Office Depot 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

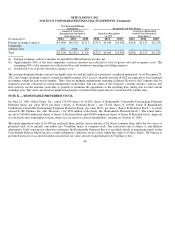

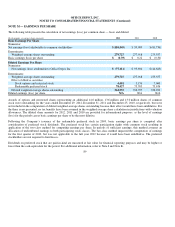

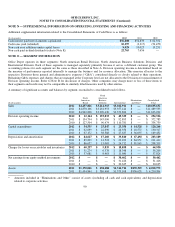

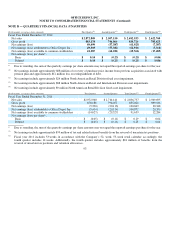

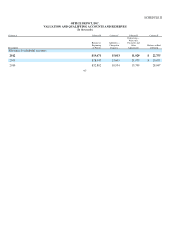

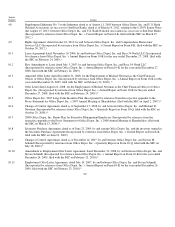

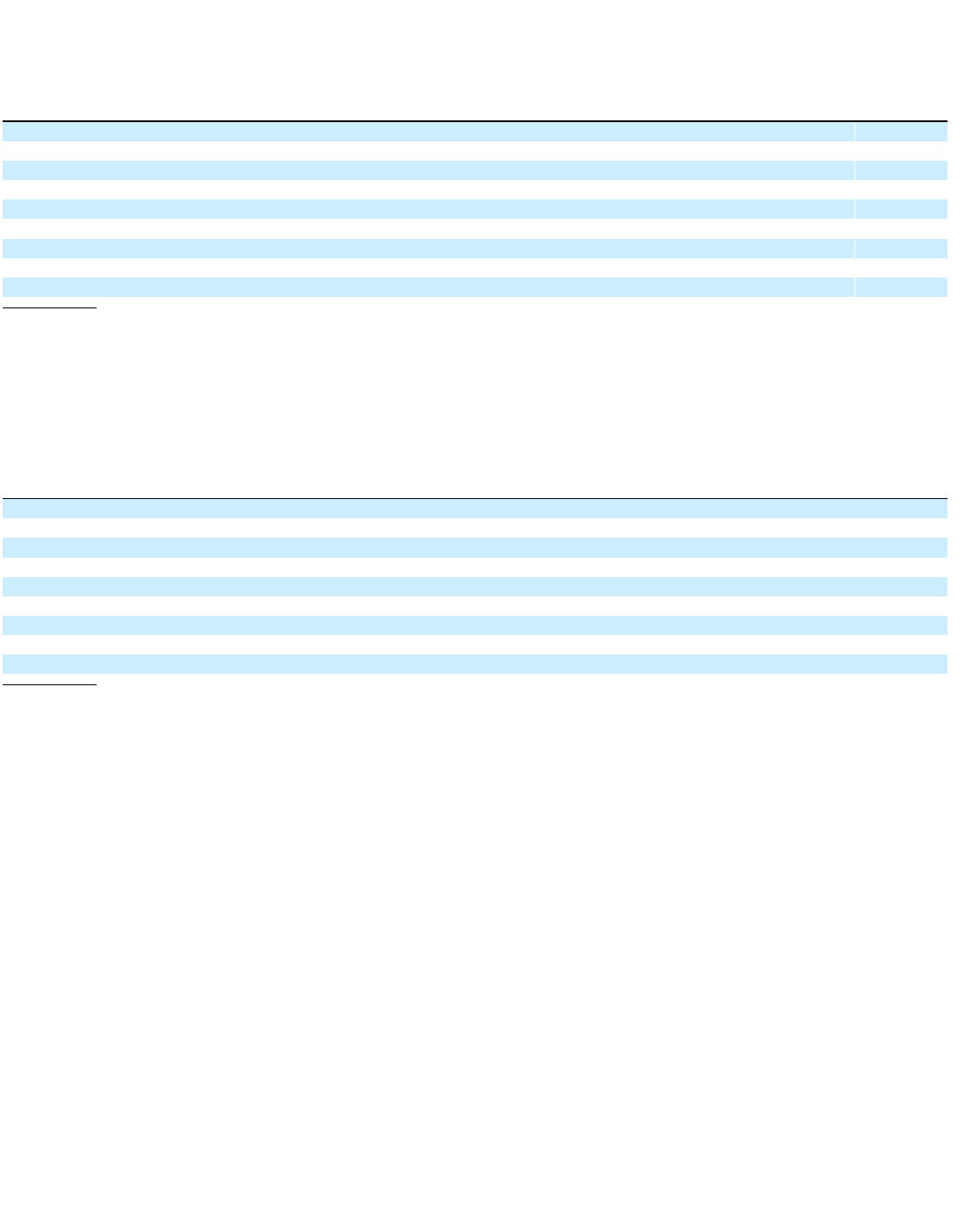

NOTE R — QUARTERLY FINANCIAL DATA (UNAUDITED)

93

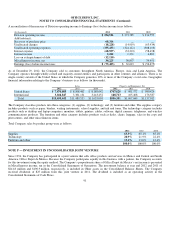

(In thousands, except per share amounts) First Quarter Second Quarter Third Quarter Fourth Quarter

Fiscal Year Ended December 29, 2012

Net sales

$2,872,809

$ 2,507,150

$ 2,692,933

$ 2,622,760

Gross

p

rofit

883,174

746,064

834,724

783,623

Net earnin

g

s (loss)

49,499

(57,387)

(61,925)

(7,307)

Net earnin

g

s (loss) attributable to Office De

p

ot, Inc.

49,503

(57,382) (61,916)

(7,316)

Net earnin

g

s (loss) available to common stockholders

41,287

(64,281)

(69,566)

(17,485)

Net earnin

g

s (loss)

p

er share*:

Basic

$0.14

$ (0.23)

$ (0.25)

$ (0.06)

Diluted

$0.14

$(0.23)

$(0.25)

$(0.06)

* Due to roundin

g

, the sum of the

q

uarterl

y

earnin

g

s

p

er share amounts ma

y

not e

q

ual the re

p

orted earnin

g

s

p

er share for the

y

ear.

Net earnings include approximately $68 million of recovery of purchase price income from previous acquisition associated wit

h

p

ension

p

lan and a

pp

roximatel

y

$12 million loss on extin

g

uishment of debt.

Net earnin

g

s include a

pp

roximatel

y

$24 million North American Retail Division fixed asset im

p

airment.

Net earnin

g

s include a

pp

roximatel

y

$88 million North American Retail and International Division asset im

p

airments.

Net earnin

g

s include a

pp

roximatel

y

$9 million North American Retail Division fixed asset im

p

airment.

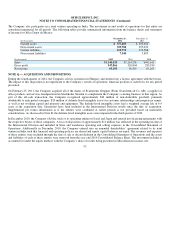

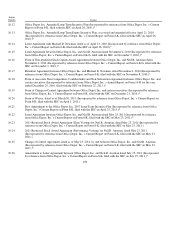

(In thousands, exce

p

t

p

er share amounts) First Quarter Second Quarte

r

Third Quarter Fourth Quarter

Fiscal Year Ended December 31, 2011

Net sales

$2,972,960

$ 2,710,141

$ 2,836,737

$ 2,969,695

Gross

p

rofit

878,188

794,052

855,02

0

899,186

Net earnin

g

s (loss)

(5,390)

(20,116)

100,849

20,348

Net earnin

g

s (loss) attributable to Office De

p

ot, Inc.

(5,414)

(20,114)

100,872

20,350

Net earnin

g

s (loss) available to common stockholders

(14,627)

(29,327)

91,659

12,284

Net earnin

g

s (loss)

p

er share*:

Basic

$ (0.05)

$ (0.11)

$ 0.29

$0.04

Diluted

$(0.05)

$(0.11)

$0.28

$0.04

* Due to roundin

g

, the sum of the

q

uarterl

y

earnin

g

s

p

er share amounts ma

y

not e

q

ual the re

p

orted earnin

g

s

p

er share for the

y

ear.

Net earnin

g

s include a

pp

roximatel

y

$99 million of tax and related interest benefits from the reversal of uncertain tax

p

ositions.

Fiscal year 2011 includes 53 weeks in accordance with the Company’s 52- week, 53-week retail calendar; accordingly, the

fourth quarter includes 14 weeks. Additionally, the fourth quarter includes approximately $24 million of benefits from the

reversal of uncertain tax

p

ositions and valuation allowances.

(1) (2) (3) (4)

(1)

(2)

(3)

(4)

(1) (2)

(1)

(2)