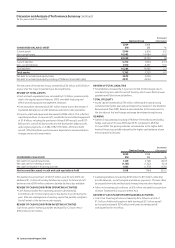

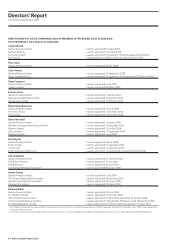

The net assets of the Qantas Group increased by $30 million to $5.8 billion

at year end. The major movements are discussed below.

REVIEW OF TOTAL ASSETS

•Cashandcashequivalentshaveincreasedby$1.0billion,predominantly

due to the capital raised in February 2009, new debt financing and

effective working capital management initiatives.

•Totalreceivablesdecreasedby$391millionmainlyduetothereceiptof

liquidated damages on aircraft deliveries and lower trade receivables.

•Property,plantandequipmentdecreasedby$186million.Thisreflected

capital expenditure on new aircraft, modifications and related equipment

of $1.4 billion, including the purchase of three A380 aircraft, one B737-

800 aircraft, one A330-200 aircraft and five Bombardier Q400 aircraft,

and progress payments on A380, B787, B737-800, A330 and A320

aircraft. Offsetting these purchases were depreciation and amortisation

charges and aircraft impairments.

REVIEW OF TOTAL LIABILITIES

•Totalliabilitiesincreasedby2.3percentto$14.3billionlargelydueto

increased long term debt for aircraft funding which was offset by lower

payables and Other financial liabilities.

TOTAL OF EQUITY

•Issuedcapitalincreasedby$753millionreflectingthecapitalraising

completed during the year and participation by investors in the Dividend

Reinvestment Plan (DRP). Reserves decreased due to the movements in

the fair value of fuel and foreign exchange derivatives during the year.

GEARING

•QantasGroupgearing(includingoffBalanceSheetdebtbutexcluding

hedge reserves) at 30 June 2009 was 49:51 compared to 46:54 at

30 June 2008. The gearing ratio has increased due to the higher debt

levels of the group partially reduced by the higher cash balances at year

end compared to last year.

The Qantas Group held cash of $3,617 million as at 30 June 2009. An

additional $1.1 billion of funding facilities are in place for future aircraft

deliveries and a $500 million undrawn standby facility is also available.

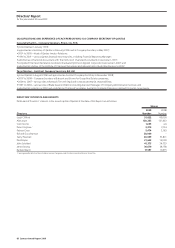

REVIEW OF CASH FLOWS FROM OPERATING ACTIVITIES

•Cashflowsprovidedfromoperatingactivitiesdecreasedby

$1.0 billion to $1.1 billion mainly due to the decline in profit during the

year. Effective management of working capital has partially mitigated

the full extent of the decline in cash receipts.

REVIEW OF CASH FLOWS FROM INVESTING ACTIVITIES

Cash flows used in investing activities decreased by 12.0 per cent or

$159 million to $1.2 billion.

•Capitalexpenditureincreasedby$106millionto$1.5billion,reflecting

aircraft deliveries, aircraft progress and delivery payments. This was offset

by proceeds from sale and lease back transactions and other disposals.

•Othernetinvestingcashoutflowsof$13millionincludedtheacquisition

of Jetset Travelworld Group and Jetstar Asia.

REVIEW OF CASH FLOWS FROM FINANCING AC TIVITIES

•Cashfromfinancingactivitiesincreasedby$2.6billiontoatotalof

$1.1 billion. Additional long-term debt funding of $1.5 billion as well

as the capital raising of $514 million and lower dividends paid all

contributed to the net inflow.