Office Depot 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

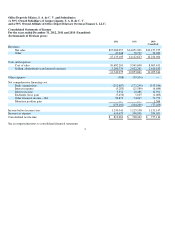

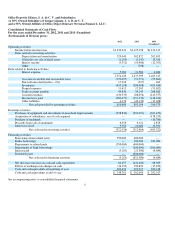

Revenue is recognized at the point of sale for retail transactions and at the time of successful delivery for contract, catalog

and internet sales. Sales taxes collected are not included in reported sales. The Company does not charge shipping and

handling costs to its customers; such costs are included within selling, administrative and general expenses within the

consolidated statements of income and amounted to $124,109, $118,037 and $101,803 in 2012, 2011 and 2010

(unaudited), respectively.

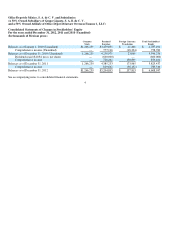

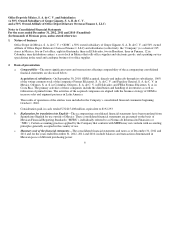

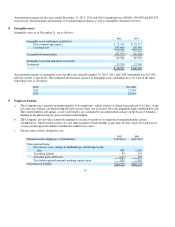

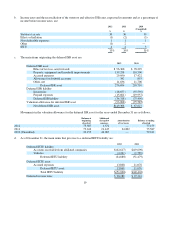

Movements in the allowance for doubtful accounts for the years ended December 31 are as follows:

11

n.

F

oreign currency transactions

—

Foreign currency transactions are recorded at the applicable exchange rate in effect at the

transaction date. Monetary assets and liabilities denominated in foreign currency are translated into functional currency

amounts at the applicable exchange rate in effect at the balance sheet date. Exchange fluctuations are recorded as a

com

p

onent of net com

p

rehensive financin

g

cost in the consolidated statements of income.

o.

R

evenue recognition

—

Revenues are recognized in the period in which the risks and rewards of ownership of the

inventories are transferred to the customers, which generally coincides with the delivery of products to customers in

satisfaction of orders.

p.

A

dvertising

—

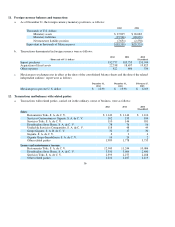

Advertising costs are charged to expense when incurred. Advertising expense for the years ended

December 31, 2012, 2011 and 2010 (unaudited) was $239,639, $203,451and $202,107, respectively. Prepaid advertising

costs were $44,723 and $59,936 as of December 31, 2012 and 2011.

q.

R

eclassifications

—

Certain amounts in the consolidated financial statements as of December 31, 2011 and for the years

ended December 31, 2011 and 2010 (unaudited) have been reclassified in order to conform to the presentation of the

consolidated financial statements as of and for the

y

ear ended December 31, 2012.

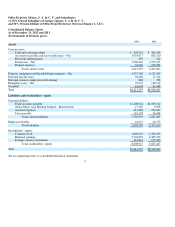

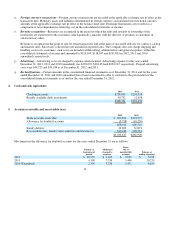

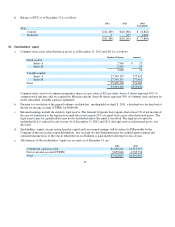

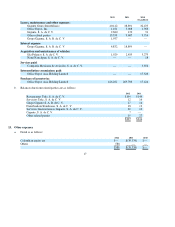

4. Cash and cash equivalents

2012 2011

Checkin

g

accounts

$258,009

$290,598

Readil

y

available dail

y

investments

90,752

12,058

$348,761

$302,656

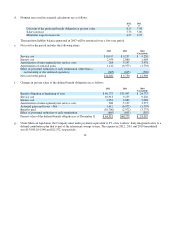

5. Accounts receivable and recoverable taxes

2012 2011

Trade accounts receivable

$663,894

$619,977

Allowance for doubtful accounts

(5,728)

(10,259)

658,166

609,718

Sundr

y

debtors

33,263

32,871

Recoverable taxes, mainl

y

value-added tax and income tax

342,188

220,331

$1,033,617

$862,92

0

Balance at

beginning o

f

period

Additional

charged to

expenses

Write-

offs of

uncollectible

accounts

Balance a

t

ending of period

2012

$10,259

$1,107

$5,638

$5,728

2011

4,109

7,556

1,406

10,259

2010 (Unaudited)

2,305

3,276

1,472

4,109