Qantas 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145 Qantas Annual Report 2009

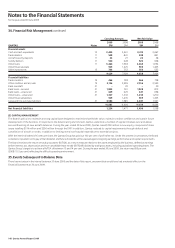

Notes to the Financial Statements

for the year ended 30 June 2009

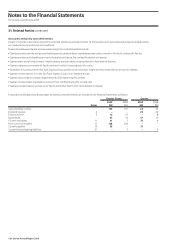

34. Financial Risk Management continued

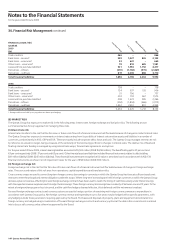

Asat30June2009,55percent(2008:68percent)offorecastoperationalandcapitalexpenditureforeignexchangeexposureslessthanoneyearand

18percent(2008:20percent)ofexposuresgreaterthanoneyearbutlessthanveyearshavebeenhedged.Asat30June2009,totalunrealised

exchangegainsonhedgesofnetrevenuedesignatedtoservicelong-termdebtwere$121million(2008:$425milliongain).

Fortheyearended30June2009,othernancialassetsandliabilitiesincludederivativenancialinstrumentsusedtohedgeforeigncurrency,including

hedgingoffuturecapitalandoperatingexpenditurepayments,totalling$231million(netasset)(2008:$615million(netliability)).

These are recognised at fair value in accordance with A ASB 139.

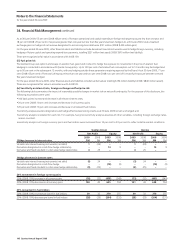

(iii) Fuel price risk

TheQantasGroupusesoptionsandswapsonaviationfuel,gasoilandcrudeoiltohedgetheexposuretomovementsinthepriceofaviationfuel.

HedgingisconductedinaccordancewithQantasGrouppolicy.Upto100percentofestimatedfuelconsumptionoutto12monthsmaybehedgedand

upto50percentinthesubsequent12months,withanyhedgingoutsidetheseparametersrequiringapprovalbytheBoard.Asat30June2009,71per

cent(2008:65percent)offorecastfuelexposurelessthanoneyearandtwopercent(2008:twopercent)offorecastfuelexposurebetweenoneand

veyearshavebeenhedged.

Fortheyearended30June2009,othernancialassetsandliabilitiesincludefuelderivativestotalling$154million(liability)(2008:$840million(asset)).

These are recognised at fair value in accordance with A ASB139.

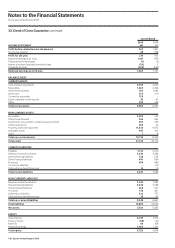

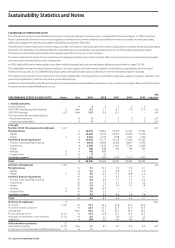

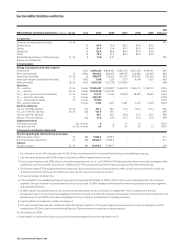

(iv) Sensitivity on interest rate, foreign exchange and fuel price risk

Thefollowingtablesummarisestheimpactofreasonablypossiblechangesinmarketriskonnetprotandequity.Forthepurposeofthisdisclosure,the

following assumptions were used:

•100basispointsincreaseanddecreaseinallrelevantinterestrates;

•20percent(2008:10percent)increaseanddecreaseinallcurrencypairs;

•20percent(2008:10percent)increaseanddecreaseinallrelevantfuelindices;

•sensitivityanalysisassumesdesignationsandhedgeeffectivenesstestingresultsasat30June2009remainunchanged;and

•sensitivityanalysisisisolatedforeachrisk.Forexample,fuelpricesensitivityanalysisassumesallothervariables,includingforeignexchangerates,

remain constant.

•sensitivityanalysisonforeigncurrencypairsandfuelindiceswereincreasedfrom10percentto20percenttoreflectvolatilemarketconditions.

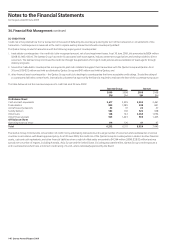

Qantas Group Qantas

Net Profit Equity Net Profit Equity

2009 2008 2009 2008 2009 2008 2009 2008

100bps increase in interest rates $M $M $M $M $M $M $M $M

Variablerateinterestbearinginstruments(netdebt) 1 (24) – – 1 (24) ––

Derivatives designated in a cash flow hedge relationship – – 14 9 – – 14 9

Derivativeandxedratedebtinafairvaluehedgerelationship 4 25 –– 4 25 ––

100bps decrease in interest rates

Variablerateinterestbearinginstruments(netdebt) (1) 24 – – (1) 24 ––

Derivatives designated in a cash flow hedge – – (14) (9) – – (14) (9)

Derivativeandxedratedebtinafairvaluehedgerelationship (5) (25) – – (5) (25) ––

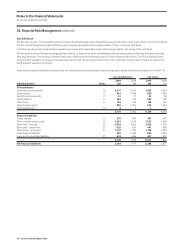

20% movement in foreign currency pairs

20% (2008: 10%) increase in all currency pairs (76) (32) (458) (549) (73) (32) (461) (549)

20% (2008: 10%) decrease in all currency pairs 104 43 625 704 101 43 628 704

20% movement in fuel indices

20%(2008:10%)increaseperbarrelinfuelindices 39 32 279 255 39 32 279 255

20%(2008:10%)decreaseperbarrelinfuelindices (28) (29) (204) (232) (28) (29) (204) (231)