Office Depot 2012 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Common stock consists of common nominative shares at a par value of $10 per share. Series A shares represent 50% of

common stock and may only be acquired by Mexican citizens. Series B shares represent 50% of common stock and may be

freely subscribed. Variable capital is unlimited.

15

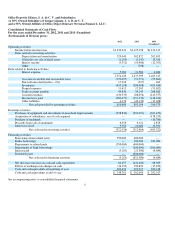

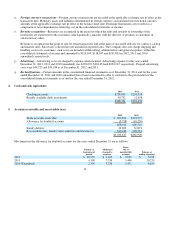

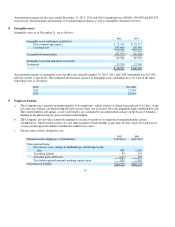

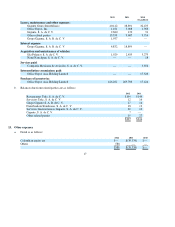

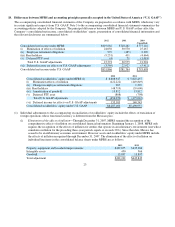

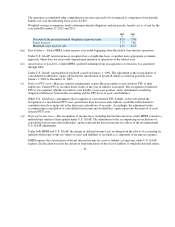

h. Balance of PTU as of December 31 is as follows:

2012 2011 2010

(Unaudited)

PTU:

Current

$(11,489)

$(10,186)

$ (8,822)

Deferred

5

(79)

1,018

$(11,485)

$(10,265)

$ (7,804)

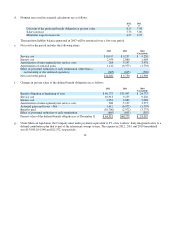

10. Stockholders’ equity

a. Common stock at

p

ar value (historical

p

esos) as of December 31, 2012 and 2011 is as follows:

Number of Shares Amoun

t

Fixed ca

p

ital:

Series A

2,500

$25

Series B

2,500

25

5,000

5

0

Variable ca

p

ital:

Series A

27,749,159

277,492

Series B

27,749,159

277,492

Total

55,498,318

554,984

55,503,318

$555,034

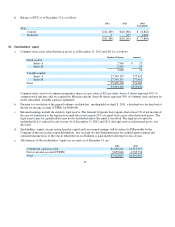

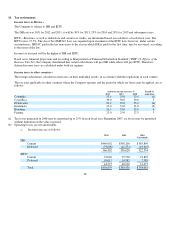

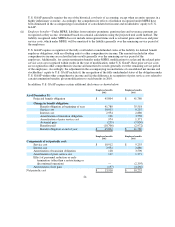

b. Pursuant to a resolution at the general ordinary stockholders’ meeting held on April 8, 2011, a dividend was declared out o

f

the net tax income account (CUFIN) for $600,000.

c. Retained earnings include the statutory legal reserve. The General Corporate Law requires that at least 5% of net income of

the year be transferred to the legal reserve until the reserve equals 20% of capital stock at par value (historical pesos). The

legal reserve may be capitalized but may not be distributed unless the entity is dissolved. The legal reserve must be

replenished if it is reduced for any reason. As of December 31, 2012 and 2011, the legal reserve, in historical pesos, was

$111,007.

d. Stockholders’ equity, except restated paid-in capital and tax retained earnings will be subject to ISR payable by the

Company at the rate in effect upon distribution. Any tax paid on such distribution may be credited against annual and

estimated income taxes of the

y

ear in which the tax on dividends is

p

aid and the followin

g

two fiscal

y

ears.

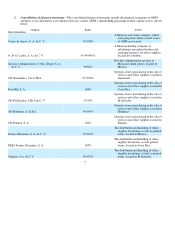

e. The balances of the stockholders’ e

q

uit

y

tax accounts as of December 31, are:

2012 2011

Contributed ca

p

ital account

$1,569,241

$1,515,297

Net tax income account (CUFIN)

5,855,646

4,785,758

Total

$7,424,887

$6,301,055