Office Depot 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

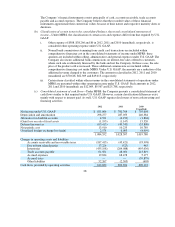

(c) In May 2012, the FASB issued ASU No. 2012-04, Fair Value Measurement: Amendments to Achieve Common

Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, which updated the guidance

in ASC Topic 820, Fair Value Measurement. ASU 2012-04 clarifies the application of existing fair value

measurement requirements including (1) the application of the highest and best use and valuation premise

concepts, (2) measuring the fair value of an instrument classified in a reporting entity’s shareholders’ equity,

and (3) quantitative information required for fair value measurements categorized within Level 3. ASU 2012-

04 also provides guidance on measuring the fair value of financial instruments managed within a portfolio, and

application of premiums and discounts in a fair value measurement. In addition, ASU 2012-04 requires

additional disclosure for Level 3 measurements regarding the sensitivity of fair value to changes in

unobservable in

p

uts and an

y

interrelationshi

p

s between those in

p

uts.

(ix) The followin

g

are new

p

ronouncements issued under U.S. GAAP which will be effective in future re

p

ortin

g

p

eriods:

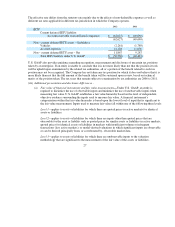

(a) In December 2011, the FASB issued ASU No. 2011-11, Balance Sheet: Disclosures about Offsetting Assets

and Liabilities. This ASU requires an entity to disclose information about offsetting and related arrangements

to enable users of its financial statements to understand the effect of those arrangements on its financial

position. The objective of this disclosure is to facilitate comparison between those entities that prepare their

financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the

basis of International Financial Reporting Standards (“IFRS”). The amended guidance is effective for annual

reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The

Com

p

an

y

will ado

p

t this ASU in 2013.

(b) In July 2012, the FASB issued ASU 2012-02, Intangibles

–

Goodwill and Other (Topic 350): Testing

I

ndefinite-Lived Intangible Assets for Impairment. This update amends ASU 2011-08, Intangibles – Goodwill

and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment and permits an entity first to

assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset

is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test in

accordance with Subtopic 350-30, Intangibles - Goodwill and Other - General Intangibles Other than

Goodwill. The amendments are effective for annual and interim impairment tests performed for fiscal years

beginning after September 15, 2012. Early adoption is permitted, including for annual and interim impairment

tests performed as of a date before July 27, 2012, if a public entity’s financial statements for the most recent

annual or interim period have not yet been issued or, for nonpublic entities, have not yet been made available

for issuance. The adoption of ASU 2012-02 is not expected to have a material impact on the Company’s

financial

p

osition or results of o

p

erations.

(c) In October 2012, the FASB issued ASU 2012-04, Technical Corrections and Improvements in Accounting

Standards Update No. 2012-04. The amendments in this update cover a wide range of Topics in the

Accounting Standards Codification. These amendments include technical corrections and improvements to the

Accounting Standards Codification and conforming amendments related to fair value measurements. The

amendments in this update will be effective for fiscal periods beginning after December 15, 2012. The

adoption of ASU 2012-04 is not expected to have a material impact on the Company’s financial position or

results of o

p

erations.