Office Depot 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

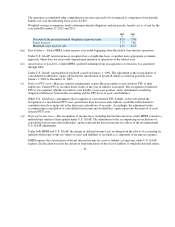

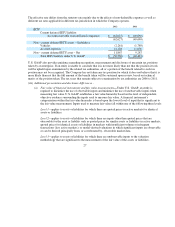

The Company’s financial instruments consist principally of cash, accounts receivable, trade accounts

payable and accrued expenses. The Company believes that the recorded values of these financial

instruments approximate their current fair values because of their nature and respective maturity dates or

durations.

28

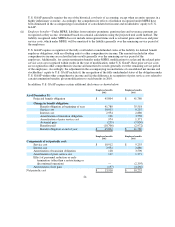

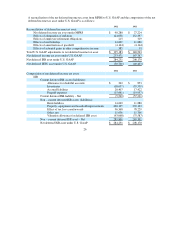

(b) Classification of certain items in the consolidated balance sheets and consolidated statements of

income—Under MFRS, the classification of certain costs and expenses differ from that required by U.S.

GAAP.

i. Other expense of $588, $38,266 and $0 in 2012, 2011 and 2010 (unaudited), respectively, is

considered other o

p

eratin

g

ex

p

ense under U.S. GAAP.

ii. Normal bank commissions stemming from credit card transactions are included within

comprehensive financing cost in the consolidated statements of income under MFRS; these

amounts are included within selling, administrative and general expenses under U.S. GAAP. The

Company also incurs additional bank commissions on interest-free sales offered to customers,

where such sale is ultimately financed by the bank and not the Company. In those cases, the sale

price of the product sold is increased. Those additional commissions are included within

comprehensive financing cost under MFRS. Under U.S. GAAP, the amounts are a reduction of the

additional revenue charged to the customers. The amounts reclassified in 2012, 2011 and 2010

(unaudited) are $70,618, $62,309 and $49,013, res

p

ectivel

y

.

iii. Certain items classified within other revenues in the consolidated statements of operations under

MFRS are presented within other operating income under U.S. GAAP. Such amounts in 2012,

2011 and 2010 (unaudited) are $12,069, $9,567 and $25,788, res

p

ectivel

y

.

(c) Consolidated statement of cash flows

—

Under MFRS, the Company presents a consolidated statement of

cash flows similar to that required under U.S. GAAP. However, certain classification differences exist,

mainly with respect to interest paid. As well, U.S. GAAP requires disclosures of non-cash investing and

financin

g

activities.

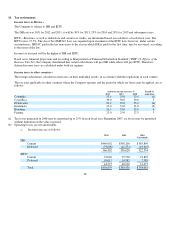

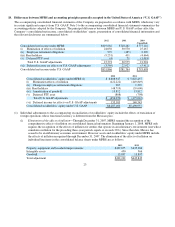

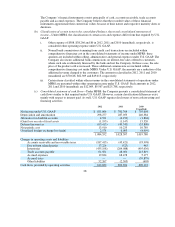

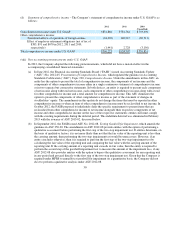

2012 2011 2010

(Unaudited)

Net income under U.S. GAAP

$831,866 $ 781,764

$793,698

De

p

reciation and amortization

298,277

287,053

240,384

Allowance for doubtful accounts

4,531

(6,150)

(1,804)

(Gain) loss on sale of fixed assets

(1,195)

(1,147)

15,52

0

Deferred income tax

(65,415)

(49,343)

(33,808)

Net

p

eriodic cost

13,910

10,235

10,789

Unrealized forei

g

n exchan

g

e loss (

g

ain)

2,578

6,095

(4,999)

1,084,552

1,028,507

1,019,78

0

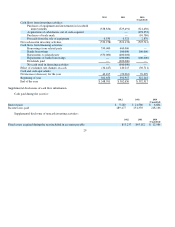

Chan

g

es in o

p

eratin

g

assets and liabilities:

Accounts receivable and recoverable taxes

(187,415)

(45,421)

(93,998)

Due to/from related

p

arties

17,226 (527)

463

Inventories

(435,198) (204,088)

(495,636)

Trade accounts

p

a

y

able

61,564

48,050

213,819

Accrued ex

p

enses

19,834

68,478

5,177

Accrued taxes

—

—

(39,879)

Other liabilities

52,267

(2,305)

(603)

Cash flows

p

rovided b

y

o

p

eratin

g

activities

612,830

892,694

609,123