Office Depot 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

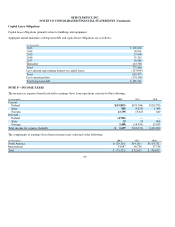

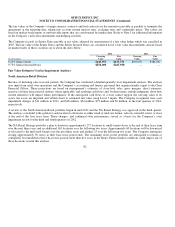

NOTE H – EMPLOYEE BENEFIT PLANS

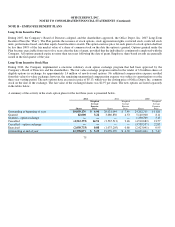

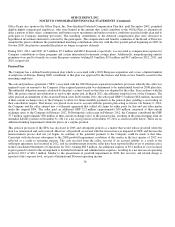

Long-Term Incentive Plan

During 2007, the Company’s Board of Directors adopted, and the shareholders approved, the Office Depot, Inc. 2007 Long-Ter

m

Incentive Plan (the “Plan”). The Plan permits the issuance of stock options, stock appreciation rights, restricted stock, restricted stoc

k

units, performance-based, and other equity-based incentive awards. The option exercise price for each grant of a stock option shall not

be less than 100% of the fair market value of a share of common stock on the date the option is granted. Options granted under the

Plan become exercisable from one to five years after the date of grant, provided that the individual is continuously employed with the

Company. All options granted expire no more than ten years following the date of grant. Employee share-based awards are generally

issued in the first quarter of the year.

Long-Term Incentive Stock Plan

During 2010, the Company implemented a one-time voluntary stock option exchange program that had been approved by the

Company’s Board of Directors and the shareholders. The fair value exchange program resulted in the tender of 3.8 million shares o

f

eligible options in exchange for approximately 1.4 million of newly-issued options. No additional compensation expense resulted

from this value-for-value exchange; however, the remaining unamortized compensation expense was subject to amortization over the

three year vesting period. The new options have an exercise price of $5.13, which was the closing price of Office Depot, Inc. common

stock on the date of the exchange. The fair value of the exchanged shares was $2.97 per share. The new options are listed separately

in the tables below.

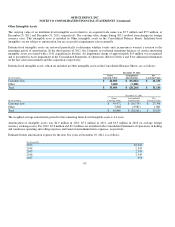

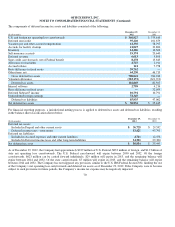

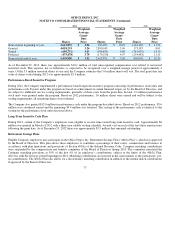

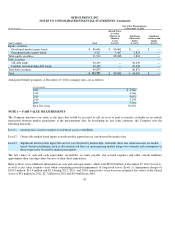

A summary of the activity in the stock option plans for the last three years is presented below.

75

2012 2011 2010

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding at beginning of year

19,059,176

$6.90

20,021,044

$7.49

24,202,715

$11.81

Granted

82,00

0

3.22

3,680,85

0

4.53

5,140,900

8.11

Granted

–

o

p

tion exchan

g

e

—

—

—

—

1,350,709

5.13

Cancelled

(4,512,37

2

) 14.51

(3,567,513) 9.46

(4,510,682) 21.57

Cancelled

–

o

p

tion exchan

g

e

—

—

—

—

(3,739,557)

22.85

Exercised

(2,050,733)

0.88

(1,075,205)

0.86

(2,423,041)

0.95

Outstandin

g

at end of

y

ear

12,578,071 $5.25

19,059,176 $ 6.90

20,021,044 $7.49