Qantas 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Qantas Annual Report 2009

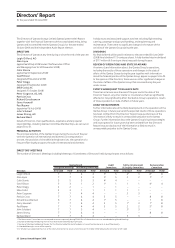

Discussion and Analysis of Performance Summary

for the year ended 30 June 2009

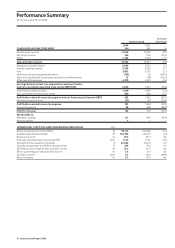

REVIEW OF INCOME STATEMENT

•Profitbeforerelatedincometaxexpense(PBT)was$181million,a

decreaseof$1.2billionor87.1percent.Profitattributabletomembersof

Qantaswas$117million.Thiswasachieveddespitea1.9percent

decreaseincapacityandadecliningdemandenvironmentinboth

domesticandinternationalmarketsaswellasstrongcompetition.

•Anumberofsignificantitemswereincludedintheresultsfortheyear.

TheseitemsincludedaprofitonsaleofQantasHolidaysof$86million,

achangeinFrequentFlyeraccountingestimateswhichincreased

revenueby$164million,ofwhich$84millionisnon-recurring,

redundanciesof$106millionandaccelerateddepreciationand

impairmentlossesof$170million.

REVIEW OF SALES AND OTHER INCOME

•Totalsalesandotherincomefortheyeardecreasedby$1.1billionto

$14.6billion,adecreaseof6.9percentontheprioryear.

•Netpassengerrevenuedecreasedby$1.1billionor8.7percentto

$11.6billion.Thisreflectedcapacityreductionsof1.9percent,aseat

factordecreaseof1.1percentagepointsandayieldreductionof

4.3percentprimarilyreflectingthedeclineinpremiumandbusiness

traveldemand.

•Netfreightrevenuedecreasedby$195million,or20.3percentto

$764million.Reducedcapacityaswellaslowertradeactivityduetothe

economicdownturncontributedtothedecline.

•Otherrevenuecategoriesincreasedby$225millionto$2.2billion.

ThiswasprimarilyduetotheprofitonsaleofQantasHolidaysand

changesinaccountingestimatesforQantasFrequentFlyer.

REVIEW OF EXPENDITURE

•Manpowerandstaffrelatedexpenditureincreasedby$151millionor

4.3percentto$3.7billion.RedundanciesandEnterpriseBargaining

Agreement(EBA)increaseswerethemaincontributorstothisincrease.

•Aircraftoperatingvariablecostsincreasedby$226millionor8.7percent

to$2.8billionlargelyduetoincreasesinlandingfeesandengineering

materialspricerises.

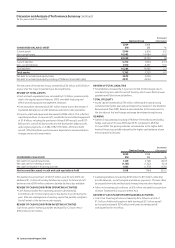

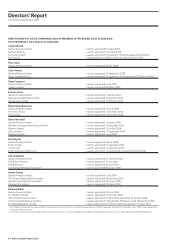

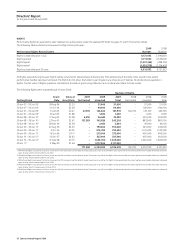

2008

$M %

Currentassets 5,616 6.2

Non-currentassets 14,084 <0.0

Totalassets 19,700 1.8

Currentliabilities 7, 604 (11.7)

Non-currentliabilities 6,361 19.0

Totalliabilities 13,965 2.3

5,735 (0.5)

Netdebttonetdebtplusequity(ratio) 24:76

NetdebttonetdebtplusequityincludingoffBalanceStheetdebt(ratio) 46:54

REVIEW OF EXPENDITUREcontinued

•Fuelcostsdecreasedby$99millionor2.7percent.Increasesintheinto-

planefuelpriceafterhedgingwerelargelyoffsetbyfavourableforeign

exchangemovements.Thevolumeofbarrelsconsumeddecreasedby

3.5percentinlinewithlessflyinghoursfromcapacityreductions.Fuel

conservationandothersavinginitiativesof$62millionalsocontributed

tothedecreaseinfuelcosts.

•Otherexpendituredecreasedby$5millionor0.2percent.Sellingand

marketingsavingswereoffsetbyincreasedpropertycosts,capacityhire

andcommunicationcosts.

•Depreciationandamortisationcostsdecreasedby$79millionor5.4per

cent,mainlyduetodepreciationsavingsonaircraftwrittendowninthe

prioryearandaone-offmaintenanceaccountingchargeforQantasLink

aircraftintheprioryear.

•Non-cancellableoperatingleasechargesincreasedby$50millionor

12.5percentasaresultofunfavourableforeignexchange,aswellasan

increaseinthenumberofleasedaircraft.

•Theshareofnetloss/(profit)inassociatesandjointlycontrolledentities

decreasedby$43milliontoa$15millionloss.LowerearningsfromAir

PacificandJetstarPacificwerethemaincontributorstothischange.

REVIEW OF OTHER INCOME STATEMENT ITEMS

•Ineffectiveandnon-designatedderivativesresultedingainsof

$105millioninthecurrentyearcomparedto$55millionoflosseslastyear.

•Netfinancecostsincreasedby$68million,primarilyduetoalowercash

interestratesreducinginterestincome.

•Theeffectivetaxrateincreasedfrom31.1percentto32.0percent.

•Basicearningspersharedecreasedby43.4centsto5.6centspershare.

Thisreflectedthedecreasedprofitaftertaxfortheyearandincreased

numbersorsharesonissue.

continued

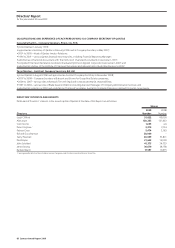

•Fuelcostsdecreasedby$99millionor2.7percent.Theinto-plane

fuelpriceafterhedgingincreasedby8.5percentandaccountedfor

$149millionoftheincreaseincosts.Thevolumeofbarrelsconsumed

decreasedby3.5percentinlinewithlessflyinghoursfromcapacity

reductions.Fuelconservationandothersavinginitiativesalsocontributed

tothedecreaseinfuelcostsof$62million.FluctuatingAustralian

currencymovementsincreasedfuelcostsbutwerenettedoffbyhedging

toprovideanetbenefitof$93million.

•Otherexpendituredecreasedby$29millionor1.1percent.Sellingand

marketingsavingswereoffsetbyincreasedpropertycosts,capacityhire

andcommunicationcosts.TheprioryearincludedFXlossescomparedto

thecurrentyeargainsclassifiedinotherrevenue.

•Depreciationandamortisationcostsdecreasedby$79millionor5.4per

cent,largelyduetothewritedownofaircraftintheprioryearnolonger

beingdepreciated.

•Non-cancellableoperatingleasechargesincreasedby$50millionor12.5

percentasaresultofunfavourableFXandpricing,despiteloweractivity.

•Theshareofnetprofit/(loss)inassociatesandjointlycontrolledentities

decreasedby$43milliontoa$15millionloss.LowerearningsfromAir

PacificandJetstarPacificinvestmentswerethemaincontributors.

•Themark-to-marketopenderivativepositionsoncapitalexpenditure,

requiredunderAASB139,resultedinineffectivederivativegainson

capitalexpenditureof$110millioninthecurrentyearcomparedto

$39millionoflosseslastyear.

•Netfinancecostsincreasedby$68million,primarilyduetoalowercash

interestratesreducinginterestincome.Aslightincreaseinfinancing

costscontributedtotheincrease.

•Thefavourablenetimpactofforeignexchangeratemovementson

overallPBTwas$98million.

•Theeffectivetaxrateincreasedfrom31.1percentto32.0percent.

Basicearningspersharedecreasedby42.5centsto6.5centspershare.

Thisreflectedthedecreasedprofitaftertaxfortheyear.