Qantas 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91 Qantas Annual Report 2009

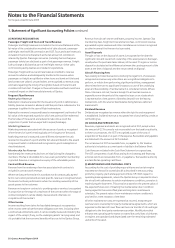

Notes to the Financial Statements

for the year ended 30 June 2009

1. Statement of Significant Accounting Policies continued

(E) FOREIGN CURRENCY TRANSACTIONS

Transactions

Foreign currency transactions are translated to Australian dollars at the

rates of exchange prevailing at the date of each transaction except where

hedge accounting is applied. At balance date, monetary assets and

liabilities denominated in foreign currencies are translated to the functional

currency at the rates of exchange prevailing at that date. Resulting

exchange differences are brought to account as exchange gains or losses in

the Income Statement in the year in which the exchange rates change.

Non-monetary assets and liabilities that are measured in terms of historical

cost in a foreign currency are translated using the exchange rate at the date

of the transaction. Non-monetary assets and liabilities denominated in

foreign currencies that are stated at fair value are translated to Australian

dollars at foreign exchange rates prevailing at the dates the fair value

was determined.

Translation of Foreign Operations

Assets and liabilities of foreign operations, including controlled entities and

investments in associates and jointly controlled entities, are translated at

the rates of exchange prevailing at balance date. The Income Statements of

foreign operations are translated to Australian dollars at rates

approximating the foreign exchange rates prevailing at the dates of the

transactions. Exchange differences arising on translation are recorded in

the foreign currency translation reserve. The balance of the foreign

currency translation reserve relating to a foreign operation that is disposed

of, or partially disposed of, is recognised in the Income Statement in the

year of disposal.

Foreign exchange gains and losses arising from a monetary item receivable

from or payable to a foreign operation, the settlement of which is neither

planned nor likely in the foreseeable future, are considered to form part of

a net investment in a foreign operation and are recognised directly in

equity in the foreign currency translation reserve.

(F) DERIVATIVE FINANCIAL INSTRUMENTS

Qantas is subject to foreign currency, interest rate, fuel price and credit

risks. Derivative financial instruments are used to hedge these risks. It is

Qantas policy not to enter into, issue or hold derivative financial

instruments for speculative trading purposes.

Derivative financial instruments are recognised at fair value both initially

and on an ongoing basis. Transaction costs attributable to the derivative

are recognised in the Income Statement when incurred. The method of

recognising gains and losses resulting from movements in market prices

depends on whether the derivative is a designated hedging instrument,

and if so, the nature of the risk being hedged. The Qantas Group

designates certain derivatives as either hedges of the fair value of

recognised assets or liabilities or a firm commitment (fair value hedges);

or hedges of highly probable forecast transactions (cash flow hedges).

Gains and losses on derivative financial instruments qualifying for hedge

accounting are recognised in the same Income Statement category as the

underlying hedged item. Changes in underlying market conditions or

hedging strategies could result in recognition in the Income Statement of

changes in fair value of derivative financial instruments designated

as hedges.

Qantas documents at the inception of the transaction the relationship

between hedging instruments and hedged items, as well as its risk

management objective and strategy for undertaking each transaction.

Qantas also documents its assessment, both at hedge inception and on an

ongoing basis, of whether the hedging instruments that are used in hedge

transactions have been and will continue to be highly effective.

Fair Value Hedges

Changes in the fair value of derivative financial instruments that are

designated and qualify as fair value hedges are recorded in the Income

Statement, together with any changes in the fair value of the hedged asset

or liability that are attributable to the hedged risk.

Cash Flow Hedges

The effective portion of changes in the fair value of derivative financial

instruments that are designated and qualify as cash flow hedges are

recognised in equity in the hedge reserve. Amounts accumulated in the

hedge reserve are recognised in the Income Statement in the periods when

the hedged item will affect profit or loss (i.e. when the underlying income

or expense is recognised). Where the hedged item is of a capital nature,

amounts accumulated in the hedge reserve are transferred from equity

and included in the measurement of the initial cost or carrying amount

of the asset or liability.

When a hedging instrument expires or is sold, terminated or exercised,

or Qantas revokes designation of the hedge relationship but the hedged

forecast transaction is still expected to occur, the cumulative gain or loss

at that point remains in equity and is recognised in accordance with the

above policy when the transaction occurs. If the underlying hedged

transaction is no longer expected to take place, the cumulative unrealised

gain or loss recognised in equity with respect to the hedging instrument is

recognised immediately in the Income Statement.

Ineffective and Non-designated Derivatives

From time to time, certain derivative financial instruments do not qualify

for hedge accounting. Changes in the fair value of any derivative

instrument, or part of a derivative instrument, that does not qualify for

hedge accounting are recognised immediately in the Income Statement.

Fair Value Calculations

The fair value of financial instruments traded in active markets is based

on quoted market prices at balance date. The fair value of financial

instruments that are not traded in an active market are estimated using

valuation techniques consistent with accepted market practice. The Qantas

Group uses a variety of methods and input assumptions that are based on

market conditions existing at balance date. The fair value of derivative

financial instruments includes the present value of estimated future

cash flows.

Financial Guarantee Contracts

Financial guarantee contracts are recognised as a financial liability at the

time the guarantee is issued. The liability is initially measured at fair value

and subsequently at the higher of the amount determined in accordance

with AASB 137 Provisions, Contingent Liabilities and Contingent Assets

and the amount initially recognised less cumulative amortisation,

where appropriate.

The fair value of financial guarantees is determined as the present value of

the difference in net cash flows between the contractual payments under

the debt instrument and the payments that would be required without the

guarantee, or the estimated amount that would be payable to a third party

for assuming the obligations.

Where guarantees in relation to loans or payables of controlled entities or

associates and jointly controlled entities are provided for no compensation,

the fair values are accounted for as contributions and recognised as part of

the cost of the investment.